Boram Sangjo "KB Securities deceived us... Return 10 billion won"

KB Securities "We explained sufficiently" denies responsibility

Court "Not deceptive but... 3.9 billion won compensation"

In relation to the 2019 Lime Fund scandal, Boram Sangjo, a major domestic funeral service company, filed a civil lawsuit against KB Securities, the fund seller, and won partial victory in the first trial.

The Lime scandal involved Lime Asset Management offering returns of 5-8%, higher than market interest rates, while using new investments to pay off earlier investors, leading to a massive redemption suspension affecting about 4,500 investors and damages amounting to 1.6 trillion won. In this ruling, the court determined that "the securities company recommended the fund without first understanding the investors' profiles and failed to properly explain the total return swap (TRS) contract structure that could increase investor losses, constituting incomplete sales."

According to the legal community on the 20th, the Seoul Central District Court Civil Division 22 (Presiding Judge Choi Wook-jin) ruled that KB Securities must pay approximately 3.995 billion won in an unjust enrichment lawsuit filed by Boram Sangjo People against KB Securities, involving about 10 billion won.

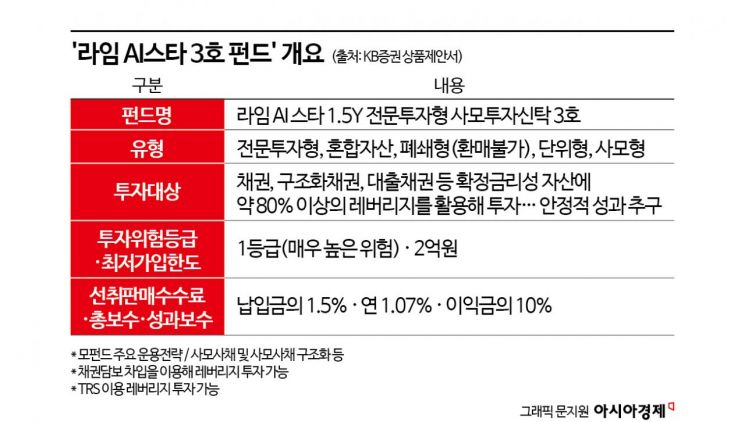

Previously, KB Securities sold Lime Asset Management's 'Lime AI Star' fund in 2019, and the two companies entered into a TRS contract to maximize returns using leverage effects. A TRS contract is where the securities company provides a loan secured by the fund and receives fees. Since the securities company is repaid first, losses increase the investors' losses. The AI Star fund was a 'sub-fund' of a 'mother fund' that mainly invested in ▲hard-to-liquidate private bonds ▲high-interest unstable bonds ▲unsecured bonds, making it a fund of funds through indirect investment.

In March of that year, Boram Sangjo invested 10 billion won in the 1.5-year maturity 'Lime AI Star' No. 3 fund through KB Securities. At that time, KB Securities recommended three products to Boram Sangjo employees who visited the branch, and Boram Sangjo ultimately chose the Lime fund instead of funds with lower risk. This was to efficiently manage the advance payments received from funeral service customers, pouring half of the annual net increase in advance payments. However, after the Lime scandal broke out, the AI Star fund suffered almost total losses.

