Expansion of Domestic Seller Entry 'K-Venue'

Free 3-Day Delivery Service for Domestic Products

From 'Zero Commission' Policy to Entry Support

Countdown to Food Sales Launch

China's overseas direct purchase (direct import) platform AliExpress is accelerating its push into the domestic e-commerce market. Leveraging ultra-low-priced Chinese products, AliExpress, which has landed in the domestic market, recently made significant enhancements to its 'K-venue' channel service, where domestic sellers are registered. With a challenge extended into the food sector, including fresh food, attention is focused on whether the dynamics of the domestic e-commerce market will change.

On the 26th, AliExpress announced support measures for sellers entering K-venue. The support plan includes strengthening consultation services for sellers and reinforcing entry guidelines.

First, a KakaoTalk channel will be opened to provide real-time consultation and training via KakaoTalk for sellers entering K-venue. A comprehensive entry guideline for new sellers will also be created. This guideline will include necessary information for operations such as pre-entry stages, order processing, sales, and delivery. Additionally, a dedicated staff member providing Korean language services will be assigned through the seller support center.

Global online marketplace AliExpress held a press conference on the 6th at Lotte Hotel Seoul to announce the 'Strengthening of Intellectual Property Rights and Consumer Protection.' Ray Jang, CEO of AliExpress Korea, is discussing measures to prevent consumer rights violations such as counterfeit and defective sellers. Photo by Younghan Heo younghan@

Global online marketplace AliExpress held a press conference on the 6th at Lotte Hotel Seoul to announce the 'Strengthening of Intellectual Property Rights and Consumer Protection.' Ray Jang, CEO of AliExpress Korea, is discussing measures to prevent consumer rights violations such as counterfeit and defective sellers. Photo by Younghan Heo younghan@

Earlier this month, AliExpress launched a groundbreaking offer by waiving all fees for domestic sellers entering K-venue for the first time. From the beginning of this month, both entry fees and sales commissions are waived for sellers joining K-venue, applicable to all entrants. This demonstrates AliExpress's full commitment to expanding domestic sellers, even at the cost of forfeiting one of the main revenue sources in the e-commerce industry.

K-venue is a domestic product sales channel launched by AliExpress in October last year. Domestic companies register on AliExpress and handle product delivery themselves, similar to open markets of domestic e-commerce companies. Currently, major brands such as LG Household & Health Care, Korea P&G, and Aekyung are registered, with recent new entrants including Chamzon, Egojin, and Speedrack. Additionally, the number of registered brands is increasing in everyday consumer goods, beauty, furniture, and sports sectors.

K-venue was introduced to address AliExpress's previous drawbacks, such as long delivery times and quality issues. Products sold on K-venue are from domestic sellers and are delivered free of charge directly from Korea. Delivery times vary by product and region but most are delivered within three days. Even if customers are not satisfied with the received products, some items sold on K-venue support free returns.

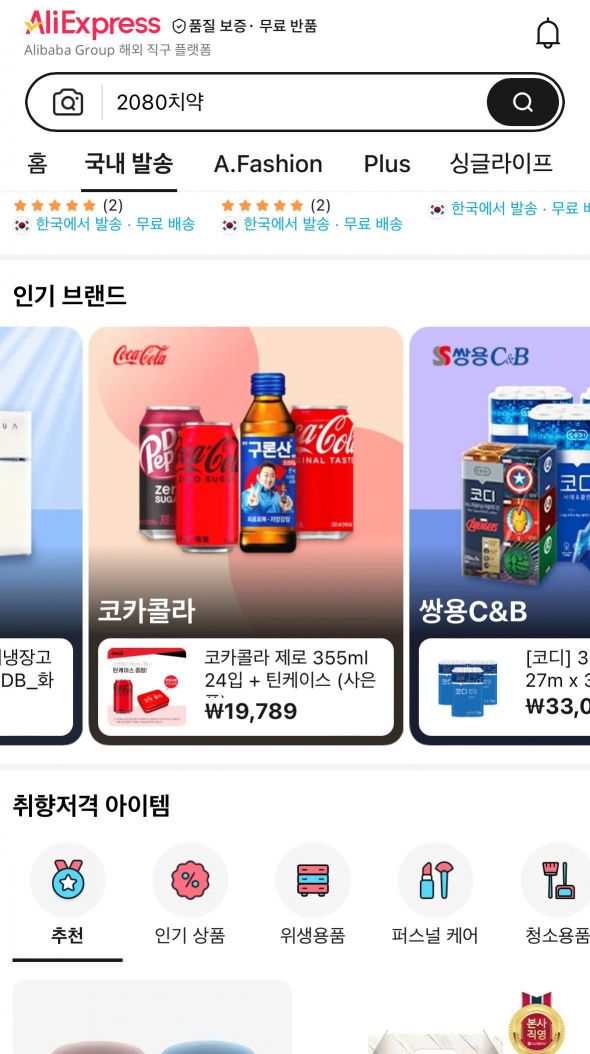

Products sold on K-Venue, the domestic seller entry channel of AliExpress. [Image captured from AliExpress app]

Products sold on K-Venue, the domestic seller entry channel of AliExpress. [Image captured from AliExpress app]

AliExpress is also pushing for expansion into the food sector. According to the distribution industry, food companies such as Dongwon F&B, Samyang Foods, and Pulmuone are reportedly considering entering K-venue. If these companies join K-venue, they are expected to mainly sell processed foods like tuna and ramen. Sales of fresh food are also anticipated. AliExpress's parent company, Alibaba Group, has posted a job opening for a fresh food merchandiser (MD) with a condition to work in Seoul. Regarding this, an AliExpress representative stated, "It is true that we are hiring a fresh food MD," but added, "There are no concrete business plans or finalized decisions yet."

AliExpress's moves are interpreted as a strategy to diversify sales areas and expand market share in the domestic e-commerce market. Until now, AliExpress has increased its influence in the domestic market through the so-called 'C-commerce (Chinese e-commerce)' model, selling low- to mid-priced manufactured goods and clothing produced locally in China at ultra-low prices via overseas direct purchase. However, since products are shipped directly from China, there have been criticisms about long delivery times and customs procedures. Additionally, product quality has been considered poor, and difficulties in product returns and exchanges have been pointed out as weaknesses.

In fact, the number of domestic companies newly entering K-venue is increasing. An AliExpress official said, "It is difficult to disclose the exact number of partner companies (registered sellers)," but added, "Thanks to the various benefits currently offered, applications for entry have been rapidly increasing recently, and we expect this trend to continue for the time being."

AliExpress has been actively growing since last year by emphasizing ultra-low prices. According to the marketing cloud operated by IGAWorks, the monthly active users (MAU) of the AliExpress app as of December last year were 5.6 million. This is the third highest among domestic e-commerce apps for the same month. Considering that the AliExpress app recorded 2.52 million MAU in January last year, it has secured more than double the number of app users in one year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.