Samsung Electronics and TSMC Invest in Packaging Equipment to Meet AI Chip Demand

Intek Plus Expected to Benefit from Increased Demand for Inspection Equipment

As the artificial intelligence (AI) boom continues, the supply shortage of AI chips compared to demand persists. Major semiconductor companies such as Samsung Electronics, Intel, and TSMC are enhancing chip performance through packaging as one of the measures to meet demand. Packaging is a technology that combines different semiconductors to operate like a chipset. With increased investment in the packaging sector, inspection equipment companies are expected to benefit. The demand for semiconductor packaging inspection equipment is rising as inspection areas expand and multilayer and miniaturized inspections become necessary.

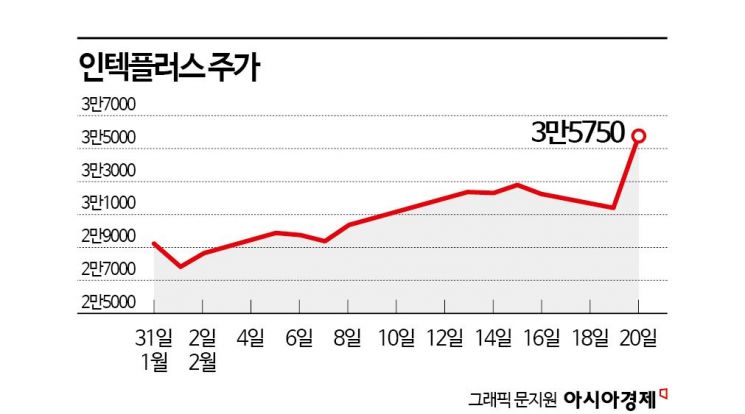

According to the financial investment industry on the 20th, Intekplus has risen 22.4% since the beginning of this month. Considering that the KOSDAQ index rose 8.4% during the same period, the return rate compared to the market reaches 14 percentage points.

Intekplus possesses machine vision technology that uses computers to extract and analyze information from images or videos. It develops and sells 2D and 3D automatic visual inspection equipment and modules that acquire, analyze, and process image data of the surface shape of inspection targets. Visual inspection equipment using machine vision technology requires a diverse academic foundation including electrical, electronic, mechanical, physical, chemical, and optical fields, and is a highly technical area requiring the systemic integration of thousands of components.

Myungjun Kwon, a researcher at Yuanta Securities, explained, "Global semiconductor companies will continue to expand the stacked packaging method," and "domestic semiconductor clients emphasize the importance of the packaging technology I-Cube to expand the supply of high-bandwidth memory (HBM) semiconductors." He added, "They plan to invest about 2 trillion won in advanced packaging," emphasizing that "Intekplus has a track record of delivering related inspection equipment in the second half of last year."

TSMC is utilizing the advanced packaging technology called 'Chip on Wafer on Substrate (CoWoS).' Since last year, it has been improving the efficiency of the CoWoS packaging process and expanding production capacity. It plans to double the production volume of the CoWoS packaging process by the end of this year compared to last year.

Intekplus has experience supplying equipment to Taiwanese semiconductor companies. Since it has secured technological competitiveness in inspection equipment, expectations for supply are growing.

Yongho Cha, a researcher at Ebest Investment & Securities, analyzed, "This year, semiconductor companies' expansion investments will focus on AI-related special fields such as HBM, packaging, and advanced processes," and "although Intekplus's semiconductor visual inspection equipment division's non-memory performance has been highly dependent on North American clients, it will diversify its client base going forward."

Yuanta Securities estimated that Intekplus will achieve sales of 130 billion won and operating profit of 15.5 billion won this year. Sales are expected to increase by 75.4% compared to the previous year, and operating profit is expected to turn positive. Researcher Kwon emphasized, "Looking at the order backlog trend, it exceeds the scale of 2022, which recorded the highest annual sales," adding, "Intekplus is continuously expanding new clients, and its competitiveness related to semiconductor packaging can be highlighted."

Intekplus secured operating funds by issuing convertible bonds worth 20 billion won in November last year. The nominal and maturity interest rates are both 0%, and the conversion price was 40,798 won, which was higher than the stock price at the time of issuance. The issuance conditions were favorable to Intekplus, reflecting high expectations from investors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)