LS Stock Closely Linked to Copper Prices

Expectations for Improved Performance of Major Subsidiaries

Renewable Energy Benefits from Increased Electricity Consumption

With the rise in copper prices, LS, which has the highest overseas ratio among domestic cable companies, continues its upward stock trend.

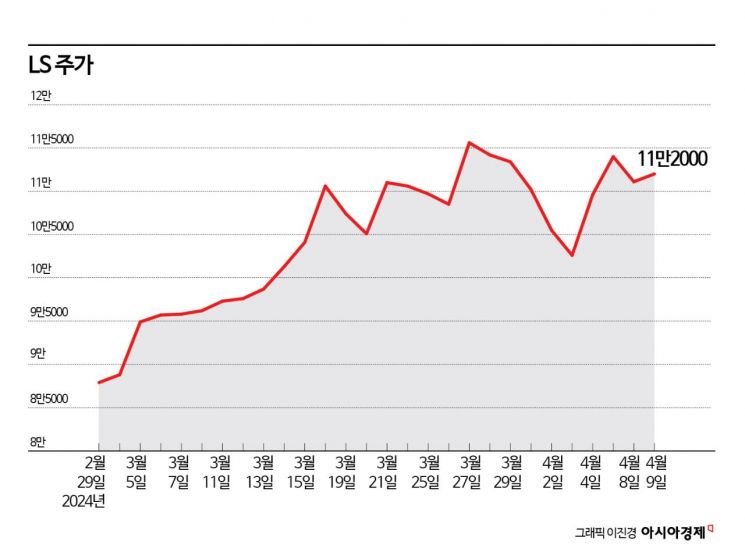

According to the financial investment industry on the 10th, LS's stock price rose about 26% over a little more than a month from the 4th of last month to the 9th of this month. During the same period, the KOSPI increased by only 1%.

As a holding company, LS has vertically integrated its business from copper smelting to electrical equipment with electricity and copper. Among domestic cable companies, it has the highest overseas ratio. 50% of the sales of its major affiliate LS Cable & System come from overseas. SPSX produces communication and power cables in the US and Europe. SPSX, which is gaining attention for its US optical cable investment, holds a 16% market share in US communication cables.

Yoo Jin Lee, a researcher at Eugene Investment & Securities, explained, "LS Cable & System is expanding its production capacity for submarine cables, which are more profitable than other types of cables," adding, "In 2021, they announced plans to expand four submarine cable plants, and in 2023, five more plants."

The cable industry, which had not seen high growth rates for a long time, has recently attracted attention due to the expansion of renewable energy and the development of artificial intelligence (AI) technology. According to data released by the International Energy Agency, the sector with the highest increase in energy demand from 2015 to 2022 is the cryptocurrency mining sector. The data center sector consumes more than twice the energy of the cryptocurrency mining sector. As the AI industry grows, data center sizes are expanding, and AI-dedicated data centers are being established. Electricity consumption is increasing further, while the power grid is aging seriously. Investments in renewable energy are also active to keep pace with the increasing electricity consumption. As the offshore wind power market grows in the US, demand for submarine cables is also rising.

Jihoe Ok, a researcher at Samsung Futures, said, "The energy transition, including electric vehicles and renewable energy technologies, is expected to cause a surge in copper consumption over the next few years," adding, "Copper demand related to AI and data centers alone could reach up to 1 million tons by 2030." He further predicted, "The surge in demand due to the AI boom will worsen the supply-demand imbalance, leading to a rise in copper prices."

The recent rise in copper prices is also expected to help improve LS's performance. On the London Metal Exchange (LME), the futures price of copper reached $9,328 per ton on the 4th, marking the highest level since January last year. The performance of LS's major subsidiaries, such as LS Cable & System and LS MnM, is closely linked to copper prices.

Gwansoon Choi, a researcher at SK Securities, explained, "The recent rise in copper prices is largely due to supply factors," adding, "Prices are rising due to the closure of large mines in Panama and Peru and production cuts at Chinese smelters." He continued, "With the manufacturing Purchasing Managers' Index (PMI) of the US and China rebounding, expectations for economic recovery are also being reflected," and added, "As the gap between spot prices and futures prices widens, there is a high possibility of further increases in spot prices."

Due to a high ratio of treasury stock holdings, there is also potential benefit from the government's corporate value-up program implementation. LS purchased 111,000 treasury shares from November last year to February this year. The ratio of treasury stock holdings increased to 15.1%. The financial investment industry expects that considering the government's corporate value-up program and improvements to the treasury stock system, LS might consider treasury stock cancellation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)