Tuition Fees Decrease to 4-Year-Ago Levels

"Persistent High Inflation Dampens Household Spending Sentiment"

As prices have soared to unprecedented levels, spending on education, which had been considered the 'last bastion' among household consumption items that rarely decreased, has also significantly declined.

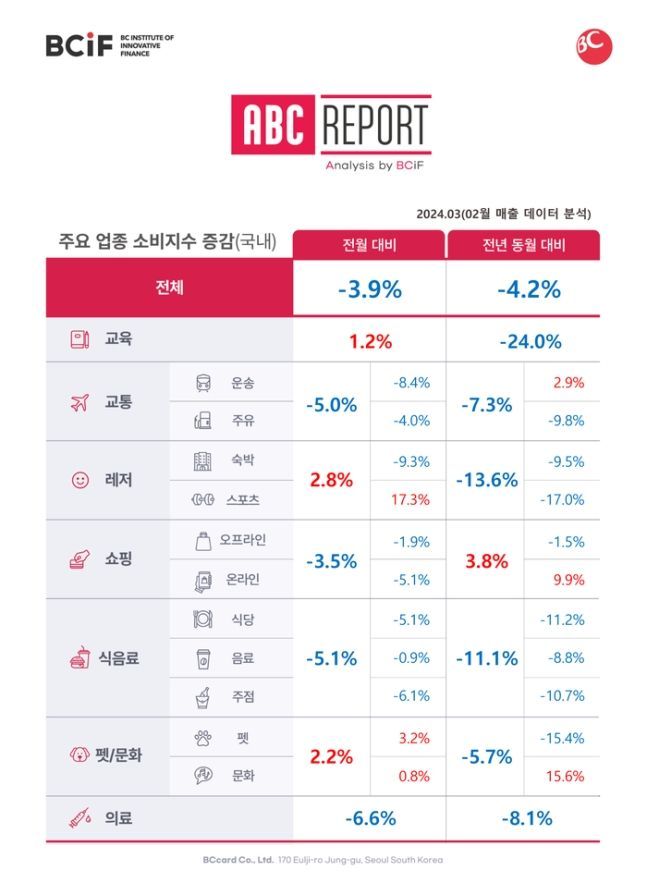

According to the 14th issue of the 'ABC (Analysis by BCiF) Report' released on the 18th by BC Card's New Finance Research Institute, which analyzed card payment data, sales in seven major industries last month decreased by 4.2% compared to the same month last year. Sales declines were observed in sectors such as ▲leisure (-13.6%), ▲food and beverage (-11.1%), and ▲medical (-8.1%). Sales in transportation and pet & culture sectors also fell by 7.3% and 5.7%, respectively, compared to the same month last year. The only sector that saw an increase in sales during the same period was shopping (+3.8%), with offline sales decreasing by 1.5% but online sales rising by 9.9%.

The most notable area in this analysis was the sharp decline in sales in the education sector. Last month, education sector sales rose by 1.2% compared to the previous month but dropped by 24% compared to a year ago. Analyzing sales annually over the past four years (March 2020 to February 2024), education sector sales had steadily increased until early last year despite the high inflation situation. However, in the most recent year (March 2023 to February 2024), sales decreased by 15.0% compared to the same period the previous year, returning to levels seen four years ago. This decline is attributed to decreased sales in ▲arts and physical education academies (-31.5%), ▲tutoring academies (-26.7%), and ▲foreign language academies (-26.5%).

BC Card expects the contraction in household consumption sentiment due to sustained high inflation to continue for the time being. Last month, sales in major sectors such as ▲sports (-17.0%), ▲pets (-15.4%), ▲restaurants (-11.2%), and ▲bars (-10.7%) all decreased by more than 10% compared to the same month last year.

Meanwhile, the government, which declared a 'war on private education,' has set a goal to keep the growth rate of private education expenses within the consumer price inflation rate. However, according to the '2023 Survey on Private Education Expenses for Elementary, Middle, and High School Students' released by the Ministry of Education and Statistics Korea on the 14th, the average monthly private education expense per person increased by 5.8% from the previous year to 434,000 won. This is higher than last year's consumer price inflation rate of 3.6%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.