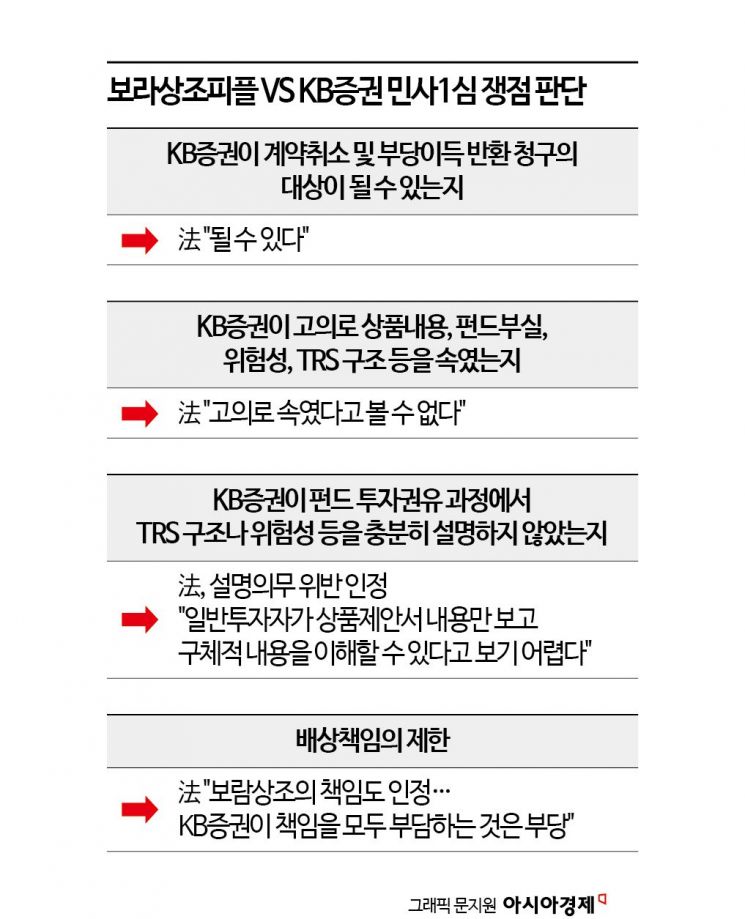

Boram Sangjo filed a lawsuit demanding payment of 11.378 billion won including investment principal and statutory interest. They argued under civil law that if the contract was mistaken due to the opponent's deception, the contract could be canceled. They claimed that KB Securities emphasized the fund as 'safe' despite knowing its poor condition and risks, and concealed the possibility of loss expansion due to the TRS structure.

KB Securities denied responsibility. They argued, "It is common knowledge that leveraged products are high-return and high-risk. We provided detailed explanations," and "If the investor had at least roughly read the fund proposal, the mistake could have been resolved." They also claimed they only acted as intermediaries between Boram Sangjo and Lime Asset Management and were not parties to the contract.

The court first judged, "KB Securities is the contracting party of Boram Sangjo and can be the defendant in this lawsuit. However, KB Securities did not intentionally deceive about investment strategies, signs of poor condition, risks, or the TRS structure." This was based on the product proposal stating that 'investment in unrated private bonds is possible, and principal and interest may not be paid on time,' and 'risk rating 1 (very high risk).' "The proposal stated that collateral is deposited for the TRS," and "even if Boram Sangjo knew the risks of the structure, they might still have subscribed to the fund. Therefore, it cannot be said that Boram Sangjo was mistaken because of KB Securities."

However, the court recognized KB Securities' responsibility for 'incomplete sales' by failing to comply with the 'suitability principle' when selling the fund. The suitability principle requires financial companies to understand investors' characteristics such as investment purpose, experience, and assets, and recommend investments accordingly. KB Securities recommended the product first and only obtained the investment profile confirmation form just before the subscription contract, which was problematic. Even if the product was not significantly different from Boram Sangjo's existing profile, the procedure to understand the investment profile beforehand should have been followed when recommending a new investment. Additionally, the risks of leverage and the priority repayment rights should have been explained concretely to match the level of general investors such as Boram Sangjo's finance staff.

KB Securities' compensation liability was limited to about 40%. This was because the party who ultimately decided on the Lime fund among the three recommended funds and who did not properly review the proposal was Boram Sangjo. The court pointed out, "Boram Sangjo invested without knowing the basic details or risks of the fund. There were sufficient opportunities to ask KB Securities," and "the finance staff, who cannot be said to have high financial investment knowledge, handled the practical work for the investment of about 10 billion won alone, and the final investment decision was made internally at Boram Sangjo, so their responsibility is not light." Furthermore, the court added, "The losses were primarily due to Lime fund's poor management. KB Securities was not specifically aware of that possibility," and "it is wrong to hold KB Securities fully responsible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)