May Regular Change Results Announced on June 15

Selection Based on Arbitrary Designated Days Among 10 Trading Days from 17th to Month-End

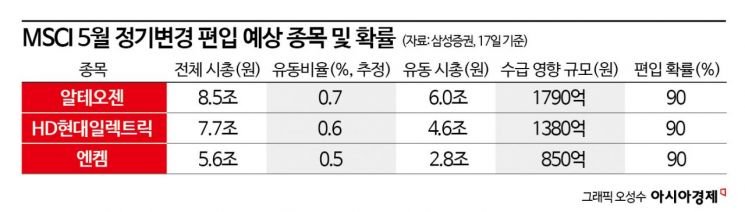

Alteogen, HD Hyundai Electric, Enchem Expected to Be Included

As the regular MSCI index rebalancing approaches, attention is focused on newly included and excluded stocks. Alteogen, HD Hyundai Electric, and Enchem are expected to be included.

According to the financial investment industry on the 22nd, the results of the MSCI regular rebalancing will be announced on the 15th of next month. To prepare for this, the selection process will be conducted based on arbitrarily designated trading days among 10 trading days from the 17th of this month to the end of the month.

In the securities industry, Alteogen, HD Hyundai Electric, and Enchem are expected to be included in this rebalancing. Dongyoung Kim, a researcher at Samsung Securities, said, "The stocks expected to be included are Alteogen, HD Hyundai Electric, and Enchem." He added, "The estimated cutoff (market capitalization threshold for inclusion/exclusion) used for the rebalancing is 3.7 trillion KRW, or 2.638 billion USD. As of the first day of the review period, the 17th, Alteogen, HD Hyundai Electric, and Enchem have all met the market capitalization and free float market capitalization criteria due to recent stock price increases." Kim predicted that if included, Alteogen would see an inflow of about 180 billion KRW, HD Hyundai Electric about 140 billion KRW, and Enchem about 85 billion KRW in demand.

Byungjae Kwon, a researcher at Hanwha Investment & Securities, also named these three stocks as candidates for inclusion in this rebalancing. Kwon said, "Alteogen, which has been mentioned as a candidate since the last rebalancing, has a market cap that significantly exceeds the cutoff of 3.7 trillion KRW, so it is expected to be included stably. HD Hyundai Electric and Enchem also increased their market caps by 119% and 163%, respectively, compared to the review reference date (January 18), so they are expected to be included along with Alteogen."

Yuanta Securities also expects these three stocks to be included. However, while the inclusion possibility for Alteogen and HD Hyundai Electric is seen as high, Enchem's inclusion possibility is rated as moderate. Kyungbeom Ko, a researcher at Yuanta Securities, said, "The inclusion possibility for Alteogen and Enchem is considered 'High.' Enchem's inclusion also looks likely, but considering our conservative cutoff and recent adjustments, we rate the inclusion possibility as 'Mid.' Due to recent adjustments, the probability of falling below the inclusion hurdle cannot be ruled out." Enchem reached a 52-week high of 394,500 KRW intraday on the 8th but has since shown a weak stock price. On the first day of the review period, the 17th, its stock price dropped more than 9%, falling to the low 300,000 KRW range. Market capitalization, which had increased to about 6.8 trillion KRW on the 11th, decreased to about 5.6 trillion KRW on the 17th.

The number of excluded stocks is expected to be between a minimum of 2 and a maximum of 6. Kakao Pay, Hanon Systems, Kangwon Land, Samsung Securities, Kumho Petrochemical, and Hyundai Construction are mentioned. Ko said, "Exclusions in this rebalancing are expected to be between 2 and 6 stocks. Although the cutoff is set conservatively, it is necessary to approach the scope of stock exclusions broadly." Yuanta Securities sees a high possibility of exclusion for Kakao Pay and Hanon Systems, while the possibility for Kangwon Land, Samsung Securities, Kumho Petrochemical, and Hyundai Construction is rated as moderate. Ko explained, "Considering market cap and free float market cap levels, Kakao Pay and Hanon Systems are likely to be excluded. Kangwon Land has a high possibility of exclusion but also a small chance of remaining, so its exclusion possibility is rated as moderate. Samsung Securities, Kumho Petrochemical, and Hyundai Construction are close to the exclusion candidate group but have relatively low competition with other unmentioned stocks, so the possibility of remaining is not small."

Samsung Securities identified Kakao Pay, Hanon Systems, and Kangwon Land as basic expected exclusion candidates. Researcher Kim said, "Kakao Pay (free float market cap of 880 billion KRW) and Hanon Systems (free float market cap of 940 billion KRW) are confirmed for exclusion due to failure to meet the free float market cap criteria caused by recent stock price weakness. Next, among existing stocks, exclusions will be made in order of lowest market cap, with Kangwon Land being the next first priority."

Hanwha Investment & Securities listed Samsung Securities, Kangwon Land, Hanon Systems, and Kakao Pay as expected exclusion candidates. Researcher Kwon said, "Samsung Securities, Kangwon Land, and Hanon Systems have relatively small market caps, lowering their inclusion priority, and Kakao Pay is expected to be excluded due to falling below the free float market cap cutoff."

Additionally, KT is expected to see a reduction in weighting due to an increase in foreign ownership. Researcher Kim said, "KT's foreign ownership ratio has risen from the low 40% range at the beginning of the year to 45.6% recently, reducing KT's additional foreign buying capacity to 7.0%. According to regulations, if the additional foreign buying capacity falls below the 7.5% hurdle, the applicable free float factor for the stock is halved again, which is expected to apply to KT in this rebalancing." As of the 17th, KT's market cap is 8.6 trillion KRW, and the MSCI free float factor is 25%, so KT's MSCI free float market cap is 2.2 trillion KRW. In the May rebalancing, the MSCI free float factor is expected to decrease to 12%, reducing KT's MSCI free float market cap to about 1 trillion KRW. Kim analyzed, "With a decrease of about 1.1 trillion KRW in free float market cap, the selling impact from tracking funds is expected to be about 34 billion KRW. However, since this is a simple weighting change rather than inclusion/exclusion, the final impact on the stock price is likely to be muted, so the impact of this change will not be significant."

Meanwhile, the results of the May rebalancing will be reflected in the index on May 31 and will take effect from June 3.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)