Surpassing 1 Trillion Won for 2 Consecutive Years... Over 100,000 People Caught

Car Insurance Fraud Common Among 20s, Hospital Insurance Fraud Among 60s

FSS: "Insider Tips Crucial in Fighting Insurance Fraud"

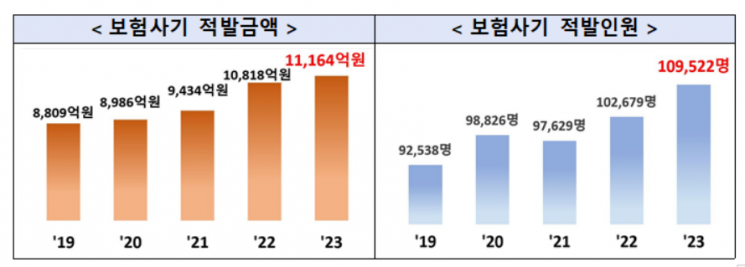

Last year, the amount of insurance fraud detected surpassed 1 trillion won for the second consecutive year, marking an all-time high.

The Financial Supervisory Service (FSS) announced on the 6th that the amount of insurance fraud detected last year was 1.1164 trillion won, an increase of 3.2% (34.6 billion won) compared to the previous year (1.0818 trillion won). During the same period, the number of people caught for insurance fraud rose by 6.7% (6,843 people) to 109,522.

The scale of insurance fraud has been increasing every year. The amount detected was 880.9 billion won in 2019, and in 2022, it surpassed 1 trillion won for the first time in history. The number of people caught for insurance fraud also exceeded 100,000 for the first time that year.

By insurance category, automobile insurance accounted for the largest fraud amount last year at 547.6 billion won (49.1%). Long-term insurance also suffered significant losses at 484 billion won (43.4%). Guarantee insurance (43.8 billion won, 3.9%) and general insurance (40.9 billion won, 3.7%) followed. The automobile insurance fraud amount increased by 77.1 billion won (16.4%) compared to the previous year due to rises in driver and damage manipulation (40.1 billion won) and intentional collisions (20.5 billion won). On the other hand, long-term insurance fraud decreased by 33.8 billion won (6.5%) due to reductions in false hospitalization, surgery, and diagnosis claims.

By age group, those in their 50s accounted for the largest share at 22.8%, followed by those aged 60 and above (22.6%), 40s (20.1%), 30s (18.3%), 20s (14.9%), and under 10s (1.3%). The increase rates compared to the previous year were higher than the average increase rate (6.7%) for those in their 30s (14.5%) and 40s (10.3%). People in their 20s were involved in many automobile-related frauds such as intentional collisions (31%) and drunk or unlicensed driving (14.5%). Those aged 60 and above were often involved in hospital frauds such as false hospitalization (18.8%).

Last year, four individuals including broker A colluded with B Hospital to recruit patients with indemnity insurance by promising free cosmetic procedures. B Hospital performed cosmetic and plastic surgeries but falsified related documents by claiming procedures such as thyroid radiofrequency ablation and uterine HIFU treatments. Through this, A and his group, B Hospital doctors, and patients embezzled 380 million won in insurance payouts.

By occupation, company employees accounted for the largest share of fraud at 21.3%, followed by unemployed and daily workers (13.2%), housewives (9.3%), and students (5.0%). The increase rates compared to the previous year exceeded the average increase rate (6.7%) for unemployed and daily workers (26.4%), company employees (18.6%), and insurance industry workers (9.7%).

The FSS plans to strongly respond to insurance fraud that harms the public by increasing insurance premiums and actively promote preventive education and publicity. An FSS official stated, "Insurance fraud is conducted secretly and systematically, so insider tips are crucial," adding, "Consumers should be especially cautious as those who participate in insurance fraud without guilt may face not only repayment of insurance money but also criminal penalties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.