Embrain Trend Monitor Survey

63.7% of Respondents "Have Experience Using Specialized Cards"

Increased Demand for Preferential Exchange Rates and Currency Exchange Benefits

Competition for Customer Acquisition in the Financial Industry

Since the transition to the endemic phase (periodic outbreaks of infectious diseases), demand for overseas travel has been steadily rising, and it has been found that more than 6 out of 10 people who have used travel-specialized 'travel cards' have done so. The number of users is expected to increase due to advantages such as receiving benefits from preferential exchange rate services when exchanging currency, and the convenience of withdrawing or making payments locally without carrying cash.

The electronic board at the currency exchange counter in Terminal 1 of Incheon International Airport displays the exchange rates for various currencies. Photo by Jinhyung Kang aymsdream@

The electronic board at the currency exchange counter in Terminal 1 of Incheon International Airport displays the exchange rates for various currencies. Photo by Jinhyung Kang aymsdream@

On the 20th, market research firm Embrain Trend Monitor conducted a survey on 'currency exchange services and the use of travel-specialized cards (travel cards)' targeting 1,000 adults aged 19 to 69 nationwide who had traveled abroad within the past year. As a result, 63.7% of all respondents said they had experience using travel cards.

They cited the advantages of travel cards as 'convenience through mobile applications (apps),' 'simplicity in the card issuance process,' and 'differentiated currency exchange benefits.' Contrary to the expectation that mobile-based travel card services would be more useful to younger generations than middle-aged and older adults, a high willingness to use them was observed across all age groups. In fact, 87.1% of all respondents expressed an intention to use travel cards in the future, with age group proportions evenly distributed: 88.0% in their 20s, 88.5% in their 30s, 90.5% in their 40s, 82.5% in their 50s, and 86.0% in their 60s.

Accordingly, not only existing services like Travelog and Travel Wallet but also Toss Foreign Currency Account Check Cards, Shinhan SOL Travel, Kona Travel Zero, Hanpas Triple, and others from commercial banks, internet-only banks, and fintech companies are rushing into the travel-specialized service market. As these financial sectors compete to attract related customers, the scope of app installations and usage rates is also expanding.

For example, Hana Card's Travelog surpassed 4 million service subscribers this year. The app installation rate increased by 27.7% as of January compared to June 2022, when social distancing was lifted, and the usage rate also rose by 30.7%. Fintech company Travel Wallet's app installation rate, which was 1.52% in April 2022, recorded more than a fivefold increase to 8.09% as of January this year. Additionally, Shinhan Card's 'Shinhan SOL Travel Check Card' exceeded 500,000 issued cards within two months of its launch.

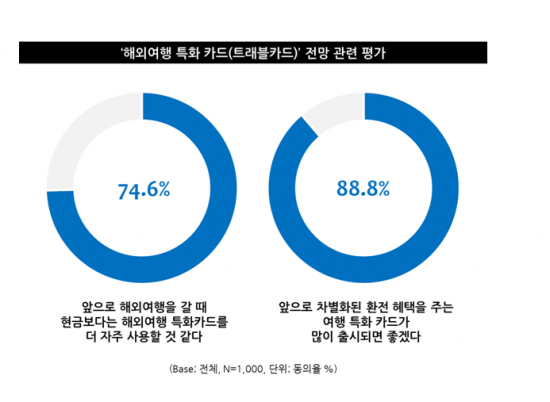

Demand for travel cards is expected to continue its upward trend. 74.6% of Embrain Trend Monitor survey respondents said, "I think I will use travel cards more often than cash when traveling abroad." Also, 73.5% responded that "I will mainly use payment cards locally and exchange cash only as a small emergency fund."

On the other hand, a significant portion of respondents (82.4%) said, "Even if there is a travel-specialized card, I would feel uneasy without local cash," confirming that demand for cash exchange still exists. An Embrain official noted, "There seems to be high growth potential for local currency withdrawal services using ATM machines in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)