Lithium Futures Price Approaches 120,000 Yuan

Price Range Recovered Since Late November Last Year

Raw Material Price Increase Expected to Boost Profits Through 'Lagging Effect'

The prices of lithium and nickel, key raw materials for batteries, have shown an upward trend for nearly a month. While it remains to be seen whether this is a sustained increase, there is growing speculation that Korean battery companies, which have struggled amid falling mineral prices, may have found an opportunity to improve their performance.

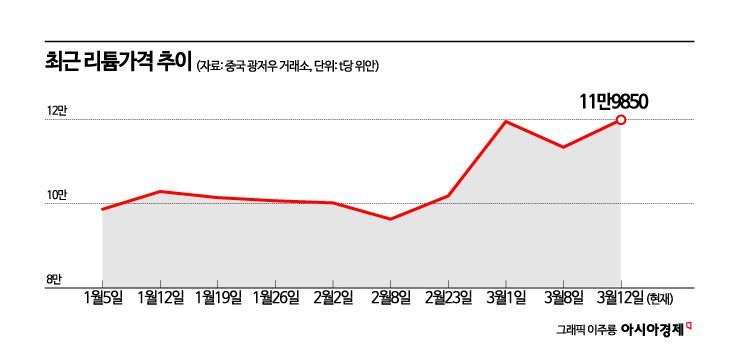

According to the Guangzhou Futures Exchange in China on the 13th, the closing price of lithium carbonate was 119,800 yuan per ton (approximately 21.88 million KRW) as of the previous day, up 29.1% compared to 92,800 yuan per ton (approximately 16.94 million KRW) on the 20th of last month, three weeks earlier. This marks a 15 trading-day consecutive rise, the first rebound in lithium prices for 3 to 4 weeks since May to June last year, nine months ago.

Lithium prices had been on a downward trend due to oversupply of batteries from China and a global economic slowdown starting early last year. Lithium prices, which had risen to 580,000 yuan per ton (about 100 million KRW) in November 2022, fell to around 89,000 yuan per ton (about 16 million KRW) in February this year.

Nickel prices, which had also been declining, have similarly shown signs of recovery. As of the 11th, nickel was priced at $17,910 per ton (approximately 23.48 million KRW), up about 7.9% from the beginning of the year ($16,600). It rose 14.7% from the lowest point earlier last month ($15,620). Lithium hydroxide, widely used by domestic battery companies, also showed recovery at $13,425 per ton (approximately 17.59 million KRW).

With mineral prices rising, attention is focused on the possibility of a sustained rebound. Battery companies, struggling due to sluggish electric vehicle sales, are pinning hopes on the rise in raw material prices.

Recent price strength is analyzed to be the result of reduced supply and expanded electric vehicle subsidies. As lithium prices fell close to production costs, mineral companies cut back on supply. The front-end industry has somewhat revived due to the release of electric vehicle subsidies earlier this year, which is also considered a cause of the mineral price rebound.

Rising raw material prices consecutively affect the prices of cathode materials and battery cells. Cathode material companies sign contracts linking mineral prices such as lithium and nickel to their selling prices. The selling price is based on the mineral price at the time of selling the final product, the cathode material, not at the time of purchasing the minerals. When mineral prices fall, companies buy high and sell low, but when mineral prices rise, they buy low and sell high. The increase in product prices leading to higher margins when products are sold is called the 'Lagging Effect.' Battery companies are hopeful for improved profitability this year due to the Lagging Effect. A battery industry insider said, "Although there have been many negative forecasts for the battery industry this year, if the Lagging Effect takes hold, it could be an opportunity for companies to strengthen their fundamentals," adding, "If the North American electric vehicle market fully activates, it is expected to overcome the chasm (a temporary pause in growth industries)."

However, it is uncertain whether the mineral price trend will continue. Typically, the time lag between mineral prices and battery prices is considered to be about 3 to 6 months. From the 1st to the 10th of this month, the average export price of NCM (Nickel-Cobalt-Manganese) and NCA (Nickel-Cobalt-Aluminum) cathode materials was $29,955, falling below $30,000 for the first time since the introduction of the HS code for secondary batteries in January 2022. This is a 44% decrease compared to the same period last year and about 4.4% lower than last month.

Professor Lee Hogun of Daeduk College's Department of Automotive Engineering said, "It appears that the battery and cathode material industries have entered a rebound phase, but the recovery of front-end demand needs to be observed until the second quarter," adding, "The activation of the North American electric vehicle market is a positive factor for the industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)