Recent 1-Year Large Shareholding Details of Bearing Asset Management

Hyundai Department Store Affiliates Hansome and Hyundai Home Shopping Large Shareholdings

Truston Asset Management Holdings in Korea Alcohol, LF, Cosmecca Korea, etc.

Interest is growing in the investment strategies and equity holdings of three asset management firms?Bearings Asset Management, Woori Asset Management, and Truston Asset Management?selected by the National Pension Service (NPS) as value-oriented delegated managers for domestic stocks.

According to the investment banking (IB) industry on the 22nd, the NPS Fund Management Headquarters recently selected 'value-oriented' delegated managers, a type that invests in stocks of companies whose market value is undervalued. The NPS has also introduced a new investment strategy considering the government’s corporate value-up program, which will be fully launched in the second half of this year.

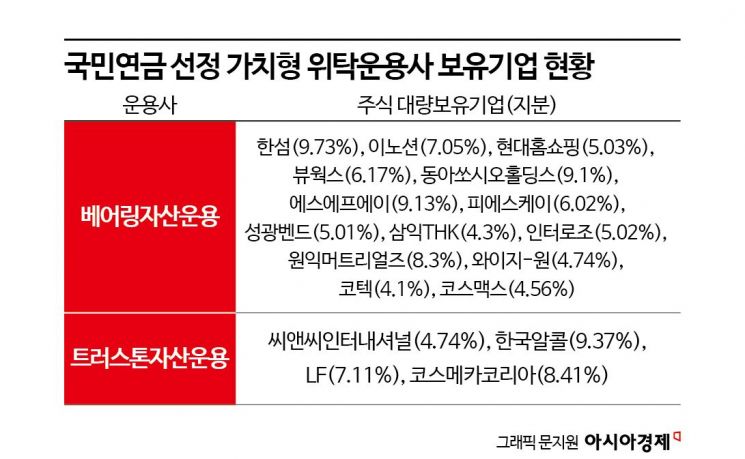

Looking at the disclosures of large shareholding reports filed through the Financial Supervisory Service’s electronic disclosure system over the past year by Bearings Asset Management, selected as an NPS value-oriented delegated manager, notable equity holdings in Hyundai Department Store Group affiliates stand out. Bearings holds a 9.73% stake (2,277,584 shares) in Handsome, a fashion-specialized company affiliated with Hyundai Department Store. The stake in Handsome increased from 8.2% as of November 15 last year to 9.73% as of February 26 this year. Bearings has also steadily increased its stake in Hyundai Home Shopping, a home shopping company under the same Hyundai Department Store group, surpassing 5% as of February 26 this year, holding 5.03% (603,382 shares). Additionally, Bearings holds a 7.05% stake (2,821,547 shares) in Innocean, an advertising affiliate of Hyundai Motor Group, as of February 16 this year, up about 1% from 6.04% (2,416,216 shares) as of December last year.

Bearings has also steadily accumulated shares in Vieworks, a medical industrial imaging solutions specialist, holding 6.17% (616,725 shares) as of January 8 this year. Other holdings include Dong-A Socio Holdings (9.1%), SFA (9.13%), PSK (6.02%), Sungkwang Bend (5.01%), Samick THK (4.3%), Interojo (5.02%), Wonik Materials (8.3%), YG-One (4.74%), Kotek (4.1%), and Cosmax (4.56%). Bearings is a global asset manager whose Korean operations surpassed KRW 15 trillion (approximately USD 11.3 billion) in assets under management as of September last year.

Another delegated manager, Truston Asset Management, holds a 4.74% stake (474,196 shares) in CNC International as of February 6 this year. This is a decrease of 87,966 shares (0.87%) from 5.61% (562,162 shares) as of November 15 last year. Truston also holds a 9.37% stake (2,023,416 shares) in Korea Alcohol as of October 25 last year. Other holdings include LF (7.11%) and Cosmecca Korea (8.41%). Although Truston has not made any disclosures in the past year, it also holds significant stakes in BYC (8.13%) and Taekwang Industrial (5.8%), engaging in shareholder activism. Woori Asset Management has not separately disclosed large shareholding reports for stocks or other securities.

Meanwhile, the NPS plans to decide the scale and timing of fund allocations to each asset manager by considering the portfolio management conditions of the NPS fund and market conditions. This is the first time in about eight years since 2016 that the NPS has selected value-oriented delegated managers among its eight types of domestic stock investments. With the government’s listed company value-up policy about to be implemented, market expectations are rising as to whether the NPS’s selection of value-oriented delegated managers will support undervalued and value stocks. Seowon Joo, head of the Fund Management Headquarters, said, "We have selected external managers with excellent capabilities to invest in companies whose market value is undervalued. We will strive to manage the public’s retirement funds stably and enhance the fund’s long-term profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)