Urgent Response Needed as a Matter Directly Linked to Corporate Survival

Annual Green Fund Supply Increased by 67% Compared to Past 5-Year Average

Expanding Renewable Energy Investment to Meet Clean Energy Demand

Formation of 'Future Response Finance TF' with Relevant Ministries and Policy Financial Institutions

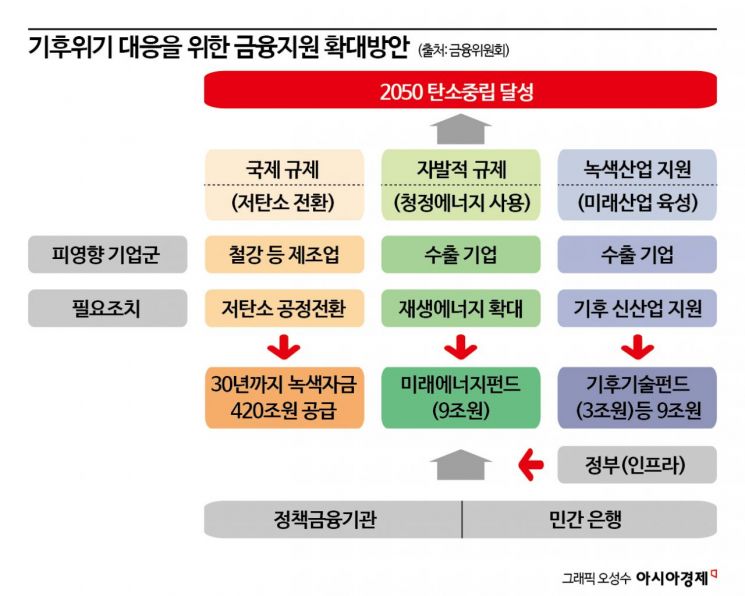

As carbon neutrality-related regulations act as new types of trade barriers directly linked to the survival of companies such as exports, the need for timely responses is increasing. In response, the government plans to pour 420 trillion won of policy funds over the next seven years. The plan prioritizes support for the issues companies find most challenging in addressing climate crisis responses, such as reducing carbon emissions.

According to the 'Plan to Expand Financial Support for Climate Crisis Response' released by the Financial Services Commission on the 19th, the Financial Services Commission will cooperate with major commercial banks, including policy financial institutions such as the Korea Development Bank and the Industrial Bank of Korea, to supply 420 trillion won to manufacturing industries like steel by 2030 to respond to international regulations for low-carbon transition. Additionally, it will establish a 9 trillion won Future Energy Fund for voluntary regulations such as the use of clean energy.

Furthermore, including related ministries such as the Ministry of Trade, Industry and Energy and the Ministry of Environment, policy financial institutions, and the Korea Federation of Banks, a 'Future Response Finance Task Force (TF)' will be formed to provide additional support for tasks requiring financial assistance to achieve '2050 Carbon Neutrality.' According to the Korea Capital Market Institute, the investment scale required to achieve '2050 Carbon Neutrality' is estimated at 2,097 trillion won, with annual required amounts of 15 to 17 trillion won from 2021 to 2025, 29 to 44 trillion won from 2026 to 2030, and up to 163 trillion won after 2030.

Kim Joo-hyun, Chairman of the Financial Services Commission, stated, "We plan to supply 60 trillion won annually by expanding the average annual green fund supply of policy financial institutions by 67% compared to the previous five-year average of 36 trillion won by 2030," adding, "Since demand is expected to increase further, we plan to adjust the annual supply volume accordingly." The reduction in greenhouse gas emissions is expected to be 85.97 million tons.

160 trillion won will be invested to expand renewable energy investments in response to clean energy demand. The total estimated cost for new renewable power generation capacity expansion by 2030 is approximately 188 trillion won. For offshore wind power and others, it is expected to take up to about 25 years from loan issuance to repayment, making financial institutions reluctant to provide loans. According to the Financial Services Commission's calculations, to raise 160 trillion won in the market, there is a need to supply venture capital (54 trillion won) such as subordinated loans and equity investments.

Chairman Kim explained, "By jointly supplying 23 trillion won, part of the venture capital, policy financial institutions and commercial banks will play a pioneering role," adding, "Policy financial institutions such as the Korea Development Bank will supply 14 trillion won in subordinated loans to induce subordinated loans from private financial institutions, and Industrial Bank of Korea, Kookmin Bank, Shinhan Bank, Hana Bank, Woori Bank, and NongHyup Bank will invest a total of 9 trillion won by 2030 to newly establish the Future Energy Fund." The Financial Services Commission expects that if renewable energy projects such as wind power proceed according to the 'Basic Plan for Electricity Supply and Demand,' the share of renewable energy power generation will reach 21.6%.

Utilizing Climate Technology, Innovation Growth, and Growth Ladder Funds to Foster Climate Technology

To develop future growth engines through fostering climate technology, funds such as the Climate Technology Fund, Innovation Growth Fund, and Growth Ladder Fund will be utilized. Climate technology is emerging as a new survival and growth strategy for companies, but many cases fail to develop due to a lack of initial economic feasibility, prompting this measure.

The Climate Technology Fund will be established with a total scale of 3 trillion won by 2030, funded by the Industrial Bank of Korea and the five major commercial banks. Six banks will invest a total of 1.05 trillion won and match 1.95 trillion won in private funds. The Innovation Growth Fund will invest a total of 5 trillion won in related fields by 2030 through an annual 3 trillion won Innovation Growth Fund to promote climate technology development. The Growth Ladder Fund will invest a total of 1 trillion won by 2030, focusing on climate technologies with insufficient private participation or market formation. Chairman Kim stated, "We plan to select primary investment targets by referring to the Ministry of Science and ICT's climate technology classification system, the Carbon Neutrality and Green Growth Committee's climate tech types, and the Innovation Growth Joint Standards."

Additionally, the Financial Services Commission will accelerate institutional improvements to support climate finance. To facilitate banks' active support for financing to respond to the climate crisis, it has been judged that green classification should be easy to determine. Therefore, a 'Green Loan Management Guideline' will be prepared and promoted within this year in cooperation with the financial sector to apply the Korean Green Classification System to loans.

Since increased costs borne by companies during the low-carbon transition process may lead to deteriorating profitability of financial companies and increase credit risk, the Financial Services Commission plans to verify the actual status of climate risk management through gap analysis between climate risk management guidelines and internal regulations of financial companies and revise the guidelines if necessary.

Chairman Kim said, "This plan is a financial support measure needed until 2030, and it is necessary to discuss and prepare additional support measures for what is needed until 2050," adding, "Through the Financial Services Commission's Future Response Finance TF, we will discover and review long-term tasks to achieve 2050 carbon neutrality." He further explained, "The Future Energy Fund will be established in the first half of the year and investment will begin within the year, and the Climate Technology Fund will establish a master fund operation plan and set up, select sub-fund entrusted operators in the first half, and start investments within the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.