Escalation of Middle East Conflict Boosts Dollar Strength, High Oil Prices Expected to Persist

Interest Rate Cut Timing Delayed, Economic Burden Likely to Increase

Due to concerns over rising oil prices amid Middle East instability caused by Iran's airstrikes on Israel, the KOSPI fell more than 30 points shortly after opening on the 15th, and the won-dollar exchange rate started up by more than 7 won. Stock and exchange rate indices are displayed on the electronic board in the dealing room at the Hana Bank headquarters in Euljiro, Seoul. Photo by Heo Younghan younghan@

Due to concerns over rising oil prices amid Middle East instability caused by Iran's airstrikes on Israel, the KOSPI fell more than 30 points shortly after opening on the 15th, and the won-dollar exchange rate started up by more than 7 won. Stock and exchange rate indices are displayed on the electronic board in the dealing room at the Hana Bank headquarters in Euljiro, Seoul. Photo by Heo Younghan younghan@

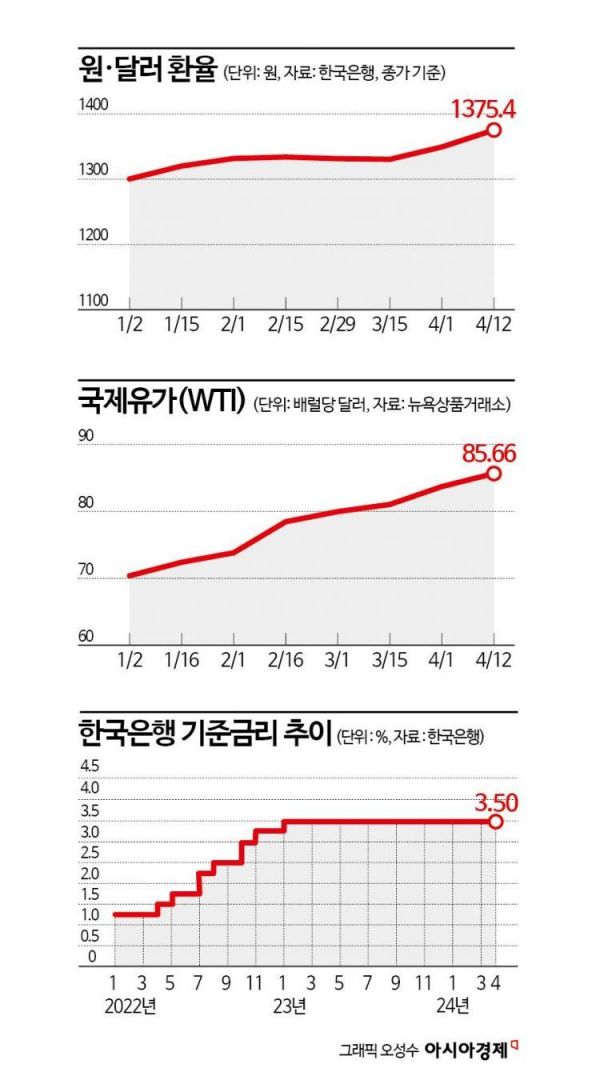

As the Middle East conflict intensifies, forecasts suggest that the dollar's strength and rising oil prices will continue for the time being. With expectations that the timing of the base interest rate cut will be pushed back, concerns are growing that the so-called "three highs" phenomenon?high oil prices, high exchange rates, and high interest rates?will dampen the vitality of our economy.

On the 15th, in the Seoul foreign exchange market, the won-dollar exchange rate opened at 1,382.0 won, up 6.6 won from the previous trading day. After opening, it showed an upward trend and was trading in the mid-1,380 won range as of 10 a.m. On this day, the won-dollar exchange rate reached its highest level in 17 months since November 2022.

The weekend attack by Iran on Israel increased geopolitical risks in the Middle East, leading to a rise in demand for the dollar as a safe-haven asset, which in turn caused the won-dollar exchange rate to rise. The exchange rate had been rapidly increasing recently due to expectations that U.S. base interest rate cuts would be delayed because of inflation, and with the escalation of the Middle East conflict, there is a possibility of further increases.

Kim Dae-jun, a researcher at Korea Investment & Securities, said, "The strength of the dollar is determined by the direction of U.S. interest rates, and with expectations that the easing of monetary policy will weaken, the dollar is again under upward pressure." He added, "The dollar is a representative safe-haven asset, so in phases where geopolitical risks escalate, it inevitably strengthens, making it very likely that the won-dollar exchange rate will rise further."

Middle East Conflict Triggers Oil Price Increase, Inflation Factor

The Middle East conflict is triggering a rise in oil prices, which could push up domestic consumer prices. As international oil prices rise, domestic fuel prices are soaring. According to the Korea National Oil Corporation, as of the second week of this month, the nationwide gasoline retail price was 1,673.3 won per liter, up 26.3 won from the previous week. Fuel prices have been rising for three consecutive weeks since late last month. The share of petroleum products in consumer prices is among the highest, following rent and mobile phone charges, so there is ample potential for it to stimulate future price increases.

Due to the strong dollar and rising oil prices, market expectations for the timing of the Bank of Korea's base interest rate cut are also being pushed back. Samsung Securities delayed its forecast for the Bank of Korea's rate cut from July to October. Kiwoom Securities and Eugene Investment & Securities also adjusted their forecasts from July to August, and Kyobo Securities revised theirs from the second quarter to the third quarter. Baek Yoon-min, senior researcher at Kyobo Securities, explained, "The retreat in expectations for the Federal Reserve's rate cut due to strong U.S. economic indicators inevitably poses a significant burden on the Bank of Korea's monetary policy shift in the near term," adding, "Considering this, we revised the timing of the Bank of Korea's base rate cut."

The so-called "three highs" phenomenon?strong dollar, high oil prices, and high interest rates?if sustained, is expected to place a heavy burden on our economy. Kang In-soo, professor of economics at Sookmyung Women's University, said, "Our economy, which is highly dependent on external factors, is vulnerable to external shocks such as oil prices and exchange rates," and added, "The government's burden to stimulate the economy is likely to increase."

As market volatility rises, the government is also expected to take measures to stabilize the market. Yoo Sang-dae, Deputy Governor of the Bank of Korea, held a market situation review meeting at the Bank of Korea headquarters in Jung-gu, Seoul, in the morning and said, "Depending on future movements in international oil prices, exchange rates, changes in global supply chains, and their ripple effects, uncertainties in the real economy such as domestic and international growth and inflation may also expand," adding, "If there is a risk of increased volatility in foreign exchange and financial markets, market stabilization measures will be implemented promptly."

The Financial Services Commission also held an emergency market review meeting chaired by Chairman Kim Ju-hyun on the same day, stating, "The current situation is unlikely to have a direct short-term impact on the domestic financial sector," but emphasized, "We will actively respond if market instability occurs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)