There has been a call to increase the legal responsibility of virtual asset exchanges, which effectively review the soundness and business viability when listing virtual assets, compared to the current standards. This comes amid large-scale damages caused by crimes such as listing fraud involving so-called Kimchi coins and market manipulation, with the reason being that the legal system to curb the incentives for listing solicitations directed at virtual asset exchanges is inadequate.

The Korean Securities Law Association (President Kim Byung-yeon) held the '272nd Regular Seminar' on the 16th at the Korea Exchange IR Center in Yeouido, Seoul.

At the seminar, Shin Eui-ho (41, 4th Bar Exam), a prosecutor from the Virtual Asset Task Force of the Seoul Southern District Prosecutors' Office, gave a presentation titled "Suggestions on Problems in the Coin Market and Institutional Improvements Confirmed through Virtual Asset Crime Investigation Cases."

Prosecutor Shin explained, "Virtual assets have no intrinsic value, and their value is determined only when they are listed on an exchange," adding, "If exchanges neglect to review the soundness and business viability of virtual assets, unexpected massive investment damages occur to general virtual asset investors who trust the exchange's screening function."

He continued, "In the domestic virtual asset market, 62% of the total circulating virtual assets are traded mainly on so-called domestic exchanges, and the trading volume is small for 'Kimchi coins.' These Kimchi coins are extremely vulnerable to liquidity shortages and market manipulation," and said, "Exchanges bear a public duty to thoroughly review these coins and decide on their listing to prevent unpredictable losses to investors."

However, the system to prevent 'listing solicitations' and the like is inadequate compared to the role of virtual asset exchanges.

Prosecutor Shin pointed out, "There are no defined 'listing standards' in the virtual asset market, and the economic benefits gained from listings are enormous, creating significant incentives for listing solicitations directed at exchanges," adding, "Most coin issuers lack networks with exchange executives and rely on 'listing brokers' who professionally handle listing tasks."

He added, "However, there are insufficient punishment regulations for listing brokers who receive certain amounts from issuers and illegally pay exchanges to solicit coin listings," and argued, "It is necessary to amend the law to include virtual asset service providers in the concept of 'financial companies, etc.' under the Act on the Aggravated Punishment of Specific Economic Crimes."

Article 7 of the Act on the Aggravated Punishment of Specific Economic Crimes stipulates that "Anyone who receives, demands, or promises money or other benefits in relation to the duties of executives or employees of financial companies, or who offers or promises to offer such benefits to a third party, shall be punished by imprisonment for up to five years or a fine of up to 50 million won."

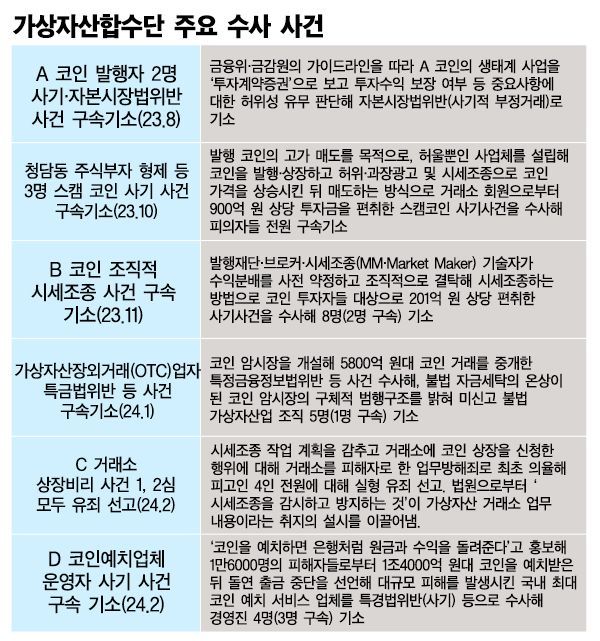

In his presentation, Prosecutor Shin introduced major investigation cases handled since the launch of the task force and explained the progress of investigations. He said, "Since the task force was launched, we have focused our capabilities on crimes related to virtual asset listings and unfair trading," adding, "Through investigations of listing fraud cases, we have accumulated precedents regarding the role and duties of virtual asset exchanges in the market and assigned legal significance to them." He also said, "For virtual asset crimes involving fraudulent unfair trading types such as market manipulation and scam coins, we punished them under criminal law for fraud and breach of trust," and "We are expanding the scope of investigations to over-the-counter black markets and coin deposit service providers, strictly punishing representative crimes in each sector of coin issuance, distribution, and service markets."

Additionally, Oh Seok-jin, a senior researcher at Hanyang University Law School, presented "Comparative Analysis of Emission Allowance Derivative Product Surveillance Systems in Major Overseas Countries - Focusing on the EU, the US, and South Korea," followed by discussions by Kim Hong-gi (58, 21st Bar Exam), professor at Yonsei University Law School, and Cho Won-hee (54, 30th Bar Exam), lead attorney at the law firm Delight.

Reporter Lim Hyun-kyung, Law Times

※This article is based on content supplied by Law Times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.