India's Sensex Index Hits All-Time High

Individual Investors Increase by 120 Million in 5 Years

Driven by Pandemic and Digital Infrastructure Growth

In India, the world's most populous country, 'Gaemi' (individual investors) are leading an unprecedented investment boom. Fueled by the investment surge sparked by the COVID-19 pandemic and bolstered by expectations of India's economic growth, the Indian stock market is soaring to new heights.

India's Major Indices Hit 'Record Highs'... Money Floods the Stock Market

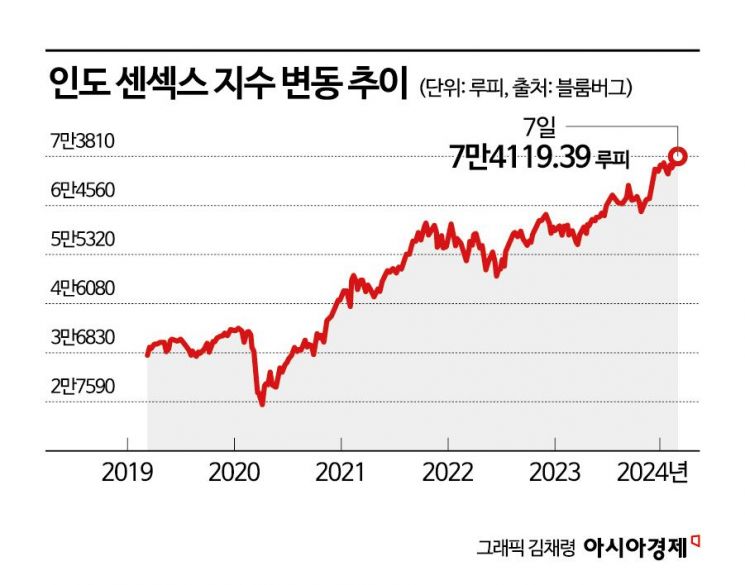

The benchmark index of the National Stock Exchange of India (NSE), the Sensex, closed at 74,114.39 rupees on the 7th, setting a new record high. The Nifty 50 index, composed of 50 large-cap stocks, also surpassed the 22,500 mark, reaching an all-time high.

People are passing by in front of the Bombay Stock Exchange (BSE) in Mumbai, India. [Image source=EPA Yonhap News]

People are passing by in front of the Bombay Stock Exchange (BSE) in Mumbai, India. [Image source=EPA Yonhap News]

The stock market surge in India is largely driven by individual investors, or 'Gaemi.' While expectations that India will lead future global economic growth and join the ranks of the world's top three economies since last year have played a role, the rapid increase in stock investments by Indians, which had been quiet until recently, is a key factor.

According to the Economic Times, the number of individual investors registered with the NSE was 161 million as of the 9th of last month. Over the past five years, from 2019 to last year, the number increased by more than 120 million, with an additional 5.4 million investors registering in January alone. Considering India's population of 1.4 billion, this suggests that about 10% have started investing in stocks within the last five years.

As these Gaemi investors continue to enter the stock market, their share in major indices is gradually increasing.

Looking at major indices, the proportion of individual investors (by investment amount) in the Nifty 50 index rose from 5.42% in 2014 to 6.98% in September last year. Similarly, the Nifty 100 and Nifty 200 indices, composed of 100 and 200 large-cap stocks respectively, saw increases of 1.3 percentage points each during the same period. Although the share is not overwhelming compared to institutional investors due to the smaller amounts invested by individuals, the trend is steadily upward.

The Economic Times reported, "Until a few years ago, investing in the Indian stock market was perceived as risky for individual investors, so it was mainly dominated by institutional investors. However, recently, individual investors have been investing their savings in mutual funds, stocks, and bonds," reflecting the changing atmosphere.

Why Have India's Gaemi Investors Surged?

The British magazine The Economist analyzed the reasons behind the surge of Gaemi investors in India in an article titled 'Why Have Indians Taken to Stock Investing?' on the 7th. According to the report, the major trigger for Indian individual investors to start investing in stocks was the COVID-19 crisis. During that time, massive amounts of money flowed into markets worldwide, supported by various stimulus packages, which also boosted the Indian stock market.

India's digital infrastructure, expanded through over a decade of investment, also fueled this upward trend. Internet penetration was significantly expanded across India, and fintech companies like Groww and Zerodha established stable services, increasing investment through these platforms. In this process, the millennial generation, willing to take some risks for high returns, jumped into the stock market.

For example, Zerodha, India's leading online brokerage, had about 1.3 million users before the COVID-19 pandemic, but by the end of 2022, this number had grown to around 10 million. This phenomenon is similar to how young people in the U.S. began investing in stocks through the Robinhood app, which was dubbed the sanctuary for Gaemi investors during the pandemic.

Additionally, Indian individual investors have started showing interest in mutual funds. The Economist reported that assets related to mutual funds in India tripled from 2009 to 2020 and increased by an additional 33% over the three years from 2020 to last year. According to the Association of Mutual Funds in India (AMFI), as of January 31 this year, there were 79.2 million individual accounts investing in Indian mutual funds.

The growing attention to the stock market is also influenced by expectations for India's economic growth. As of January, the total market capitalization of the Indian stock market reached $4.33 trillion (approximately 5,744.6 trillion won), surpassing Hong Kong's $4.29 trillion, making it the fourth-largest stock market after the U.S., China, and Japan. Expectations for economic growth have attracted foreign investment inflows, which in turn have drawn domestic investors' attention back to the market.

With individual investors showing strong interest in the stock market, it is expected that household investment portfolios in India will gradually change. The proportion of stock investments in Indian household assets increased from 2.2% in 2013 to 4.7%. Although this is low compared to the U.S. (40%), the growth rate is rapid. Last year, real estate accounted for the largest share of Indian household assets at 51%.

However, The Economist also expressed concerns about this enthusiasm for the Indian stock market, stating, "Within the market, there is worry that inexperienced novice investors may suffer losses and become discouraged, potentially never returning to the stock market, which would represent a significant loss."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)