"Expected to be in the $90 Range in Q3 This Year"

Demand Expands with China's Economic Recovery

Geopolitical Crisis Supporting Oil Prices

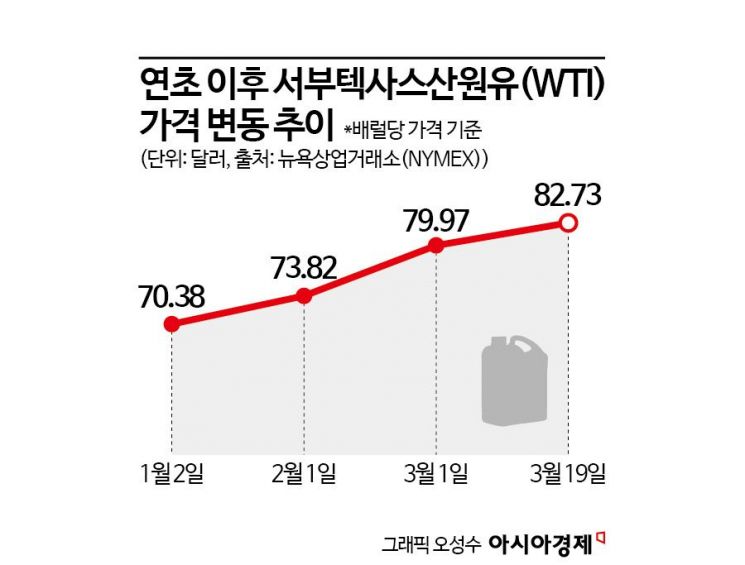

Concerns over prolonged high oil prices are growing to the extent that international crude oil prices are expected to rise to the $85-$90 range by the end of the year. Due to the war in Ukraine and the Middle East, as well as geopolitical crises in oil supply regions, prices have not fallen below the $80 mark. Additionally, demand recovery in China, which had seen reduced oil demand due to economic downturns, is strengthening expectations for continued oil price increases.

International Oil Prices Reluctant to Fall: "Phasing Out Fossil Fuels Is Just an Illusion"

The U.S. Energy Information Administration (EIA) recently forecasted the average price of North Sea Brent crude oil in Q2 this year at $88 per barrel, which is $4 higher than the short-term forecast made last month. The EIA explained, "The ongoing geopolitical crisis, the extension of production cuts by the oil-producing group OPEC+, and economic recovery are factors driving oil price increases." Frederick Lasser, Global Research and Analysis Head at Swiss-based global crude oil trading firm Gunvor, also stated at an energy conference, "Even if OPEC+ member countries do not extend additional production cuts, prices are likely to trade between $85 and $90 per barrel in Q3," adding, "If OPEC+ members extend cuts beyond Q2, prices will rise further."

In fact, international oil prices show no signs of dropping below the $80 level. Long-term forecasts suggest that fossil fuel demand will not decrease in the foreseeable future. Given the extremely low substitution rate of renewable energy, a phased-out use of oil and gas is practically impossible.

Nasser, CEO of Saudi Arabia's state-owned oil company Aramco, pointed out, "We must abandon the illusion of phasing out oil and gas use and realistically reflect actual demand," adding, "Over the past 20 years, the world has invested $9.5 trillion (approximately 1,268.2 trillion KRW) in renewable energy, yet wind and solar account for less than 4% of total energy supply, and electric vehicle adoption is below 3%."

Prolonged Geopolitical Crises in Ukraine and the Middle East... Increase in Marine Fuel Consumption

The main factor supporting the high international oil prices is the localized wars such as the Ukraine war and the Israel-Hamas conflict, along with numerous geopolitical crises derived from these events. In particular, the supply chain is threatened as the Red Sea region, a gateway for Middle Eastern oil exports worldwide, faces continued attacks on oil tankers by Yemen's Houthi rebels, preventing oil prices from falling.

Russell Hardy, CEO of Vitol Group, the world's largest commodity trading company, analyzed at an energy conference on the 21st, "Due to the geopolitical crisis caused by the Houthi rebels in the Red Sea, global vessels are unable to use the Suez Canal route and must detour, increasing route length by over 3%," adding, "This has led to increased consumption of marine fuel, raising global oil demand by more than 100,000 barrels per day." The Houthi rebels, supporting Hamas against Israel, are indiscriminately attacking commercial and oil tankers passing near Yemen's coast.

Ukraine, where pipelines transporting oil from Russia to Eastern Europe converge, is also embroiled in war, adding upward pressure on oil prices. According to oil price specialist OilPrice.com, since late last month, Ukraine has begun attacking major Russian pipeline facilities using drones, causing oil and gas prices in Europe to rise and even prompting some countries to hoard oil supplies.

China, the Largest Customer of Middle Eastern Oil, Also Influences Price Rebound with Economic Recovery

One of the reasons behind the oil price increase is the signs of economic recovery in China, which had been in a downturn due to a real estate slump. Expectations for expanded oil demand in China are expected to further stimulate the upper range of oil prices. According to China's National Bureau of Statistics, industrial production in China from January to February this year increased by 7.0% year-on-year, higher than the 6.8% increase recorded last month. Retail sales growth also reached 5.5%, exceeding the forecast of 5.2%. With these signs of economic recovery, China's crude oil refining volume from January to February rose by 3% year-on-year.

The reason international oil prices are sensitive to China's economic recovery and crude oil refining volume is that China is the world's largest oil importer. In 2017, the U.S. EIA reported that China imported 8.4 million barrels of crude oil per day, surpassing the U.S. at 7.9 million barrels. As the U.S., which emerged as an oil-producing country through shale oil production, reduced its dependence on Middle Eastern oil to about 5%, international oil prices have become more influenced by China's economy. Energy consulting firm Gelber & Associates also stated to major foreign media, "China's sustained increase in crude oil demand is a key factor driving international oil price rises."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)