Strong Oil Demand Despite Decarbonization

"The Idea That We Must Pay for the Environment Needs to Spread"

The global decarbonization trend is not leading to a rapid shift away from fossil fuels used in transportation as expected. In land transportation, diesel is declining while demand for liquefied petroleum gas (LPG) is increasing. Although batteries have emerged as an alternative to fossil fuels, interest is shifting to LPG as an intermediate solution due to the electric vehicle chasm (a demand slump just before mass adoption). In maritime transport, despite stricter decarbonization regulations, demand for crude oil tankers remains robust.

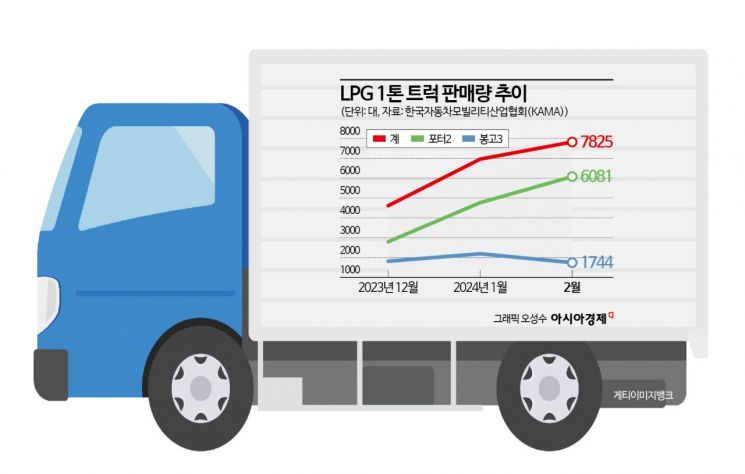

According to the Korea Automobile Mobility Industry Association (KAMA) on the 12th, sales of new 1-ton LPG trucks, the Porter 2 and Bongo 3 models, reached 7,825 units in February, a 10.4% increase from 6,961 units in the previous month. Sales in December last year were 4,614 units, and although it has been just over four months since their launch in November last year, sales continue to rise.

Especially this year, with the enforcement of the amended "Special Act on Air Quality Improvement in Air Quality Control Zones (Air Quality Control Zones Act)," the production of new 1-ton diesel trucks has been halted, benefiting LPG vehicles. The number of registered LPG vehicles in Korea peaked at 2.46 million in 2010 and has been steadily declining since. However, starting with the 1-ton LPG trucks, LPG vehicle sales are regaining momentum, and the LPG industry expects a mid- to long-term turnaround.

The popularity of LPG trucks is partly due to the slump in electric vehicle demand. Although batteries have long been considered an alternative to fossil fuels, electric vehicle demand has not met expectations. Professor Kim Pil-su of the Department of Automotive Engineering at Daelim University said, "The battery capacity of existing 1-ton electric trucks only allows for about 210 km per charge, and this drops to around 130 km in winter. While environmental regulations emphasize electric vehicles, considering that 1-ton trucks are livelihood vehicles, it is difficult to choose electric vehicles in reality."

Crude oil tankers, a fossil fuel sector with a bleak outlook due to decarbonization regulations, are also experiencing a boom recently. As of the end of last month, the newbuilding price index for crude oil tankers stood at 215.71 points, close to the record high of 237.59 points set in 2007. The newbuilding price index quantifies the price of newly ordered ships. Accordingly, HD Hyundai Heavy Industries secured an order on the 3rd for a medium-range (MR) tanker, a type of oil product carrier, at the highest price in 16 years. This reflects that demand remains strong due to disruptions in oil product supply and crude oil transportation caused by geopolitical conflicts in the Middle East and Europe.

Son In-seong, head of the Climate Change Policy Research Division at the Korea Energy Economics Institute, said, "To accelerate fuel transition to reduce greenhouse gas emissions, there must be a fundamental understanding that costs, direct or indirect, must be paid." He added, "Many people's livelihoods are at stake, so decarbonization cannot happen overnight, but proactive policies that can induce decarbonization movements should be actively introduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)