NVIDIA Stock Drops 10% Then Rebounds 4%

Long-Term Growth Expected in AI Industry

Long-Term Investment Possible with AI Semiconductor ETF

As NVIDIA's stock price, which had shown a steep upward trend this year, became more volatile, doubts about the growth of the artificial intelligence (AI) industry grew among investors. However, market experts foresee steady growth in the AI industry from a long-term perspective. The asset management sector advises that investors expecting growth in the AI industry can reduce risk from increased volatility by investing in semiconductor exchange-traded funds (ETFs).

According to the Korea Exchange on the 24th, the ACE AI Semiconductor Focus ETF recorded a recent 6-month return of 44.65% as of the closing price on the 22nd. The ACE AI Semiconductor Focus ETF concentrates its investments on listed companies related to high-bandwidth memory (HBM), such as Samsung Electronics, SK Hynix, and Hanmi Semiconductor. Since the beginning of the year, it has posted a return of 28.31%, and since its listing in October last year, it has recorded 40.75%.

The ACE Global Semiconductor Top 4 Plus Solactive ETF also posted a 6-month return of 43.37%. It focuses on investing in the top-ranked companies in key semiconductor sectors worldwide. Its major holdings include NVIDIA, TSMC, ASML, and Samsung Electronics, evenly diversified.

NVIDIA, considered the leading stock among global AI-related shares, has risen more than 60% this year through the 22nd. Over six months, it has increased by about 90%. Investing in NVIDIA as a single stock yields higher returns than investing in ETFs that include NVIDIA. However, considering NVIDIA’s 10% drop on the 19th, the risk from increased volatility cannot be ignored.

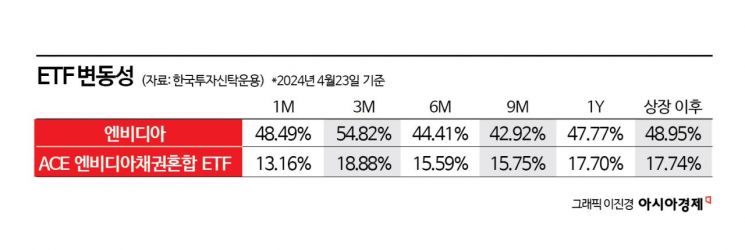

According to Korea Investment Management, NVIDIA’s annual volatility last year was 47.05%. In contrast, among domestic listed ETFs, the ACE NVIDIA Bond Mixed ETF, which has the highest NVIDIA weighting, showed a volatility of only 18.34%.

Nam Yongsoo, Executive Director of the ETF Management Division at Korea Investment Management, explained, "Apple’s stock price rose about 31 times from the launch of the iPhone in 2007 until the end of 2023," but also noted, "During this period, there were three occasions when it dropped 40% from its peak, and even a 60% drop." He added, "It is more effective to respond from a long-term perspective rather than hastily trying to follow a stock that has risen sharply in the short term," emphasizing, "In a market with increased volatility, it is necessary to consider ways to diversify risk and enhance portfolio stability."

As the Apple case shows, investing in leading stocks can increase returns, but even experts find it difficult to endure during correction periods. This is why ETFs are attracting attention for investments in industries like AI, which are expected to grow over the long term. They allow for stable investment over a long period by lowering expected returns.

Moon Namjung, a researcher at Daishin Securities, explained, "Just as the internet and smartphones brought revolutionary changes in the past, AI will establish itself as a technology that changes industrial horizons and raises national productivity to the next level." He added, "Considering the early stage of AI adoption, the AI industry will grow rapidly alongside further advancements in AI technology." He also stated, "We expect the AI market’s compound annual growth rate (CAGR) to reach up to 40% over the next 10 years," and "AI application services and AI software sectors will also grow rapidly."

However, even though investing in ETFs reduces risks from increased volatility, it does not eliminate the possibility of losses. Principal losses may occur depending on the management results, even when investing in ETFs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)