As High Inflation Persists, Speculation on Early Base Rate Cut Fades

Bank of Korea Likely to Lower Base Rate Only Once or Twice at Most This Year

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

"The signal for a rate cut has not been turned on yet"

Lee Chang-yong, Governor of the Bank of Korea, has drawn a line regarding the possibility of an early base rate cut.

At a press conference held after the Monetary Policy Committee (MPC) decided to keep the base rate unchanged on the morning of the 12th, Governor Lee stated, "It is difficult for all members of the Monetary Policy Committee to predict the possibility of a rate cut in the second half of the year."

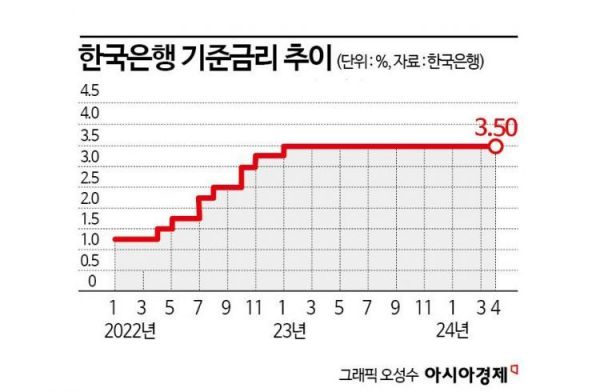

On that day, the MPC unanimously decided to keep the base rate at 3.50% per annum. The MPC has kept the rate unchanged for 10 consecutive times since February last year.

The biggest reason for keeping the base rate unchanged is unstable inflation. South Korea's Consumer Price Index (CPI) inflation rate recorded 3.1% in February and remained at 3.1% in March, marking two consecutive months above 3%. This figure far exceeds the Bank of Korea's inflation stabilization target of 2%.

This year, prices of apples, pears, and agricultural products have surged, pushing inflation higher. Last month, apple prices rose 88.2% compared to the same period last year, the largest increase since statistics began in the 1980s. Prices of other agricultural products such as pears, tangerines, tomatoes, and green onions also surged. Moreover, military conflicts in the Middle East have pushed international oil prices up to the $90 per barrel range, increasing inflationary pressures.

At the press conference, Governor Lee said, "Among the six Monetary Policy Committee members excluding myself, five expressed the view that maintaining the rate at 3.5% three months from now is appropriate." He added, "The remaining one member held the view that lowering the rate below 3.5% should also be considered."

He explained, "The five members emphasized the need to continue the tightening stance until there is confidence that core inflation and consumer price inflation rates will converge to the target (2%)."

Regarding rates six months from now, he mentioned, "It is important whether the consumer price inflation rate can reach about 2.3% by the end of the year." Governor Lee stated, "If oil prices stabilize again and the consumer price inflation rate is expected to reach about 2.3% by year-end, the possibility of a rate cut in the second half of the year cannot be ruled out." He added, "On the other hand, if the inflation rate is higher than the path toward 2.3%, a rate cut in the second half may be difficult."

He particularly drew a line against recent interpretations that "the Bank of Korea has turned on the signal for a rate cut," saying, "The signal has not been turned on yet."

He explained, "Turning on the signal means preparing to change lanes, but that is not the case. We are still debating whether or not to turn on the signal while reviewing the data," using an analogy.

In the market, views that the timing of the Bank of Korea's base rate cut will be delayed compared to initial expectations are increasing. Jaekyun Ahn, a researcher at Shinhan Investment Corp., said, "Considering the inflation situation, the timing of the base rate cut this year is expected to be later than initially anticipated, around August or October," and forecasted, "The number of cuts within the year will likely be limited to one."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)