Visit to Seoul Mapo Senior Care Integrated Center... Checking Financial Life Difficulties of the Elderly

Expansion of Simple Mode in Financial Apps to All Financial Sectors

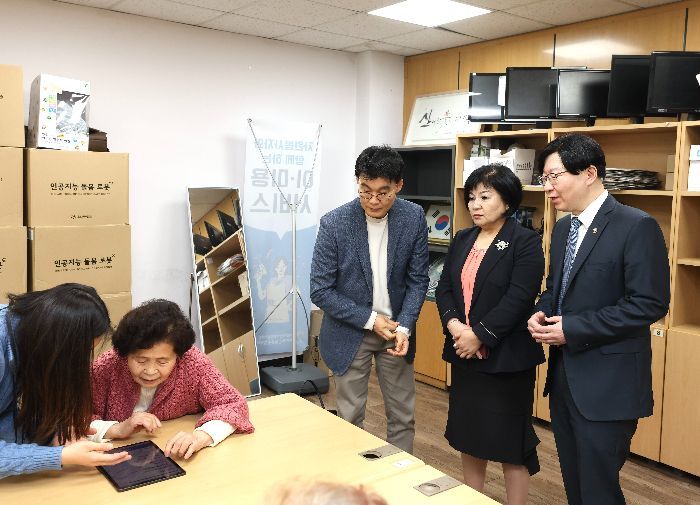

Kim So-young, Vice Chairman of the Financial Services Commission, visited the Mapo Senior Care Integrated Center located in Mapo-gu, Seoul, on the 29th with Kim Mi-young, Director of the Financial Consumer Protection Department at the Financial Supervisory Service, to inspect the on-site financial education for the elderly.

Vice Chairman Kim personally toured the financial education site conducted for seniors in accordance with last year's national financial education policy, 'Customized Financial Education by Life Cycle,' and checked the difficulties seniors face in managing their financial lives or using financial services. She also listened to suggestions from frontline workers who directly provide financial education, such as university student financial education volunteers and specialized counselors.

In particular, during the process of checking difficulties related to financial use, Vice Chairman Kim asked and answered questions about whether seniors are actually using the simplified (elderly) mode of financial apps, which began to be launched by banks starting in June, and whether there are any additional inconveniences related to app usage. She inspected and confirmed whether various policies prepared for consumer convenience are spreading in the field.

Through this field visit, Vice Chairman Kim expressed gratitude for the efforts of instructors and counselors responsible for financial education on-site and stated that going forward, the financial authorities plan to actively support the increasing demand for visiting education by significantly expanding related budgets and personnel so that more on-site visiting financial education can be conducted.

Director Kim of the Financial Consumer Protection Department also said, "As the elderly population increases, financial fraud prevention education and digital financial education for seniors are very important, and we will continue to strengthen financial education for financially vulnerable groups, including seniors."

Meanwhile, the education on this day was conducted as a program including financial fraud prevention education, digital financial education, and counseling on financial difficulties, at the request of the center for seniors using the care center. The education included methods to prevent financial fraud such as voice phishing, which seniors are prone to fall victim to, one-on-one digital financial utilization education by university student financial education volunteers using the Financial Supervisory Service’s ‘Smart Senior App,’ and customized financial difficulty counseling by financial expert counselors from the Financial Supervisory Service.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)