IMF Spring Meeting Discussion on South Korea's Monetary Policy

"Different Nature Compared to 1 Year and 6 Months Ago"

"Influenced by Geopolitical Risks and Weakness of Neighboring Currencies"

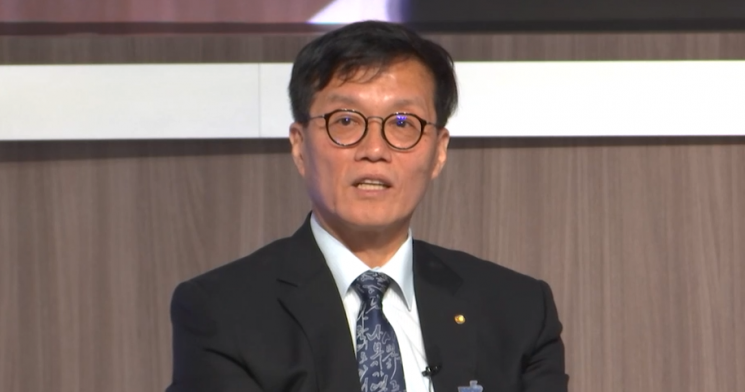

Lee Chang-yong, Governor of the Bank of Korea, is speaking at a discussion on South Korea's monetary policy during the 2024 International Monetary Fund (IMF) Spring Meetings held in Washington DC, USA, on the 17th (local time). (Photo by IMF Spring Meetings video capture)

Lee Chang-yong, Governor of the Bank of Korea, is speaking at a discussion on South Korea's monetary policy during the 2024 International Monetary Fund (IMF) Spring Meetings held in Washington DC, USA, on the 17th (local time). (Photo by IMF Spring Meetings video capture)

Lee Chang-yong, Governor of the Bank of Korea, recently described the won-dollar exchange rate surge to 1,400 won as a "temporary phenomenon" and stated that "we have the resources and means to mitigate volatility."

On the 17th (local time), during a discussion held on the sidelines of the International Monetary Fund (IMF) Spring Meetings, Governor Lee emphasized that "over the past two weeks, the won-dollar exchange rate has been heavily influenced by external factors beyond what fundamentals can justify," but also highlighted that the Bank of Korea possesses the resources and means to take market stabilization measures if necessary.

In an interview with the US CNBC broadcast the previous day, Governor Lee also commented on the exchange rate issue, saying, "Considering market fundamentals, the recent volatility is somewhat excessive," and added, "If exchange rate volatility continues, we are prepared to take market stabilization measures." The Bank of Korea and the Ministry of Economy and Finance conducted verbal intervention on the 16th when the exchange rate surged to 1,400 won.

Governor Lee stressed that the current sharp rise in the exchange rate differs from that in November 2022. At that time, the highest closing won-dollar exchange rate was 1,423.8 won on November 3, 2022. He explained that the dollar's value steadily increased then due to expectations of continued US interest rate hikes, whereas the current strong dollar phenomenon stems from market expectations that the US Federal Reserve's rate cut timing may be delayed.

He stated, "The uncertainty about how long the US will maintain the current interest rate level and when it will start lowering rates significantly impacts emerging market exchange rates," adding, "Although this is a sensitive period with many uncertainties, once the market adapts to the US monetary policy stance, the exchange rate burden will lessen."

Regarding recent exchange rate movements, he mentioned geopolitical risks arising from Middle East instability in addition to US monetary policy, noting that "the impact varies considerably depending on whether a country is an oil importer or not."

He also emphasized that the depreciation of the Chinese yuan and Japanese yen affects the won's weakness. Since the won acts as a 'hedging instrument' against the yuan and yen, it is more affected. Governor Lee had previously diagnosed at a press conference following the Monetary Policy Committee meeting on the 12th that "(Because the won is) proxied by neighboring currencies such as Japan's and China's, there is suspicion that the won has been excessively depreciated relative to our fundamentals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)