Dividend and Trademark Revenue Decline, Net Profit Turns Negative

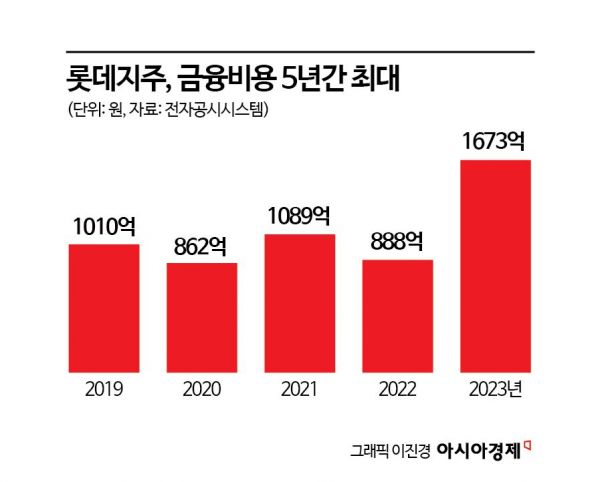

Last Year's Financial Costs 88.8 Billion → 167.3 Billion KRW

Subsidiary Support and Shareholder Return Policies Burden Financial Structure

Lotte Holdings reported a significant increase in interest expenses last year. Due to rising interest rates, funding costs expanded, and with the poor performance of affiliates leading to decreased dividends and trademark income, the company recorded a net loss again after one year.

According to the Financial Supervisory Service's electronic disclosure system on the 21st, Lotte Holdings posted a separate basis net loss of 57.8 billion KRW last year, turning to a deficit compared to the previous year. Net income refers to the pure profit earned by the company after deducting financial costs and corporate taxes from operating profit.

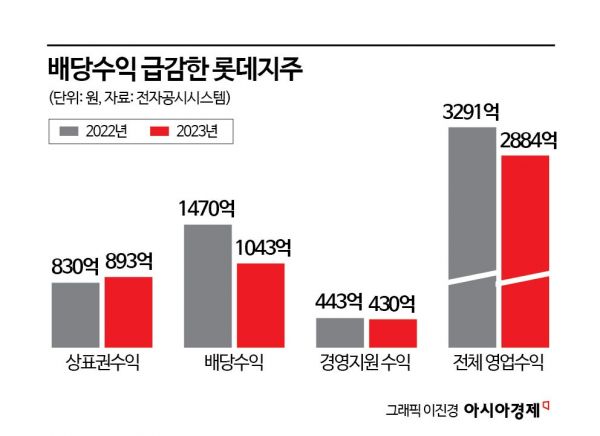

Lotte Holdings' separate basis sales last year amounted to 288.4 billion KRW, a 12% decrease from 329.1 billion KRW the previous year. Consolidated results reflect the performance of affiliates proportionate to their shareholding, while separate sales represent the income Lotte Holdings earned over the year. Last year, sales declined due to reduced dividends and trademark usage income from affiliates, which are core to Lotte Holdings' revenue.

Poor Performance of Affiliates Including Lotte Chemical

The poor performance of affiliates, including Lotte Chemical, led to a decrease in the holding company's operating income. In 2022, Lotte Chemical's dividend income was 72.8 billion KRW, but it dropped by 42 billion KRW to only 30.7 billion KRW in 2023. Even when combining management support income and education income, the total was 43.1 billion KRW. It appears that trademark usage fees were virtually unpaid as in the previous year. The prolonged poor performance is due to the deteriorating petrochemical market conditions. The price decline caused by large-scale petrochemical plant expansions in China and weakened upstream demand have left the company unable to predict a rebound in the petrochemical industry.

Although Lotte Shopping's performance improved last year, increasing its sales contribution, it was insufficient to offset declines from other affiliates. Lotte Holdings received 70.5 billion KRW from Lotte Shopping under the names of trademark income, management support income, dividend income, and education income (related to the acquisition of the Talent Development Institute business). This was an increase of about 5 billion KRW from 65.2 billion KRW in 2022.

Lotte Holdings' Financial Costs Doubled Last Year

The biggest factor behind Lotte Holdings' return to net loss last year was financial costs. Financial costs mainly consist of interest expenses incurred when the company raises funds. Last year, Lotte Holdings' financial costs reached 167.3 billion KRW, doubling from 88.8 billion KRW the previous year. The rise in interest rates significantly increased borrowing costs.

In fact, in February last year, Lotte Holdings issued corporate bonds worth 350 billion KRW in three tranches to repay debt, with issuance yields rising from the previous 1-4% range to 4.5-4.9%. At the time, the market viewed the increased issuance amid a credit rating downgrade as a successful subscription. However, these high issuance yields have become a burden on the group's financial structure.

To secure cash, Lotte Holdings also issued commercial paper (CP) weekly in amounts of 5 billion and 10 billion KRW with maturities of 1, 3, and 6 months in the short-term financial market. At the beginning of the year, CP could be issued at interest rates in the 3% range, but over time, rates rose to 4.5-4.9%. Early this year, Lotte Holdings again raised funds, issuing 300 billion KRW in corporate bonds at a 4.3% interest rate to repay CP and corporate bonds. The issuance yield expanded from the 1% range to 4.3%.

Focused Investment in New Business Areas Including Lotte Bio... "Financial Burden from Strengthened Shareholder Return Policy"

Lotte Holdings continues large-scale fundraising with massive interest expenses to support subsidiaries' new businesses. Last year, it spent 88 billion KRW on a paid-in capital increase for Lotte Biologics (80% stake). It also participated in Lotte Chemical's paid-in capital increase (about 300 billion KRW) and provided financial support to Lotte Healthcare (investment of 25 billion KRW).

Besides borrowing from financial markets to secure investment funds, the company sold its Yangpyeong-dong office building to Lotte Homeshopping, securing 131.7 billion KRW. It is expected to continue supporting affiliates and investing this year. Song Jong-hyu, a senior analyst at Korea Ratings, said, "Although standalone operating performance is shrinking, the trend of expanding investments to foster new growth engines such as bio and healthcare continues. The company sets a dividend payout ratio of over 30% based on separate profits, so the strengthened shareholder return policy may increase financial burdens."

Meanwhile, at the regular shareholders' meeting scheduled for the 28th, Lotte Holdings plans to pass agenda items including approval of financial statements, dividend payments, and the reappointment of Chairman Shin Dong-bin as an inside director.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)