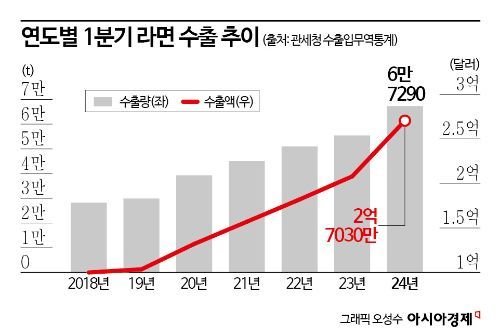

$270.3 Million Export Value in Q1... 30% Increase YoY

Export Volume Also Rises 22% to 67,290 Tons

Ramen Industry Sees Bright Q1 Performance Amid Export Boom

The domestic ramen industry, aiming for an annual export value of 1 billion dollars this year, has announced a strong start with first-quarter export figures increasing by more than 30% compared to last year. With growing demand in overseas markets sustaining strong exports, the outlook for the first quarter's performance this year is also excellent.

According to the Korea Customs Service's import-export trade statistics on the 19th, ramen exports in the first quarter of this year amounted to $270.3 million (approximately 376 billion KRW), a 30.0% increase from the same period last year ($207.86 million). Since ramen exports first surpassed $100 million in the first quarter of 2018, the figures have shown an upward trend every year. Last year, exports exceeded $200 million, and this year, the first quarter set a new record for the highest export value, continuing the positive momentum. Export volume also rose by 21.5% to 67,290 tons compared to 55,393 tons in the same period last year.

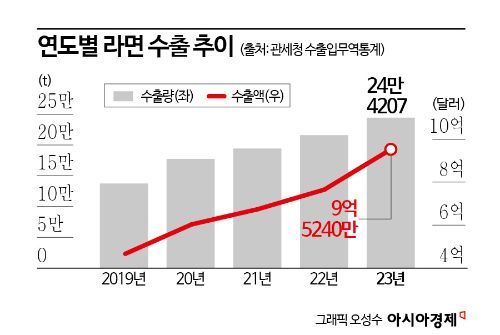

Marking its 60th anniversary last year, Korean ramen recorded an all-time high export value of $952.4 million (approximately 1.32 trillion KRW), approaching the $1 billion mark. Ramen exports have shown rapid growth since surpassing $200 million in 2015, reaching $466.7 million in 2018, $603.57 million in 2020, and $765.41 million in 2022. Additionally, some ramen companies like Nongshim produce products not only domestically but also overseas, meaning the global market size for Korean ramen companies is even larger than the export figures suggest.

Korean ramen has rapidly increased its global market recognition based on the influence of K-content, continuing remarkable growth. Scenes of eating ramen frequently appear in Korean movies, dramas, and variety shows, attracting overseas consumers' interest, and challenges on social networking services (SNS) have positively contributed to promoting domestic products. Furthermore, the increase in demand for convenience foods during the COVID-19 pandemic is also considered a factor behind the export growth.

With exports performing well, ramen companies are expected to continue last year's upward trend in their first-quarter results this year. According to financial information provider FnGuide, Nongshim's first-quarter sales are estimated at 903.5 billion KRW, up 5.0% from the same period last year, with operating profit increasing by 4.5% to 66.6 billion KRW. Ottogi is also expected to grow, with sales of 896.3 billion KRW and operating profit of 66.8 billion KRW, up 4.6% and 2.2% respectively year-on-year. The most notable is Samyang Foods, with first-quarter sales projected at 321.2 billion KRW, a 30.1% increase, and operating profit expected to rise 63.6% to 39 billion KRW. Demand has expanded in the U.S., as well as Southeast Asian regions such as Thailand and Indonesia, and Europe.

With consensus that overseas markets are the definite key to growth, the industry is accelerating its global market strategies. Nongshim, which first entered the U.S. by establishing a factory in California in 2005, increased supply by building a second factory in 2022 in response to surging product demand during the pandemic, and plans to add a new production line to the second U.S. factory in the fourth quarter of this year. Additionally, Chairman Shin Dong-won has announced plans to consider establishing a third U.S. factory next year, clearly indicating expansion toward the North American market.

In fact, as Nongshim actively markets to the Hispanic population in the U.S., strengthening its dominance in the North American market, the growth potential remains high. Nongshim plans to target California and Texas, regions with a high proportion of Hispanic consumers, with new products featuring flavors preferred by this demographic, and based on this, intends to actively enter the Mexican market. Kang Eun-ji, a researcher at Korea Investment & Securities, predicted, "If they succeed in targeting the Hispanic population who enjoy spicy flavors, it will be possible to enter the South American market based on recognition among the Hispanic population in the U.S."

Samyang Foods, which continues its export strategy based entirely on domestic production, will increase production capacity by about 30% when its second factory in Miryang is completed in May next year. The company plans to develop new channels and clients in its core markets of China and Southeast Asia, and expand penetration into major distribution channels in the U.S. and European markets to drive external growth. Han Yoo-jung, a researcher at Hanwha Investment & Securities, evaluated, "The U.S. subsidiary is expected to expand store entries and product lines based on positive sales data from initial shipments to Walmart and Costco completed last year, and the China subsidiary is expected to rebound sales through expanded entry into rapidly growing snack channels and convenience stores in China."

Ottogi, which has a relatively high domestic sales ratio, is also known to be strengthening its overseas business by increasing the number of export countries this year and reorganizing its U.S. subsidiary. Additionally, Paldo completed its second factory on the 16th to respond to increasing local demand in Vietnam, expanding its production and export base. The second factory can produce up to 100 million ramen products annually, including cooked noodles and instant noodles, and Paldo plans to strengthen exports centered on its local subsidiary based on this capacity.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)