Major Commercial Banks Rapidly Accept FSC Dispute Resolution Guidelines

Internal Task Force Strengthened, ELS Investor Consultations... Expert Committee Established

Hana Bank Completes First Compensation Payment Two Days After Board Resolution

Uncertain If All Investors Will Accept Voluntary Compensation

Victims' Group Representative Criticizes, "Very Dissatisfied with Compensation Plan"

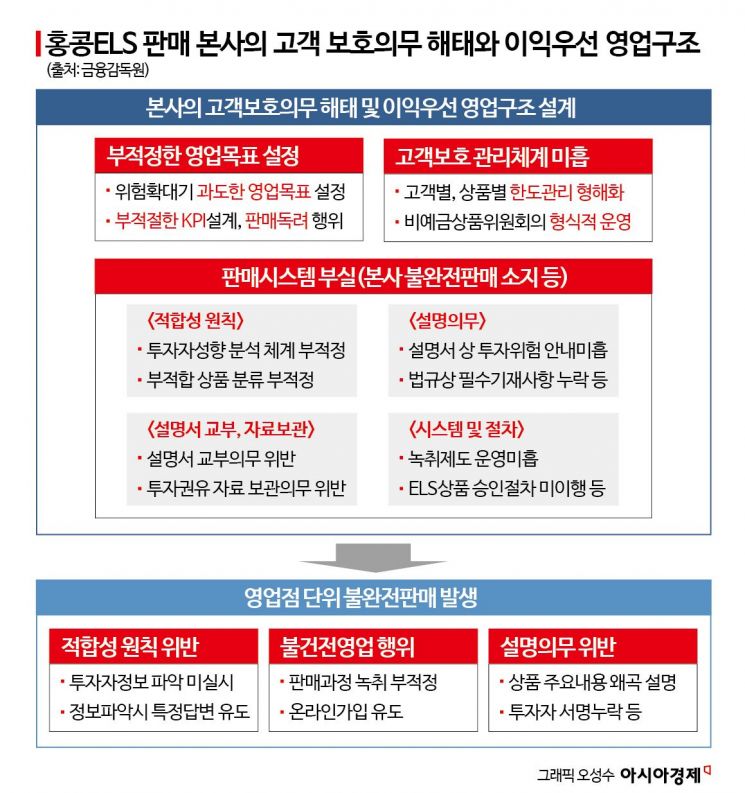

In response to the financial authorities' swift pressure for voluntary compensation regarding Hong Kong H Index (Hang Seng China Enterprises Index·HSCEI) equity-linked securities (ELS), major commercial banks are taking steps such as holding temporary board meetings to consecutively accept the Financial Supervisory Service's dispute mediation standards, strengthening internal organizations, and establishing advisory bodies including external experts. Hana Bank, which quickly reorganized its structure, became the first in the banking sector to make a compensation payment just two days after the board's resolution on voluntary compensation.

According to the financial sector on the 1st, major commercial banks such as KB Kookmin Bank, Woori Bank, Shinhan Bank, NH Nonghyup Securities, SC First Bank, and Citibank Korea, which have decided on voluntary compensation, plan to launch full-scale compensation from April by establishing internal compensation task forces and external expert groups responsible for review. The scale of Hong Kong ELS maturing this year is largest at KB Kookmin Bank with 6.75 trillion KRW, followed by Shinhan Bank with 2.33 trillion KRW, NH Nonghyup Bank with 1.8 trillion KRW, Hana Bank with 1.4 trillion KRW, and Woori Bank with 40 billion KRW.

Estimating the compensation scale based on Hong Kong ELS products sold from January to July 2021, the banking sector's compensation amount is expected to reach at least 2 trillion KRW. The maturity scale of H Index ELS in the banking sector from January to July this year reaches 10 trillion KRW, and assuming a confirmed loss rate of 50%, the cost to compensate an average of 40% is calculated. Most commercial banks are expected to reflect this estimated compensation amount as provisions in the first quarter of this year.

The banking sector is accelerating the compensation process. Since the Financial Supervisory Service has announced plans to hold dispute mediation committees and impose sanctions on sellers starting in April, banks are moving quickly to avoid unfavorable situations. Woori Bank, which was the first to decide on voluntary compensation, began notifying subscribers maturing in April, and Hana Bank presented the first compensation case just two days after holding its board meeting.

