New Soju Product 'Jinro Gold' Released on 21st

Strengthening Marketability with 15.5% Alcohol Content

HiteJinro, the number one company in the soju industry, is solidifying its domestic market share by launching a new product, ‘Jinro Gold.’ Following last month’s comprehensive quality improvement of ‘Chamisul Fresh,’ including changes in manufacturing methods and alcohol content, HiteJinro plans to strengthen its dominance in the soju market with a low-alcohol, zero-sugar new product featuring 15.5% alcohol content.

According to the liquor industry on the 20th, HiteJinro will release the new soju product Jinro Gold on the 21st and begin sales of the 360ml bottle product nationwide through entertainment and home channels.

Jinro Gold is a ‘zero sugar’ soju that does not use fructose, characterized by the addition of 100% rice distilled raw material to enhance a smooth taste. While maintaining the identity by using the transparent sky-blue bottle of the existing ‘Jinro’ brand, the Chinese characters ‘진로 (眞露)’ and the toad logo, new accent colors such as rose gold and emerald have been applied to the bottle cap and label to add freshness.

The biggest feature of the newly launched Jinro Gold is its alcohol content of 15.5%. This is 0.5% lower than the existing main products, Chamisul Fresh (16%) and Jinro (16%), reflecting the recent drinking culture that favors lighter drinking and a preference for a soft and comfortable drinking experience. Earlier, HiteJinro actively incorporated the low-alcohol trend into its products by lowering Jinro’s alcohol content to 16% last year and reducing the alcohol content of its flagship brand Chamisul Fresh to 16% last month, thereby strengthening marketability.

HiteJinro, the leading company in the domestic soju market, is focusing on both quantitative and qualitative improvements of its products, including the full renewal of Chamisul Fresh earlier this year and the launch of this new product, as a strategy to regain its recently declining market share and solidify its position in the market. HiteJinro’s market share, which had maintained around 60-65% in the domestic soju market, is estimated to have slightly declined following the successful market entry of Lotte Chilsung Beverage’s soju ‘Saero,’ launched in September 2022.

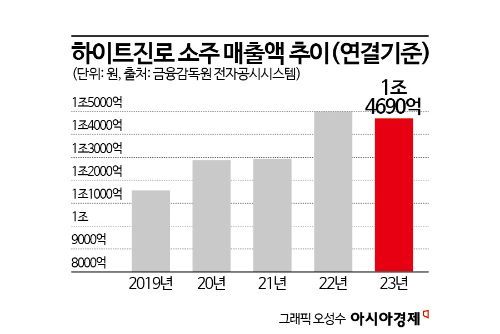

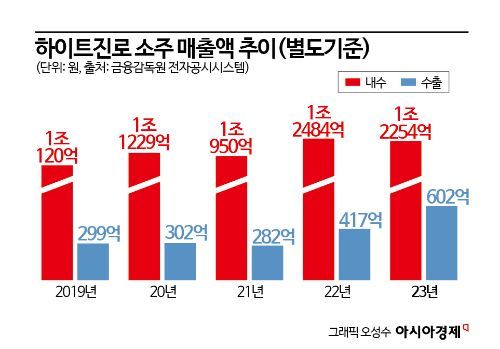

In fact, HiteJinro’s consolidated sales from the soju business last year amounted to 1.469 trillion KRW, a 2.0% decrease from 1.499 trillion KRW the previous year. Looking at sales by region, domestic soju sales on a separate basis were 1.2254 trillion KRW, down 1.8% from 1.2484 trillion KRW the previous year, which affected the decrease in sales. However, considering the significant increase in the previous year, the growth trend still appears valid. HiteJinro’s soju sales, which were around 1.1565 trillion KRW in 2019, rose to the 1.2 trillion KRW level during the COVID-19 pandemic and approached 1.5 trillion KRW in 2022.

While the domestic market showed some stagnation in growth, export sales increased by 44.4% to 60.2 billion KRW from 41.7 billion KRW a year earlier. In particular, soju export sales more than doubled, increasing by 101.3% over four years compared to 29.9 billion KRW in 2019 before the pandemic, greatly surpassing the domestic market growth rate of 21.1% during the same period. Additionally, exports of other alcoholic beverages such as fruit soju also increased by 5.3% to 79.2 billion KRW last year from 75.2 billion KRW the previous year.

HiteJinro is also taking a more proactive global strategy, seeing high potential in overseas markets. Earlier in January, HiteJinro announced that it had signed a main contract to secure a soju factory site of 82,083㎡ (approximately 24,873 pyeong) in the Green I-Park Industrial Complex in Thai Binh Province near Hanoi, Vietnam, accelerating the establishment of its first overseas production base. Furthermore, the company extended its sponsorship contract with the MLB Los Angeles Dodgers the day before. The company expects that this extension will increase brand exposure by adding permanent advertising boards.

However, since exports still account for only about 5% of total soju sales, strengthening the domestic market remains the top priority. An industry insider commented, “Although soju export sales exceeded 100 million USD for the first time in 10 years last year and the volume of soju sales in overseas markets is clearly growing, the vast majority of sales are still domestic,” adding, “The renewal of existing products and the launch of new products from the beginning of the year show the company’s determination to restore its somewhat shaken position in the domestic market.” HiteJinro plans to actively promote marketing using a new ‘Gold Toad’ character to expand initial awareness of Jinro Gold. In April, ‘Jinro Gold Pop-up Stores’ where customers can directly experience the product will be operated in Seoul and Busan.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)