Preventing Tax Avoidance by Multinational Corporations

Negative Impact on Local US Investments

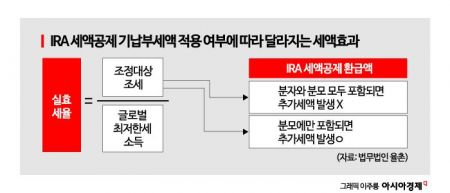

Reduced Effect of IRA Tax Credits

Need to Persuade Recognition of Prepaid Taxes

Last year, the domestic battery industry, which received tax credits worth trillions of won in the United States, is expected to pay nearly 200 billion won in additional taxes in 2026 due to the application of the global minimum tax. Battery companies are currently investing in the U.S., and as local production increases, the scale of additional taxes is also expected to rise accordingly. To address this, there have been calls to recognize the investment tax credits already paid as tax payments.

At the ‘U.S. Inflation Reduction Act (IRA) Response and Global Minimum Tax Seminar’ jointly hosted by the Korea Battery Industry Association, Korea Petrochemical Industry Association, and Korea New and Renewable Energy Association on the 23rd, CPA Hyun Jung (Yulchon LLC) said, "Last year, LG Energy Solution (676.8 billion won) and SK On (610 billion won) received about 1.3 trillion won in IRA tax credits," adding, "If there is no other income or loss, domestic companies will have to pay about 180 billion won in additional taxes, which is 15% of that amount, according to the global minimum tax."

He continued, "The amount will increase further when Samsung SDI’s portion is added in 2025," and added, "Assuming conservatively that the tax effect continues equally until 2032, about 1.8 trillion won in additional taxes will have to be paid over 10 years."

The global minimum tax is a system that imposes a minimum 15% corporate tax on multinational corporations with annual global sales exceeding 1 trillion won. If the effective tax rate in the relevant country is 10%, the remaining 5% must be paid to the home country. Our government has implemented this from this year.

This system was promoted by the Group of Twenty (G20) and the Organisation for Economic Co-operation and Development (OECD) to prevent multinational corporations from avoiding taxes by establishing headquarters in regions with tax rates lower than the global minimum tax rate (15%).

However, when tax credits are received from overseas investments, the effective tax rate decreases, resulting in a situation where additional taxes must be paid domestically.

CPA Jung argued that to resolve the issue of the diminished effect of IRA tax credits due to the global minimum tax, the U.S. should be persuaded to recognize the IRA tax credits paid in cash as taxes already paid.

He said, "The refund amount from the Advanced Manufacturing Production Tax Credit (AMPC) related to the IRA is included in global minimum tax income, causing additional taxes, but if it corresponds to a 'deduction of current corporate tax expense,' the effective tax rate will not fall below 15%."

He added, "Under U.S. tax law, the 'Direct Pay' tax credit, which pays tax credits in cash, is considered as already paid," and said, "Although it corresponds to corporate tax, it is not recorded as current corporate tax expense, so there is a possibility that it corresponds to a 'deduction of current corporate tax expense.'"

Regarding concerns about the feasibility of persuading the U.S., CPA Jung said, "Since the global minimum tax was introduced as an OECD Common Approach, the issue of additional tax imposition can only be addressed through changes to OECD administrative guidelines (allowing exceptions)." He added, "The U.S. has exerted significant influence on the Pillar 2 agreement and its amendments," and "There is a precedent where the U.S. actively expressed its position to revise OECD administrative guidelines concerning IRA-related renewable energy tax credits."

He continued, "The IRA is the largest investment in green energy in U.S. history and a key achievement of the Biden administration," and said, "With the U.S. presidential election approaching, if investments in the U.S. increase due to IRA benefits, new jobs can be created, and the U.S. side must be made aware that the negative impact of the global minimum tax would directly hit investment growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)