Stock Valuation Drops by 6.2 Trillion Won in the Week After General Election

Erasing This Year's Gains and Turning Negative... Samsung Electronics Alone Sees 2.1 Trillion Won 'Evaporated'

If Downtrend Continues, This Year's 'Absolute Investment Amount' May Also Decline

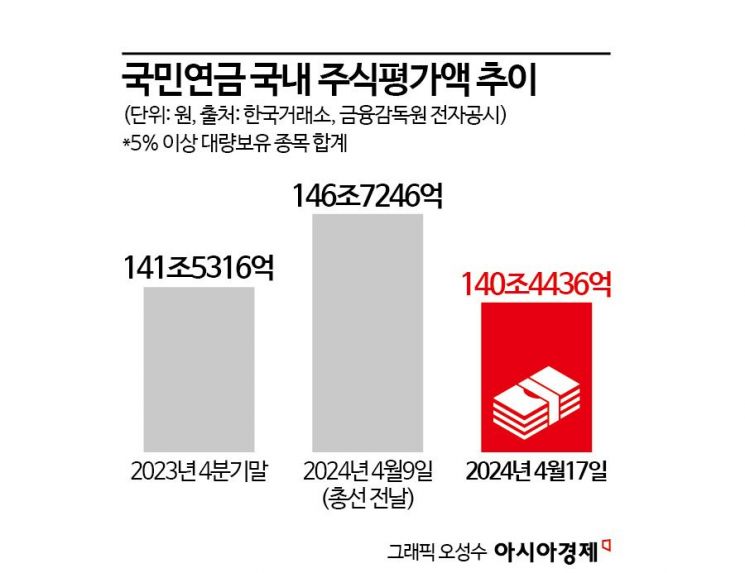

The National Pension Service, the largest institutional investor in the domestic stock market, was also hit hard by the downturn. It was revealed that the stock valuation amount evaporated by more than 6 trillion won within a week after the general election. It gave back all the gains made this year and even retreated into negative territory.

According to the Korea Exchange on the 18th, the total stock valuation amount of 277 listed companies in which the National Pension Service holds more than 5% of shares was 140.4436 trillion won as of the closing price on the 17th. Compared to the day before the general election (market closed) on the 9th (146.7246 trillion won), it decreased by 6.281 trillion won (4.3%). During this period, the KOSPI index fell 4.5% from 2703.96 to 2584.18. The current total stock valuation amount of the National Pension Service's large holdings is even lower than at the end of 2023 (141.5316 trillion won). The stock valuation gains, which had increased by more than 5 trillion won earlier this year, were wiped out within a week, turning negative.

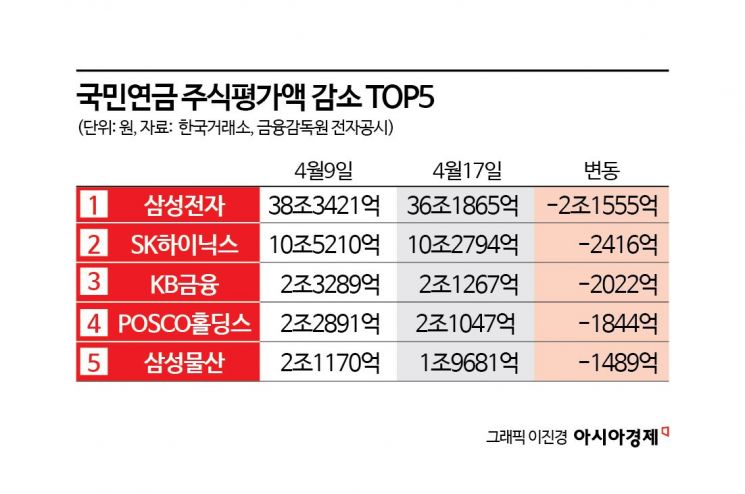

Samsung Electronics evaporates 2.1 trillion won... Companies over 1 trillion won drop from 25 to 21

The stock with the largest decrease in valuation was Samsung Electronics. Samsung Electronics accounts for the largest portion (about 25.8%) of the National Pension Service's domestic stock portfolio. The valuation of its 7.68% stake held decreased by 2.1555 trillion won from 38.3421 trillion won on the 9th to 36.1865 trillion won on the 17th. SK Hynix (-241.6 billion won), KB Financial Group (-202.2 billion won), POSCO Holdings (-184.4 billion won), and Samsung C&T (-148.9 billion won) followed. On the other hand, among the holdings during the same period, Kia's valuation increased the most from 3.115 trillion won to 3.2621 trillion won (an increase of 147.1 billion won), followed by Hyundai Motor, which rose by 91.5 billion won (from 3.7915 trillion won to 3.883 trillion won).

Overall, among the 277 holdings, the valuation of 217 stocks (78.3%) decreased, 3 stocks (1.1%) remained flat, and the remaining 57 stocks (20.6%) increased. The number of companies with a valuation exceeding 1 trillion won also decreased from 25 to 21 during the same period. Most of these stocks had no change or less than 1% change in their holdings this year. The 21 stocks accounted for 58.2% of the total stock valuation as of the 17th. The value of holdings in four companies?Samsung SDS (from 1.0478 trillion won to 984.8 billion won), Samsung Fire & Marine Insurance (from 1.0886 trillion won to 983.8 billion won), Samsung Life Insurance (from 1.1038 trillion won to 962 billion won), and LG (from 1.0208 trillion won to 961.4 billion won)?fell below 1 trillion won.

Domestic asset proportion declining... Possibility of reduced 'absolute investment amount'

The National Pension Service is increasing its overseas investment proportion to delay fund depletion. The proportion of domestic stocks in the National Pension Service's assets has gradually decreased. According to the medium-term asset allocation plan (2024?2028), the planned domestic stock investment ratio for this year is 15.4%, which is 0.5 percentage points lower than last year's plan of 15.9%. However, even the 15.4% is just a target figure. Last year, the National Pension Service invested only 14.3% of its assets in domestic stocks, far below the target. Meanwhile, the overseas stock investment ratio, which had a target of 30.3%, was actually 32.3%. Considering that overseas stock prices rose more than domestic ones, criticism arose that the National Pension Service was passive in domestic stock investment due to the lower-than-planned proportion.

In response, the National Pension Service has explained that "despite the reduction in domestic proportion, the absolute investment amount increased due to the growth of the fund size." This was in consideration of individual investors' criticism of expanded overseas investment and the role of 'value-up.' However, if stock returns worsen due to a downturn, there is a sufficient possibility that the absolute investment amount will decrease. In fact, in 2022, when the domestic stock return was -22.76%, the National Pension Service's stock valuation was 125.4 trillion won, about 40 trillion won less than 165.8 trillion won in 2021. The following year, with a rebound in returns to 22.12%, it recovered to the 140 trillion won level. Still, this is less than in 2021.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.