Acceptance Rate of 59 Savings Banks at 37.75%

Insurance and Card Companies at 40~60% Range

It has been revealed that about half of the interest rate reduction requests submitted to the secondary financial sector, including insurance, credit card companies, and savings banks, were rejected. In particular, only about one in three requests were accepted on average at savings banks.

According to the Korea Federation of Savings Banks on the 4th, the acceptance rate of interest rate reduction requests at 59 savings banks in the second half of last year was 37.75%. The right to request an interest rate reduction allows financial consumers to ask financial institutions to lower their loan interest rates based on reasons such as employment, promotion, or income increase. Although this is a slight improvement from the same period last year (35.9%), it is still considered a low level.

The total number of interest rate reduction requests submitted by savings bank borrowers was ??77,259, but only 29,168 were accepted. The amount of interest reduced was 3.617 billion KRW.

SBI Savings Bank, the largest in asset size in the industry, recorded 57.96%, down 8.38 percentage points from the same period last year. However, the amount of interest reduced through acceptance of interest rate reduction requests was 1.156 billion KRW, accounting for 32% of the total reduction amount in the savings bank industry. OK Savings Bank, ranked second, had a single-digit acceptance rate of 5.65%. IBK Savings Bank (0.68%), Moa Savings Bank (6.31%), and Samho Savings Bank (7.69%) also showed low acceptance rates.

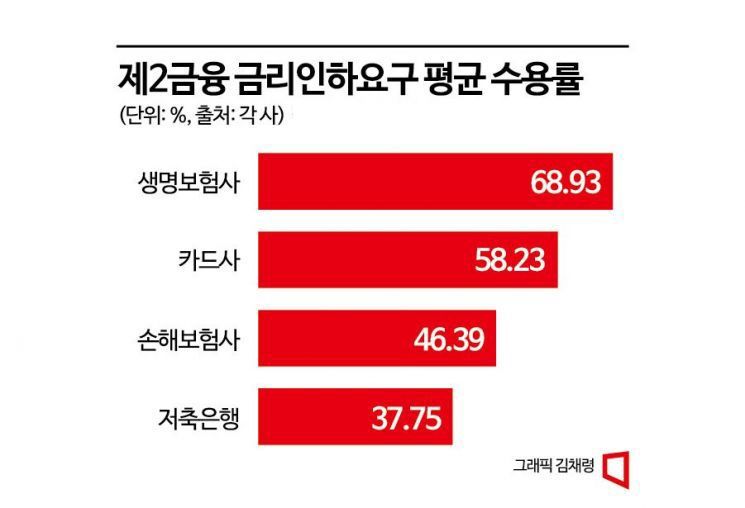

Meanwhile, the average acceptance rate for insurance companies and credit card companies was confirmed to be between 40% and 60%. The total number of applications was 312,046, of which 185,981 were accepted. The total amount of reductions was around 10 billion KRW. By sector, life insurance companies had the highest acceptance rate at 68.93%, followed by credit card companies (58.23%) and non-life insurance companies (46.39%).

The company with the lowest acceptance rate for interest rate reduction requests in the insurance and credit card industry was Dongyang Life Insurance at 27.47%. Among non-life insurers, Heungkuk Fire & Marine Insurance had the lowest acceptance rate at 32.3%. Among credit card companies, Hana Card was identified as the lowest with a 43% acceptance rate.

The industry explains that the differences in acceptance rates are due to the varying composition of borrowers at each financial institution. If the majority are low-credit borrowers for whom meaningful credit improvement is difficult, the number of accepted cases will inevitably be low. A secondary financial sector official said, “Since anyone can request an interest rate reduction, there were many cases where applications were made despite the repayment capacity remaining the same,” adding, “Generally, insurance and credit card consumers are more creditworthy than savings bank borrowers, which causes differences in acceptance rates even within the secondary financial sector.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)