BYD Establishes Factory in Mexico

Likely to Fail Due to US Government Pressure

A plan by a Chinese electric vehicle (EV) company to build a factory in Mexico is on the verge of collapse due to pressure from the U.S. government.

Since Mexico has a trade agreement with the U.S., low tariffs apply, making it a potential route for Chinese-made EVs to enter the market. At the same time, the U.S. has threatened to triple tariffs on Chinese steel. This is interpreted as an intention to block not only direct imports of steel but also 'circumvention routes' through finished products using that steel.

According to industry sources and foreign media on the 23rd, the plan by Chinese BYD to build an EV factory in Mexico has been temporarily suspended. This is due to difficulties in negotiations between BYD and the Mexican government, with analyses suggesting that the U.S. Trade Representative (USTR) influenced the Mexican side. One foreign media outlet reported that the USTR, responsible for trade policy in the U.S., pressured the Mexican government not to allow Chinese companies within the jurisdiction of the North American Free Trade Agreement.

Mexico has been considered an efficient gateway for foreign automakers to enter the U.S. market. Its geographical proximity, tariff-free trade, low labor costs, and well-established parts supplier infrastructure are strengths. BYD also considered establishing a production base in Mexico in this context.

The U.S. moved the Mexican government to block imports of Chinese products because the region could serve as a detour route for U.S. exports. Mexico has a free trade agreement (USMCA) with the U.S. and Canada. Accordingly, EVs produced in Mexico are treated the same as those made in the U.S.

The U.S. argues that Chinese EV companies receiving national subsidies should not benefit from tariff advantages through Mexico. With the Inflation Reduction Act (IRA) and tariffs blocking Chinese EV imports, if a BYD factory is established in Mexico, which is like a backyard to the U.S., trade barriers would lose their effectiveness. A bill has even been proposed in the U.S. to raise tariffs on Chinese cars from the current 27.5% to nearly 125%. An industry insider said, "Not only the U.S. government but recently even the U.S. Congress is concerned about Chinese companies entering Mexico."

Especially for EVs, more steel is used compared to internal combustion engine vehicles. Blocking EV imports could also affect steel demand. From the U.S. perspective, this is a more effective strategy.

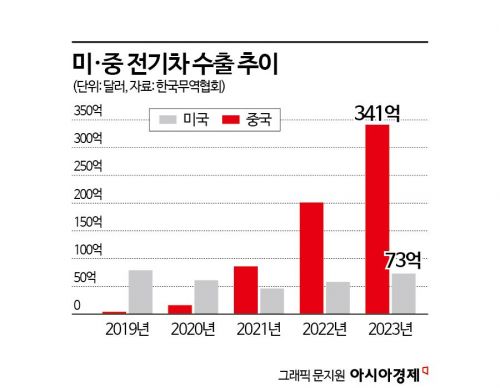

Currently, the U.S. runs a trade surplus in EVs with China. According to Korea International Trade Association statistics, last year China exported $332 million worth of EVs to the U.S., while importing $768 million worth of EVs from the U.S. This results in a surplus of over $400 million for the U.S.

Nevertheless, the U.S. is blocking Chinese EVs because they could expand market influence with price competitiveness. BYD's main model, the mid-sized sedan EV Seal, sells for 179,800 yuan (about 34 million KRW) in China, making it affordable. China recorded a surplus by significantly increasing exports in 2021 and 2022. This means it is entirely possible for China to encroach on the U.S. market if it chooses to do so.

If Chinese EV companies are blocked from entering the U.S. market, it cannot be ruled out that Chinese EV exports will spread worldwide. Chinese local EV companies have grown rapidly fueled by strong domestic demand. The EV penetration rate in China exceeded 30% last year and recently has hovered around half. Until now, a significant portion of domestic production was consumed domestically, but in the past 2-3 years, exports have been increasingly emphasized.

The Chinese government also introduced support measures in February this year to encourage local companies' overseas expansion and exports. It is reported that BYD, as well as state-owned automaker Dongfeng, are considering building EV factories in Italy, and Chery, one of China's top five automakers with early overseas sales, is considering an EV factory in Spain.

If the U.S. moves to block Chinese EVs, South Korea is expected to benefit initially. An industry insider said, "If Chinese EVs cannot enter the U.S. immediately, Korean-made EVs will relatively gain a spillover benefit," but added, "Although the U.S. is strengthening protectionist policies to check Chinese EVs, competition is inevitable because affordable, entry-level models are essential for EV popularization."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)