Seoul City Releases Big Data on Housing, Consumption, and Financial Patterns

23.2% of Single-Person Loan Households at Risk with DTI Over 300%

Youth Single-Person Households Allocate Spending to 'E-commerce' and 'Dining'

The average total assets per household of Seoul citizens were found to be approximately 950 million KRW, with an average loan amount of about 92 million KRW. In particular, among single-person households with loans, 1 in 5 was found to have a high debt repayment risk relative to their income.

On the 22nd, the Seoul Metropolitan Government released the "Seoul Citizen Lifestyle Reproduced Data" (as of Q3 2022), which enables big data analysis of the housing, consumption, and financial patterns of 3.82 million Seoul citizen households (7.4 million people).

According to the data, the average total asset valuation per household in Seoul was 953.61 million KRW, the average loan amount was 92.1 million KRW, and the average annual income per household was 73.69 million KRW. The median total assets were 555.06 million KRW, showing a large difference from the average, while the median loan amount was 90 million KRW, showing little difference.

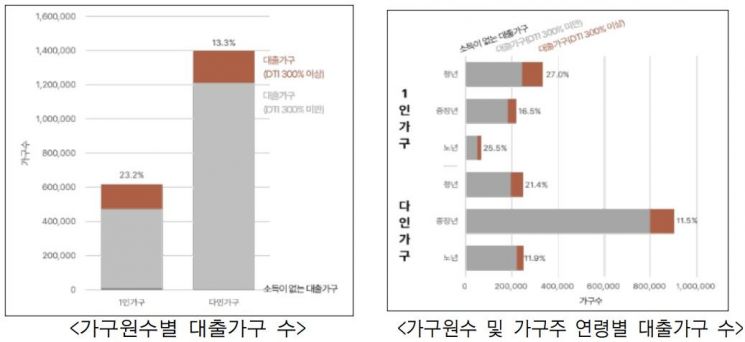

Among approximately 620,000 single-person households with loans, 23.2%, and among about 1.4 million multi-person households, 13.3% were analyzed to have a debt-to-income ratio (DTI) of 300% or higher, indicating a high risk of debt repayment. Although multi-person households held more debt, the risk rate was higher among single-person households. By age group of the household head, both single- and multi-person households showed the highest debt repayment ratios among youth (under 40 years old) at 27% and 21.4%, respectively, followed by the elderly (65 years and older), and then middle-aged (40 years to under 65 years).

Additionally, consumption pattern analysis was also disclosed. Youth single-person households spent more than half of their consumption, 53.7%, on 'e-commerce' and 'dining,' whereas elderly single-person households allocated 47.0% of their consumption to 'small retail stores' and 'medical' expenses.

The Seoul Metropolitan Government explained that this virtual reproduced data overcomes the limitations of pseudonymized linked data, which was previously restricted and unusable for purposes other than specific ones, enabling wider policy research and utilization without the risk of personal information leakage. It is also expected to complement sensitive survey items such as the Household Financial Welfare Survey by Statistics Korea, aiding in precise financial status analysis. Yoon Chung-sik, head of Seoul’s Big Data Office, stated, "The Seoul Citizen Lifestyle Reproduced Data, developed after more than a year of preparation, is a new attempt to balance personal information protection and data utilization." He added, "We will regularly update the data to provide citizens with the latest information and help improve the quality of life for Seoul citizens by enabling the data to be used across various fields."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)