Hana Bank, which decided on voluntary compensation at its board meeting on the 27th of last month, has established the 'Hong Kong H Index ELS Voluntary Compensation Committee' and the 'Hong Kong H Index ELS Voluntary Compensation Support Team' within its Consumer Protection Group to handle damage compensation. The Voluntary Compensation Committee consists of 11 members, including three external experts. Following the board's decision, Hana Bank reviewed and resolved individual voluntary compensation plans submitted to the committee held on the 28th, and after reaching agreements with some investors, completed compensation payments on the 29th. A Hana Bank official stated, "We will do our best to achieve smooth communication and compensation with investors," adding, "Through the Voluntary Compensation Committee, we will objectively identify individual factors and facts for each investor and strictly apply the Financial Supervisory Service's standards to conduct a fair compensation process."

Earlier, Woori Bank, which was the first to decide on voluntary compensation on the 22nd of last month, formed a team of 2-3 members centered on the trust department to review consumer protection and related laws and regulations and began voluntary compensation. Since last week, Woori Bank has started informing investors with Hong Kong ELS maturing in April about the voluntary compensation process and plans to pay compensation as soon as investment losses are confirmed. The amount of Hong Kong ELS subject to voluntary adjustment at Woori Bank is about 41.5 billion KRW, with total compensation estimated to be less than 10 billion KRW. A Woori Bank official explained, "We will begin the full adjustment process targeting investors whose losses have been confirmed," adding, "Once consultations with investors are completed, we will make compensation payments within a week."

Other banks are also reinforcing internal task forces and forming advisory councils centered on external experts responsible for consultation and review to speed up voluntary compensation. KB Kookmin Bank, which was the last among major commercial banks to accept the Financial Supervisory Service's dispute mediation standards through a temporary board meeting lasting over an hour on the morning of the 29th, plans to establish a 'Voluntary Adjustment Council' to support investor compensation processing alongside its existing customer protection department. Previously, KB Kookmin Bank, due to its large sales volume compared to other banks, had deployed over 200 employees to conduct a full investigation.

The newly established 'Voluntary Adjustment Council' will include external experts with extensive knowledge and experience in relevant laws and consumer protection as members. These external expert members will closely examine the facts and individual factors in the sales process for each investor to assist in calculating compensation amounts. A KB Kookmin Bank official stated, "We will promptly carry out compensation procedures sequentially for confirmed loss cases and ensure thorough investor protection."

Shinhan Bank announced on the 29th that, based on a board resolution, it will establish a 'Voluntary Adjustment Council' within its Consumer Protection Group, composed mainly of external experts experienced in financial products, consumer protection policies, and laws, to accelerate compensation. Shinhan Bank has already set up an internal task force dedicated to Hong Kong ELS since June last year and recently reviewed compensation scenarios related to Hong Kong ELS with 17 personnel ahead of the board meeting. A Shinhan Bank official said, "We will promptly proceed with compensation for customers who suffered losses and prepare measures to prevent recurrence of issues pointed out in inspections to fulfill our social responsibility as a corporate citizen."

Additionally, NH Nonghyup Bank and SC First Bank have decided to form voluntary adjustment councils or committees including external experts to conduct adjustment procedures targeting customers who suffered losses. These two banks formed Hong Kong ELS task forces in August-September last year to prepare for large-scale loss incidents. An NH Nonghyup Bank official explained, "We will form a voluntary adjustment council including external experts and establish detailed adjustment plans applying the supervisory authority's dispute mediation guidelines to promptly carry out adjustment procedures for customers who suffered losses."

Meanwhile, although major commercial banks have consecutively accepted voluntary compensation, it is uncertain whether all investors will accept it. After the Financial Supervisory Service announced the dispute mediation standards, Hong Kong ELS investors have formed 'victim groups' demanding 100% compensation. On the 29th of last month, victims held a protest rally in front of KB Kookmin Bank's new building, demanding the withdrawal of the Financial Supervisory Service's dispute mediation standards. Gil Seong-ju, chairman of the Hong Kong ELS Victims Group, criticized, "It is a very unsatisfactory compensation plan," adding, "It seems that the banks have ensured that they will not bear more than 50% responsibility under any circumstances."

Even if investors accept the voluntary adjustment plan, considerable difficulties are expected during negotiations over the compensation ratio. It may be challenging to find common ground based on qualitative criteria such as whether the investor visited with the purpose of subscribing to principal-guaranteed products and their ELS investment experience. If negotiations between the selling banks and numerous investors fail, it could lead to multiple lawsuits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)