4 Profitable Films Including 'Pamyo' Expected to Break BEP by February

Only 5 Films Surpassed Break-Even Last Year... Industry Improvement

Theater Recovery & Record High 'Policy Funds'... 'Investment Boon'

As the Korean film industry emerges from a long winter into spring, its 'partner,' venture capital (VC), is also beaming with joy. This is because more films than usual are expected to surpass the break-even point (BEP).

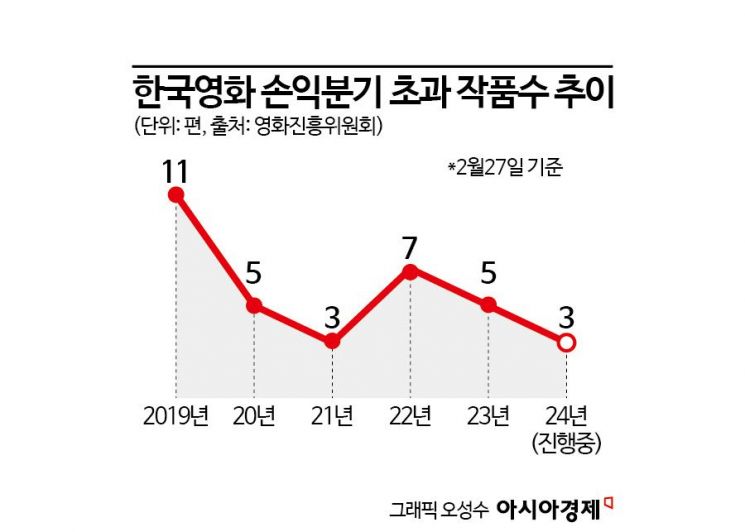

According to the Korean Film Council (KOFIC) and the VC industry on the 28th, three Korean films have exceeded the BEP this year: Simin Deokhui (1.69 million viewers), Geon-guk Jeonjaeng (980,000 viewers), and Sopung (300,000 viewers; all figures as of 2 p.m. on the 27th). The recently released Pamyo is also expected to surpass its break-even point (approximately 3.3 million viewers). Pamyo is showing a faster box office pace than Seoul-ui Bom (13.11 million viewers), which surpassed 2 million viewers on its sixth day, by reaching 2 million viewers in just four days after release. Including Pamyo, which is certain to break even, four films are expected to turn a profit this year. This nearly matches the number of films (five) that surpassed the BEP last year, including Seoul-ui Bom, in just two months.

Profit Margins Fell to -40%... 'Profit Endurance' Gradually Recovering

Since film is a 'hit-driven industry,' profit margins vary widely from film to film. Some films fail to return any investment, while others become huge hits. The latter is exemplified by Seoul-ui Bom, which far exceeded its break-even point (approximately 4.6 million viewers) and delivered more than double the principal to investors. Investors included Solaire Partners, Michigan Venture Capital, KC Ventures, Union Investment Partners, Isu Startup Investment, Gaia Investment Partners, Central Investment Partners, Bogwang Investment, and Ilsin Startup Investment. Pamyo, which is leading the box office in the first quarter, is also expected to yield high returns for investors. Gaia Venture Partners, Central Investment Partners, and Union Investment Partners invested in it.

The film industry endured a long harsh winter during the COVID-19 period. According to KOFIC, the average estimated internal rate of return (IRR) for Korean films dropped from 5.9% in 2019 to -34.1% in 2020, plunging further to -47.3% in 2021. Although it rebounded in 2022, the return was still negative (-0.3%). The IRR for 2023 was not disclosed. KOFIC explained in its report that "due to diversification of revenue structures, separate statistics were not compiled." This is because non-theatrical revenues, such as from over-the-top (OTT) services, are reflected later. The film industry and related investment sectors, which previously barely broke even when including non-theatrical income, are gradually regaining the strength to surpass the BEP solely through theatrical revenue.

Theater Recovery... Record High 'Policy Funds' Expected to Boost Activity

More films are expected to surpass the BEP after February as well. This is because the number of moviegoers, which had fallen to about half during the COVID-19 period, is now recovering. Kim Hoe-jae, a researcher at Daishin Securities, said, "The nationwide audience in 2023 is expected to be 125 million, which is 55% of the 2019 level," and added, "In 2024, the nationwide audience is expected to recover to 143 million, or 64% of the 2019 level."

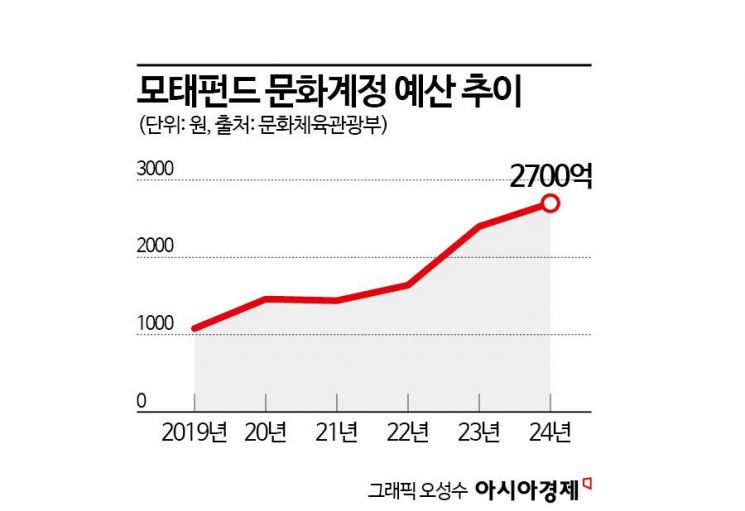

Government 'policy funds' have also been set at an all-time high, likely invigorating investment. The Ministry of Culture, Sports and Tourism allocated a total budget of 270 billion KRW for the cultural account's mother fund investment project this year. This surpasses last year's record high budget of 240 billion KRW. The cultural account budget was 108 billion KRW in 2019, 146 billion KRW in 2020, 144 billion KRW in 2021, and 164.1 billion KRW in 2022. Recently, nine fund management companies, including Ilsin Startup Investment and KC Ventures, submitted applications for the 2024 cultural account investment project.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)