The Supreme Court has ruled that it is the debtor, the account holder, who must prove whether a financial institution's account corresponds to a seizure-exempt claim, not the financial institution.

According to the court on the 25th, the Supreme Court Civil Division 3 (Presiding Justice Lee Heung-gu) recently overturned the original ruling that favored Plaintiff A in a deposit return lawsuit filed against Bank B and remanded the case to the Seoul Southern District Court (2021Da206356).

Mr. A borrowed about 8.5 million won from a loan company and failed to repay it, resulting in a court order for seizure and collection of claims in 2012. The court ordered the seizure and collection of Mr. A’s deposit of 1.8 million won at Bank B. At that time, the account balance was 1.55 million won. Mr. A filed a lawsuit against Bank B, claiming that 1.5 million won of the account balance corresponded to seizure-exempt claims as stipulated by the Civil Execution Act.

Article 246, Paragraph 1, Item 8 of the Civil Execution Act defines deposits necessary for the debtor’s livelihood for one month as seizure-exempt claims. Also, Article 7 of the Enforcement Decree of the former Civil Execution Act, which was in effect at the time, stipulated that the amount of deposits that cannot be seized is “deposits with a balance of 1.5 million won or less per individual, and if there is money that cannot be seized, the amount obtained by subtracting that money from 1.5 million won.”

The first and second trials ruled in favor of Mr. A, stating that “Bank B has an obligation to pay Mr. A the seizure-exempt amount of 1.5 million won from the deposit account balance.” Although Bank B argued that “based on the evidence submitted by the plaintiff alone, it is not possible to know whether the deposit is a seizure-exempt claim, and payment cannot be made without a court order canceling or modifying the seizure,” the court did not accept this argument.

However, the Supreme Court’s judgment was different. The Supreme Court first stated, “If the Supreme Court terminates cases without interpreting laws on the grounds that they are small claims cases, legal stability in the lives of the people may be undermined,” and added, “Even if the requirements for appeal reasons in small claims cases, such as ‘when a judgment contradicts the Supreme Court’s precedents,’ are not met, the Supreme Court can judge errors in substantive law interpretation and application to perform its essential function of ‘unifying the interpretation of laws.’”

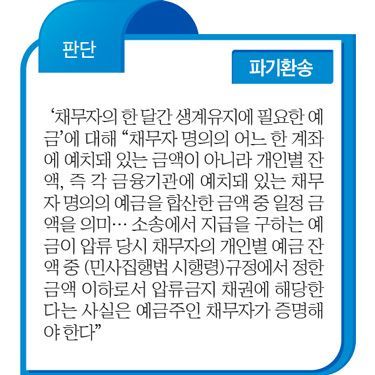

The Supreme Court also ruled on the “deposits necessary for the debtor’s livelihood for one month” stipulated in the Civil Execution Act, stating, “It does not mean the amount deposited in any one account under the debtor’s name, but the individual balance, that is, a certain amount among the total deposits under the debtor’s name held at each financial institution.”

Furthermore, the court stated, “In a lawsuit seeking payment, the fact that the deposit sought corresponds to a seizure-exempt claim because it is below the amount specified in the above regulation among the debtor’s individual deposit balances at the time of seizure must be proven by the debtor, who is the account holder. Although Mr. A submitted the transaction history of the Bank B account as evidence at the end of October 2019, without additional submission of transaction histories of other seized accounts, it is difficult to determine whether the deposits remaining in the Bank B account correspond to seizure-exempt claims, so it cannot be considered that the plaintiff has fully proven this.”

It added, “The lower courts assumed that the burden of proof regarding whether the claim is seizure-exempt lies with the third-party debtor defendant, and since the defendant failed to prove that the plaintiff withdrew deposits corresponding to the seizure-exempt amount after the seizure, the deposits can be considered seizure-exempt claims, allowing the plaintiff to seek the return of the deposits remaining in the account. This misinterpretation of the legal principle regarding the burden of proof on seizure-exempt claims and failure to conduct necessary investigations affected the judgment, which is a legal error.”

Hong Yoon-ji, Legal Times Reporter

※This article is based on content supplied by Law Times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)