Shareholders' Meetings Kick Off This Week

Wave of Calls for National Pension Service 'Intervention' by Activist Funds

Second-Term Steering Committee's Stance Expected to Emerge at This Year's Meetings

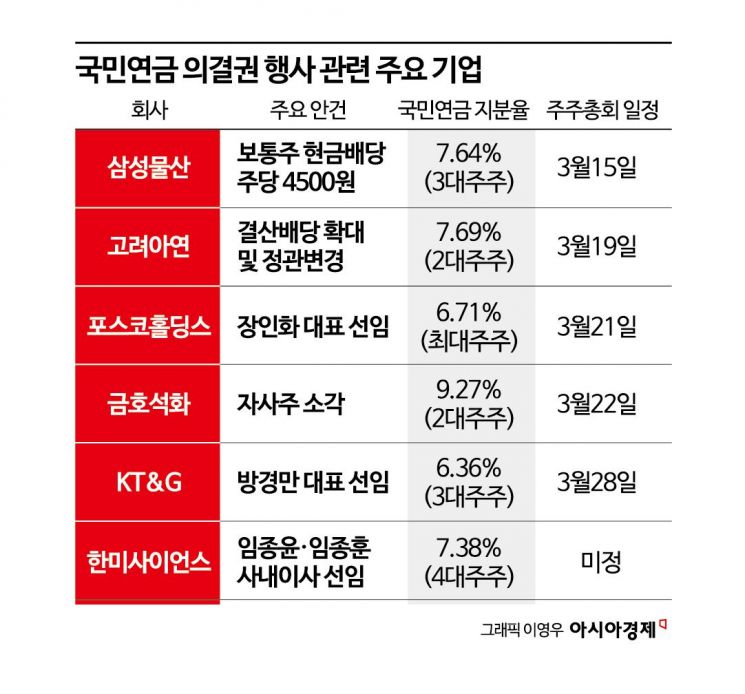

As the March shareholder meeting season kicks off, attention is focused on the 'voting intentions' of the National Pension Service (NPS), a major player in the domestic stock market. Riding the wave of the 'corporate value-up program,' voices calling for shareholder returns and improvements in corporate governance (management disputes) are growing louder, along with demands for the 'Stewardship Code' (institutional investors' exercise of voting rights). The NPS is the largest institutional investor in Korea, holding more than 5% stakes in 283 companies. It is the largest shareholder in many major listed companies and ranks as the second or third largest shareholder in many others. Last year, it exercised voting rights in 601 companies.

An NPS official said on the 11th, "Typically, the direction of voting rights is decided about 4 to 5 days before the shareholder meeting," adding, "There are more agenda items requiring important decisions than ever, so we are reviewing them carefully." According to the Korea Securities Depository, regular shareholder meetings will be held for 2,614 listed companies in Korea, including 31 companies in the second week of March. Particularly, companies such as Samsung C&T, POSCO Holdings, KT&G, Kumho Petrochemical, Korea Zinc, and Hanmi Science are drawing attention regarding the NPS's exercise and direction of voting rights. These are companies where activist funds or civic groups demand specific positions or where fierce voting battles could sway the outcome depending on the NPS's stance.

Disputed Companies, NPS 'Called to Step In'

Regarding POSCO Holdings and KT&G, which plan to appoint new representatives at their shareholder meetings, civic groups and activist funds are requesting the NPS to oppose the proposals. The UK-based activist fund Palliser Capital sent a letter to the NPS urging support for strengthening shareholder returns. This fund is demanding shareholder returns worth approximately 1.2 trillion KRW, including dividend increases at Samsung C&T. Activist fund Chah Partners publicly requested the NPS to support the agenda for the complete cancellation of treasury shares at Kumho Petrochemical. Korea Zinc and Hanmi Science, where owner-family voting battles are anticipated, are drawing attention as the NPS holds the casting vote. It is rare to find a disputed company where the NPS is not mentioned.

According to the NPS, the general direction of voting rights domestically and internationally is decided by the Fund Management Headquarters. However, for agenda items requiring in-depth discussion, such as treasury share cancellation or director appointments, the Stewardship Responsibility Committee (SRC) makes the decision. Once finalized, the Ministry of Health and Welfare, the higher authority, publicly announces the decisions before voting. On the 7th, the SRC opposed the appointment of Chairman Cho Hyun-joon and Vice Chairman Cho Hyun-sang of the Hyosung Group as inside directors, citing reasons such as 'damage to corporate value' and 'neglect of monitoring duties and excessive concurrent positions.' This was the first public stance on voting rights exercise for this year's shareholder meetings. Since adopting the Stewardship Code in 2018, the NPS has consistently opposed the appointment of Hyosung owner family members as inside directors whenever such proposals have been made. However, since the owner family's stake approaches a majority, the appointments have never been blocked due to the NPS's opposition.

Second SRC Expected to Show Clear 'Color'

The NPS Stewardship Responsibility Committee consists of nine members: two recommended each by employer, employee, and regional subscriber groups, and three recommended by expert organizations. The first SRC, active for three years from 2020, was composed of nine members recommended equally by each group. The second SRC, active since March 2023, reduced the subscriber groups' seats by three under the pretext of strengthening expertise and filled the remaining seats with three members recommended by expert organizations. The expert-recommended members have been criticized by civic groups as being 'pro-government and pro-business.'

The second SRC completed its formation in March last year, during the peak of the shareholder meeting season. Therefore, this year's shareholder meetings are expected to be the stage to truly judge the 'color' of the second SRC. An NPS official said, "Basically, the direction of voting rights is concluded by 'unanimous agreement' through in-depth discussion," adding, "If there is extreme disagreement, decisions are made by majority vote." The official also said, "The revamped SRC is now on the judgment stand to see whether it will become a 'government-controlled' or 'rubber-stamp' body, or whether it can be a supporter of 'value-up' to enhance shareholder value based on its exercise of voting rights this shareholder meeting season."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.