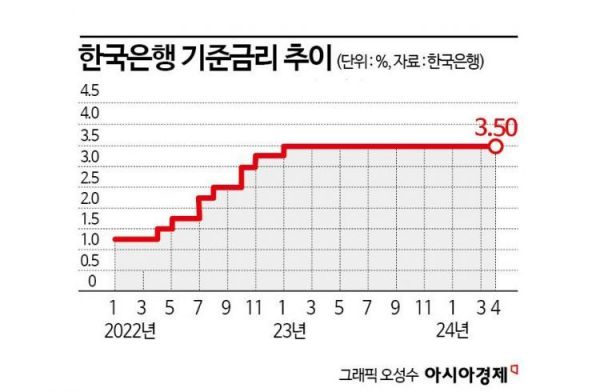

Bank of Korea Holds Base Rate Steady at 3.50% Annually

10 Consecutive Holds Since February Last Year

Weakened Case for Rate Cuts Amid Inflation Concerns, Tightening Stance Expected to Continue

The Bank of Korea has kept the base interest rate steady at 3.50% per annum for the 10th consecutive time. With persistent high inflation and the expected timing of the U.S. Federal Reserve's rate cuts being pushed back, the Bank of Korea's monetary tightening stance is expected to continue for the time being.

The Monetary Policy Board (MPB) of the Bank of Korea held a meeting on the morning of the 12th at the Bank's headquarters in Jung-gu, Seoul, where it decided to maintain the base interest rate at 3.50% per annum. The MPB has kept the base rate unchanged for 10 consecutive meetings since February last year.

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Weak Justification for Rate Cuts Amid Inflation Concerns

The primary reason for maintaining the base rate is unstable inflation. South Korea's Consumer Price Index (CPI) inflation rate recorded 3.1% in February and remained at 3.1% in March, marking two consecutive months above 3%. This figure significantly exceeds the Bank of Korea's inflation stabilization target of 2%.

Since the beginning of this year, prices of apples, pears, and agricultural products have surged, pushing inflation higher. Last month, apple prices rose by 88.2% compared to the same period last year, the largest increase since statistics began in the 1980s. Prices of pears, tangerines, tomatoes, and green onions also surged sharply.

Moreover, escalating military conflicts in the Middle East have driven international oil prices up to the $90 per barrel range, further intensifying inflationary pressures.

Kang Sung-jin, Professor of Economics at Korea University, stated, "Both the U.S. and South Korea still have inflation rates exceeding 3%. If South Korea lowers rates preemptively before the U.S., inflation could rise again, and various issues such as exchange rate volatility could arise. Therefore, maintaining the current rate to control inflation is the top priority."

In a monetary and credit policy report submitted to the National Assembly last month, the Bank of Korea stated, "Inflation is expected to gradually slow down in the second half of the year, approaching the low 2% range by the end of this year." However, it also noted, "A premature shift away from the tightening stance could undermine policy credibility and signal increased debt and risk concentration in financial markets, so the monetary tightening stance will be maintained for a sufficient period."

Kim Woong, Deputy Governor of the Bank of Korea, said at an inflation situation review meeting on the 2nd, "With living costs continuing to rise sharply and significant uncertainty remaining in the inflation outlook, it is necessary to monitor future inflation trends more closely to gain confidence in converging to the inflation target (2%)."

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held on the 12th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

U.S. Rate Cut Expectations Delayed, Making It Difficult for Us to Cut Rates First

The delayed expectation of the U.S. Federal Reserve's rate cuts is another factor making the Bank of Korea cautious about lowering its base rate. The U.S. March CPI inflation rate, announced the previous day, exceeded market expectations, causing the probability of the Fed maintaining rates in June to surge from the 40% range to the 80% range in the U.S. interest rate futures market.

The market increasingly anticipates that the U.S. may cut rates in the third quarter rather than the second quarter. Kim Sun-tae, an economist at KB Kookmin Bank, predicted, "The Fed will likely lower rates only after confirming a definite decline in core inflation in the U.S. The timing of the cut is expected to be in the third quarter."

It is also analyzed that the Bank of Korea is likely to follow suit and cut rates only after confirming the U.S. rate cut. The current U.S. base rate is 5.25?5.50%, which is 2.0 percentage points higher than South Korea's.

Kang In-soo, Professor of Economics at Sookmyung Women's University, said, "With the U.S. CPI index remaining high, the Fed is cautious about cutting rates, so it is difficult for the Bank of Korea to lower rates preemptively. Additionally, commodity prices such as oil are not falling as quickly as expected, so maintaining the current rate level is necessary to curb inflation for the time being."

Improvement in the domestic economy, centered on exports, is also a factor supporting the continuation of the base rate freeze. According to the Ministry of Trade, Industry and Energy, South Korea's exports last month amounted to $56.56 billion, marking six consecutive months of growth. Notably, semiconductor exports reached $11.7 billion, the largest scale in 21 months.

Financial imbalances such as still-high household debt and real estate concentration remain problematic. At the end of the fourth quarter last year, household credit (debt) stood at 1,886.4 trillion won, an all-time high, increasing by 8 trillion won from the previous quarter. This was due to continued growth in mortgage loans despite high interest rates. The household credit-to-nominal GDP ratio also reached 100.6% as of the end of last year.

Ahn Jae-kyun, an economist at Shinhan Investment Corp., said, "With exports increasing mainly in semiconductors and industrial production recovering this year, the justification for quickly lowering the base rate has weakened. We expect the Bank of Korea to cut rates around August or October to stimulate domestic demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)