Bank of Japan Expected to Raise Interest Rates for the First Time in 17 Years

Yen Strength May Benefit Korean Stock Market and Exports

As Japan is expected to raise its benchmark interest rate for the first time in 17 years, attention is growing on the potential impact on the South Korean economy. Experts believe that Japan's rate hike could lead to a stronger yen, which may positively affect the Korean stock market and exports. However, since Japan's rate increase is expected to be limited and gradual, it is forecasted that there will be little impact on domestic monetary policy.

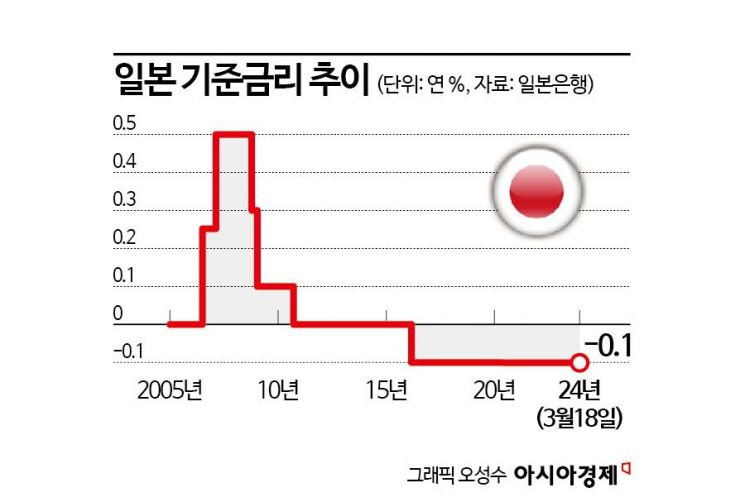

On the 19th, Japanese media such as Nihon Keizai Shimbun and Kyodo News reported that the Bank of Japan (BOJ) is expected to end its negative interest rate policy and raise the benchmark rate at the scheduled monetary policy meeting that day. If the BOJ raises rates, it would be the first rate hike since February 2007, marking 17 years.

The Bank of Japan has maintained a short-term policy rate of -0.1% since February 2016 to overcome a prolonged recession, and with this benchmark rate increase, the negative interest rate policy is expected to end after 8 years.

Experts anticipate that Japan's rate hike will trigger yen appreciation. The International Finance Center analyzed that while the U.S. Federal Reserve (Fed) and the European Central Bank (ECB) are considering rate cuts, if Japan raises rates, capital inflows into Japan will increase, leading to higher asset prices domestically and a stronger yen. Hwang Won-jung, a senior researcher at the International Finance Center, explained, "When interest rates rise, capital inflows into Japan expand, which will be a factor in yen appreciation."

There is also an assessment that a stronger yen could help boost the Korean stock market. Heo Jae-hwan, a researcher at Eugene Investment & Securities, said, "The Bank of Japan's normalization of interest rates (ending zero interest rates) could end the trend of yen depreciation," adding, "When the Korean won is weaker compared to the yen, foreign investors tend to have a buying advantage in the domestic stock market, and stock prices often perform stronger compared to Japan."

The stronger yen could be a burden for Japanese export companies, and Korean companies competing with them in overseas markets could gain a windfall benefit. Researcher Heo emphasized, "Attention is needed for the automobile and shipbuilding sectors, which still have competitive relationships with Japan."

Kim Sung-soo, a researcher at Hanwha Investment & Securities, said, "The Bank of Japan's policy announcement could help improve domestic exports in the short term," but added, "Since the export industry in our country is currently doing well, the impact of interest rate changes itself will be limited."

If the stronger yen reduces the number of Japanese tourists, there is also a possibility of improving the travel balance deficit with Japan. South Korea's travel balance deficit in January was $1.47 billion, which widened compared to last year. This is because the number of travelers going abroad to Japan and Southeast Asia increased significantly, while the number of foreign visitors to Korea has not recovered.

However, there is an analysis that changes in Japan's monetary policy are unlikely to have a direct impact on domestic monetary policy. Kim Hyung-seok, head of the International Comprehensive Team at the Bank of Korea's Research Department, said, "Since last year, movements toward changes in Japan's monetary policy have already been largely reflected in the market," adding, "The possibility that changes in Japan's monetary policy will directly affect our country is low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)