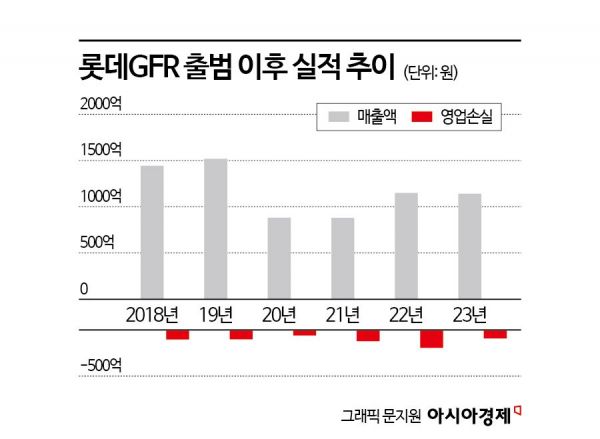

Lotte GFR Reports Operating Loss of 9.1 Billion KRW Last Year

Loss Reduced by 10 Billion KRW Compared to Previous Year

Canada Goose, Developing Kawe... Expects Profit Turnaround Next Year

Lotte Shopping's fashion subsidiary, Lotte GFR (GFR), is accelerating efforts to improve profitability by reducing its operating loss by more than 10 billion KRW last year.

According to the Financial Supervisory Service's electronic disclosure system on the 19th, Lotte GFR recorded an operating loss of 9.1 billion KRW last year, reducing its operating deficit by over 10 billion KRW compared to the previous year. Sales amounted to 114 billion KRW, similar to the previous year's 115 billion KRW.

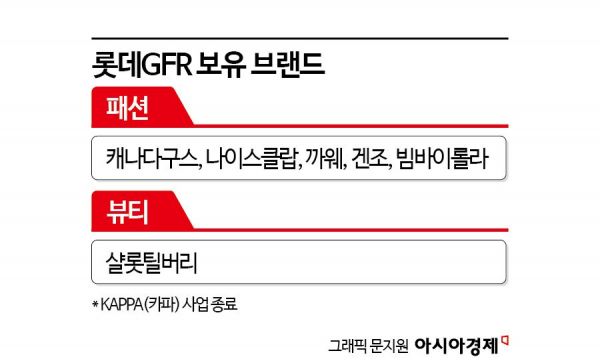

Lotte GFR is Lotte's fashion subsidiary launched in June 2018. It acquires domestic and international brand licenses and handles distribution and sales. Its business structure is similar to major fashion conglomerates such as Samsung C&T and Shinsegae International. However, as it started later, there is a significant difference in sales scale.

In 2022, Lotte GFR acquired the license for 'Canada Goose,' which boosted sales sharply from 80 billion KRW to over 110 billion KRW, but aggressive marketing campaigns caused the operating loss to balloon to 20 billion KRW.

Lotte GFR improved profitability last year by drastically cutting marketing expenses. The company spent 69.3 billion KRW on selling and administrative expenses last year, tightening belts on marketing and welfare costs to reduce spending compared to 74 billion KRW the previous year. Additionally, the absence of an extra bad debt write-off (loss on uncollectible accounts receivable) of about 700 million KRW, which was recorded in 2022, also contributed to profit improvement.

A Lotte GFR official said, "In 2022, there was a tendency to increase sales significantly through heavy product discounts, but internally it was judged that this did not greatly help branding. The policy has shifted to lowering discount rates and conducting only essential events for each brand."

Since Shin Min-wook took over as CEO of Lotte GFR in October last year, efforts to improve profitability have been carried out more intensively. Recently, the termination of the brand contract with the Italian sports brand 'Kappa' is also part of the profitability enhancement strategy.

Lotte Department Store signed an exclusive domestic business contract with Kappa in September 2021 during the tenure of CEO Jung Jun-ho (current CEO of Lotte Department Store). At that time, the brand was transformed into a lifestyle brand targeting the MZ generation, with ambitions to achieve 100 billion KRW in sales by 2025. However, the business ended after about three years without fulfilling the contract period, which was set to expire in 2028.

