Significant Increase in Overseas Stock and Bond Trading

Domestic Investors' Foreign Currency Securities Holdings Reach $114.4 Billion in Q1... Record High

This year, domestic investors' trading of overseas stocks and bonds has significantly increased. This is attributed to the strong performance of AI semiconductor stocks such as Nvidia in the stock market early this year, which led to a rise in the number of Seohakgaemi (individual investors investing in the U.S. stock market). Notably, the most purchased stock by Seohakgaemi in the first quarter was an exchange-traded fund (ETF) that tracks three times the return of the U.S. semiconductor index, followed by Nvidia as the second most purchased stock.

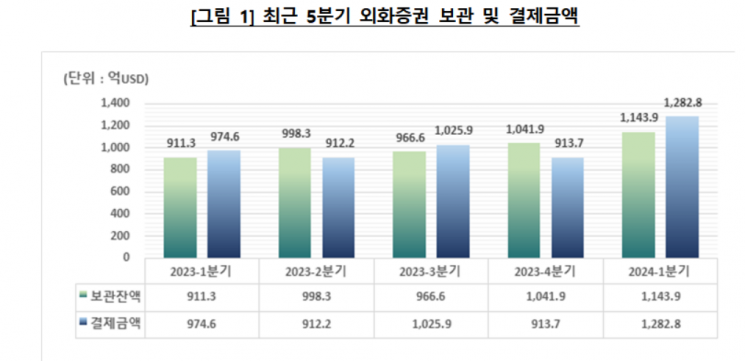

According to the Korea Securities Depository's report on the custody and settlement amount of foreign currency securities for the first quarter of 2024, the total amount of overseas stocks and bonds bought and sold by domestic investors from January to March was $128.28 billion, marking a 40.4% increase compared to the previous quarter. The settlement amount includes both purchases and sales.

By market, the U.S. accounted for 80% of the total settlement amount. For foreign currency stocks, the U.S. made up 95.4% of the total settlement scale. For bonds, the Euro market bonds had the largest scale at 81.3%.

The top settlement amount was for the "Direxion Daily Semiconductor Bull 3X Shares ETF," which tracks three times the return of the Philadelphia Semiconductor Index. It recorded $5.138 billion in purchases and $5.24 billion in sales, totaling $10.378 billion in settlement amount.

The second was Nvidia, with $4.91 billion in purchases and $4.1 billion in sales. Tesla, which was the top in settlement amount last year, ranked third with $7.285 billion.

The custody amount of foreign currency securities in the first quarter of this year was $114.39 billion, a 9.8% increase from the previous quarter. This indicates that the scale of purchases of overseas stocks and bonds was larger than the scale of sales. As of the end of March, the custody amount of foreign currency stocks was $83.64 billion, and foreign currency bonds were $30.75 billion, increasing by 8.8% and 12.5% respectively compared to the previous quarter.

Among these, the U.S. accounted for the highest proportion at 71% of the total custody amount. The U.S. accounted for 89.3% of the total foreign currency stock custody scale, increasing by 9.8% from the previous quarter ($68.02 billion).

The top stock in foreign currency stock custody amount was Tesla ($10.262 billion), maintaining its undisputed first place for three consecutive years. Nvidia ($8.921 billion) pushed Apple ($4.338 billion) to third place and rose to second. Nvidia's custody amount more than doubled from $4.364 billion last year to the first quarter of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)