Nonggyeongyeon '2023 Survey on the Management Status of Food Service Businesses'

Average Operating Profit Margin in 2022 at 11.6%... 3.5% Decrease Compared to 2019

Increase in Adoption of Food Tech Such as Self-Ordering Kiosks and Delivery Apps

Domestic dining businesses showed a recovery in sales after the COVID-19 endemic (periodic outbreak of infectious diseases), but overall business conditions were found to be worse than before COVID-19 due to rising operating costs caused by increased food material prices, intensified competition, and restrictions on obtaining price-related information.

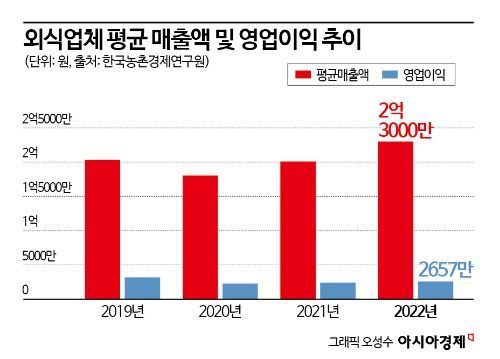

According to the "2023 Dining Business Management Status Survey" released by the Korea Rural Economic Institute on the 24th, the average sales of domestic dining businesses in 2022 were 230 million KRW, a 14.5% increase compared to the previous year (208.9 million KRW).

Sales decreased by 11.0% in 2020, when the COVID-19 pandemic fully spread, compared to 2019, but began to recover afterward, showing a clear upward trend in 2022. The average operating costs of dining businesses, which were 172.56 million KRW in 2019, decreased to 158.77 million KRW in 2020, then increased again to 178.42 million KRW in 2021 and 203.43 million KRW in 2022.

Despite the increase in sales, the improvement in operating profit fell short of expectations. The average operating profit of dining businesses in 2022 was 26.57 million KRW, higher than during the COVID-19 period of 2020-2021, but it decreased by 12.8% compared to 2019 (30.46 million KRW). In particular, the operating profit margin in 2022 was 11.6%, showing little difference from the COVID-19 period, but it fell by 3.5 percentage points compared to 2019 (15.0%), indicating that the recent business conditions of dining businesses are worse than before.

The decline in operating profit margin compared to 2019, before COVID-19, is interpreted as the average annual growth rate of sales from 2019 to 2022 being 4.2%, while operating costs increased by 5.6%, exceeding the growth in sales. Among operating costs, food material costs accounted for the largest share at 42.4% in 2022, followed by labor costs at 33.2% (representative labor costs 14.9%, employee labor costs 14.8%, family worker labor costs 3.5%), rent at 9.6%, and taxes and public charges at 7.3%, in that order.

The biggest difficulties in business management for dining businesses were identified as rising food material costs and intensified competition. The proportion of respondents who reported difficulties due to rising food material costs directly affecting operating profit reached 91.4%, and high proportions also reported difficulties due to intensified competition (83.9%), rising rent (77.3%), rising labor costs (75.2%), and institutional regulations (74.9%). Most of these items showed an increased degree of difficulty compared to the previous year. However, regarding labor shortages, the proportion of respondents reporting difficulties was somewhat reduced compared to the previous year, with 48.1% for cooking (kitchen) and 53.2% for hall serving and counter staff.

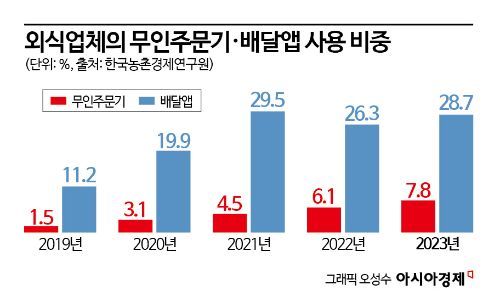

Meanwhile, as food tech adoption became widespread across the industry, the proportion of dining businesses using unmanned ordering machines also increased. The proportion of dining businesses using unmanned ordering machines rose sharply from 0.6% in 2017 to 7.8% in 2023, an increase of 7.2 percentage points, showing a clear trend of expanded adoption. By industry type, as of 2023, the use of unmanned ordering machines was about twice as high in non-general restaurants (10.4%) compared to general restaurants (5.4%). Among unmanned ordering machine types, kiosks accounted for a significant majority at 67.0% in 2023.

Additionally, the use of delivery applications by dining businesses continued to increase. The proportion of dining businesses using delivery apps was around 11.2% in 2019, expanded to 19.9% in 2020 and 29.5% in 2021 as non-face-to-face methods spread during the pandemic. It then decreased to 26.3% in 2022 with the transition to the with-COVID-19 era, but rose again to 28.7% last year. Furthermore, the use of delivery agency services by dining businesses increased steadily from 18.5% in 2021 to 19.4% in 2022 and 24.1% in 2023, showing a difference from the delivery app usage proportion, which had a sharp increase followed by a recent moderate rise.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)