Q1 Transaction Volume 19 Trillion, 66% of Last Year

M&A Listings Accumulate, Double-Digit Trillions

Pharma & Bio Including ADC, Industries to Watch This Year

The merger and acquisition (M&A) market continues to experience an endless recession. The transaction volume has retreated to the level of four years ago, and trillion-won 'mega deals' have also disappeared.

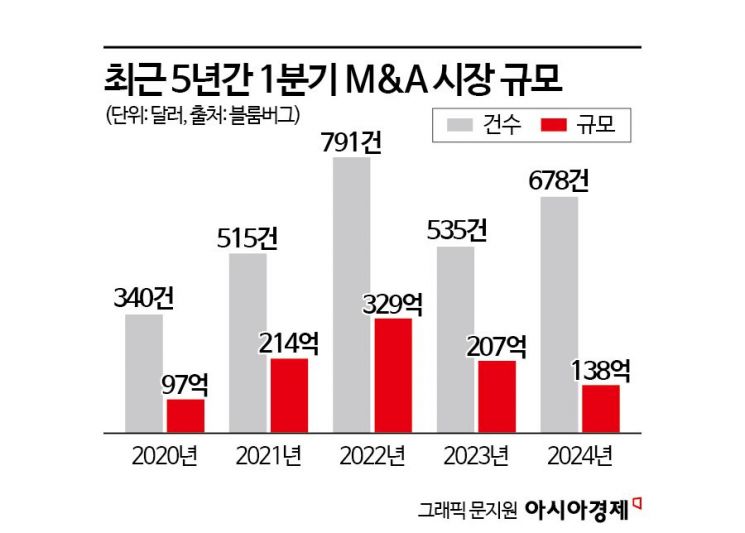

According to data from Bloomberg League Table, a U.S. economic media outlet, on the 16th, a total of 678 deals were completed in South Korea's M&A market in the first quarter of 2024. The scale was $13.8 billion (approximately 19 trillion won). The number of deals increased by 26% compared to the same period last year, but the scale decreased by 34%. In the first quarter of 2023, the number of deals was 535, and the scale was $20.7 billion (approximately 28.6 trillion won).

Bloomberg analyzed, "Compared to the first quarter performance over the past five years, the scale is low, and there were no big deals over 1 trillion won," adding, "The prolonged high interest rates and accumulating economic uncertainties are accelerating uncertainty, and the recession continues." Looking at the transaction scale in the first quarter over the past five years, it increased from $9.7 billion in 2020 to $21.4 billion in 2021 and $32.9 billion in 2022, then decreased to $20.7 billion in 2023. The downward trend continued this year, with the market scale retreating to the level of four years ago and halving compared to the peak two years ago.

"Hit the Bottom"... Improvement Expected in the Second Half

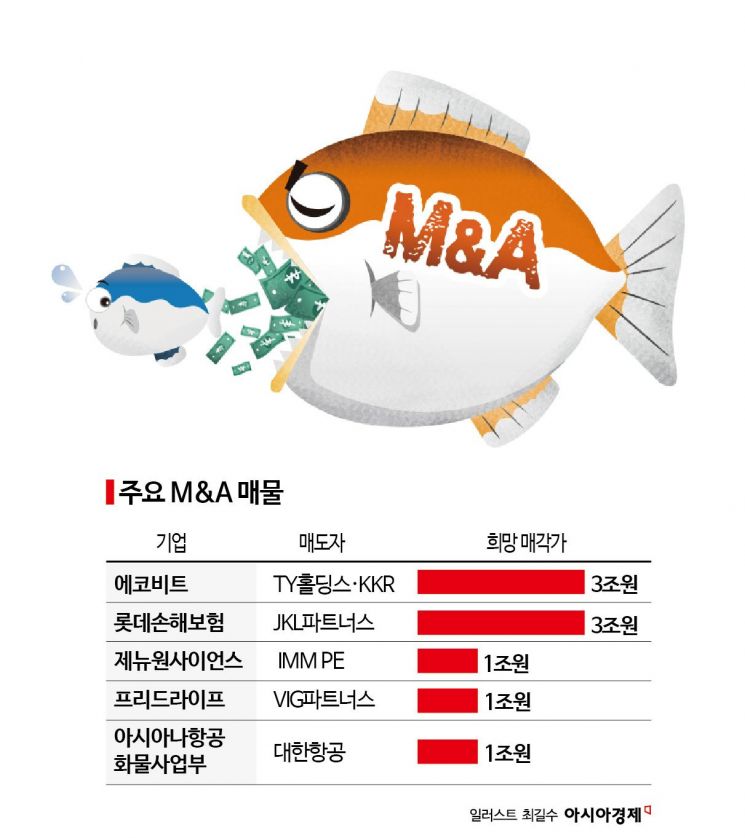

Since last year, a 'deal drought' has continued, causing M&A listings to accumulate. There are numerous trillion-won listings that did not connect to deals in the first quarter. Including pending listings, there are more than 10 companies with a 'body value' exceeding 1 trillion won. Ecobit and Lotte Insurance are mentioned with sale amounts exceeding 3 trillion won, and companies such as Genewon Science, Freed Life, and Asiana Airlines Cargo Division are expected to have transaction scales over 1 trillion won. In particular, M&A demand for private equity fund (PEF) managers to recover investment funds (exit) is higher than ever. Among the 10 companies mentioned for 'mega deals,' except for Asiana Airlines Cargo Division, which Korean Air is selling, all are listings that PEFs are pushing to sell.

Regarding the M&A market after the first quarter, the prevailing forecast is 'Sangjeohago (上低下高: low in the first half, high in the second half).' Jung Kyung-soo, head of the Samil PwC M&A Center, said, "These days, I am so busy looking at deal lists every day that I barely have time to breathe," adding, "The frequency of deals has definitely increased compared to last year, so the league table, which is compiled based on deal closings, will also show improvement in the second half." There is an expectation that the M&A downturn caused by interest rate hikes, investment sentiment contraction, and geopolitical conflicts will somewhat improve. The expectation that large corporations such as Samsung Electronics, which have had no large deals for seven years, will actively enter the M&A market also supports the 'bottom theory.'

"Pharmaceuticals and Bio: Industries to Watch"

Meanwhile, M&A in the pharmaceutical and bio industries is expected to be active. One of the large-scale deals in the first quarter was Orion's acquisition of LegoChem Bio. The acquisition amount was 550 billion won. LegoChem Bio is a representative antibody-drug conjugate (ADC) company in South Korea. The strong performance of bio and healthcare has continued since last year. According to Samil PwC, among the seven sectors in the 2023 M&A market, healthcare accounted for the highest proportion at 23% by amount. Bloomberg stated, "The global pharmaceutical and bio industry has also seen a steady increase in big deals related to ADC since last year, making it an industry to watch this year."

Globally, competition to secure ADC is fierce. Earlier this month, French big pharma Ipsen acquired ADC technology from U.S. Sutro Biopharma for $900 million. Not only big pharma but also biotech companies are entering the market. Around the same time, Danish antibody therapy developer Genmab acquired U.S. Profound Bio for $1.8 billion. The ADC market size is expected to more than double from $9.7 billion last year to $19.8 billion by 2028.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)