Following the closure of Kappa's official online mall at the end of last month, the Kappa brand was also removed from the Lotte GFR website. Kappa incurred an impairment loss of 11.7 billion KRW in its first year of business in 2022, negatively impacting the company's cash flow. Currently, the company operates seven brands: Canada Goose, Nice Claup, Kawe, Kenzo, Kenzo Kids, Bimba Y Lola, and Charlotte Tilbury. Among these, impairment losses were recorded last year for Kenzo (-2 billion KRW), Kawe (-70 million KRW), and Charlotte Tilbury (100 million KRW).

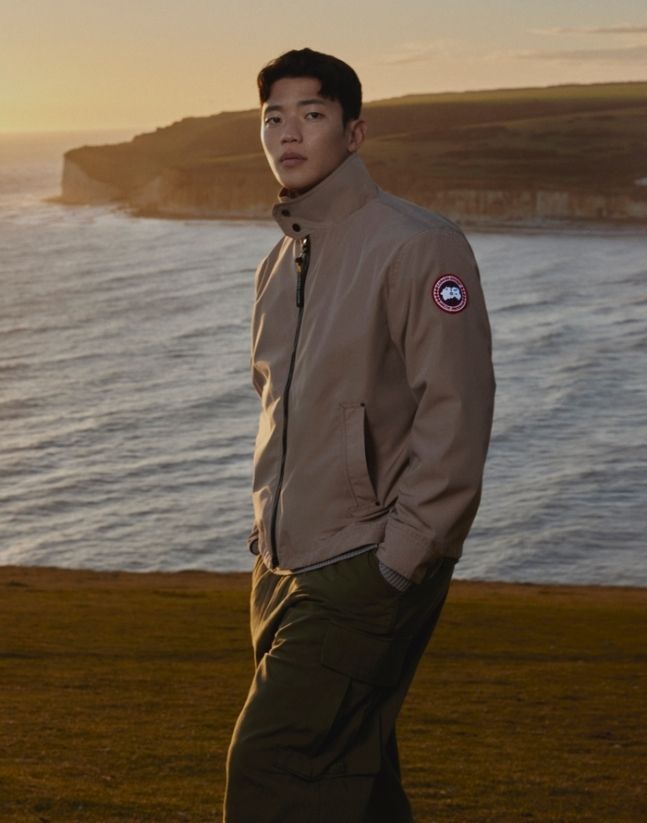

This year, the company plans to aggressively promote the Canadian luxury brand 'Canada Goose' and the French lifestyle brand 'Kawe.' Canada Goose is Lotte GFR's core asset among the seven brands, as it has not recorded any impairment losses. The goal is to expand the brand's image beyond being specialized for autumn and winter to also being sought after in spring and summer. Recently, they released a pictorial featuring soccer player Hwang Hee-chan targeting the spring and summer seasons.

The strategy for Kawe is to reposition it as a lifestyle brand. Since it is known for selling outdoor products such as hiking and fishing gear, the brand's expansion potential is considered somewhat limited. The recent marketing efforts for products in collaboration with Maison Kitsun? are part of this strategy. They expect to turn a profit by the end of next year.

The strategy to introduce additional imported overseas brands remains valid. However, adding new brands quickly seems difficult. Recently, domestic fashion conglomerates such as Handsome, Samsung C&T, LF, and Kolon FnC have set securing licenses for imported overseas brands as a key business area, leading to fierce competition. A fashion industry insider said, "All the brands that are going to enter the domestic market have basically entered. The competition is intense, so it takes a long time to secure brand contracts, and in the first year of launch, a lot of marketing investment is required, making it a costly business."

Moreover, Lotte GFR is in a situation requiring financial restructuring, having received a total capital injection of 50 billion KRW from Lotte Shopping at the end of last year and this year. A Lotte GFR official explained, "We do not limit ourselves to specific categories such as fashion or beauty, and if there are promising overseas brands in furniture or other sectors, we will look at them positively, but a cautious approach is necessary. This year, we plan to focus on nurturing the brands currently in progress."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.