SK, Hynix, Square, Telecom, and Others Hit 52-Week Highs

Shareholder Return Expectations Rise Amid Corporate Value-Up Programs

SK Group stocks are on a strong upward trend, consecutively hitting 52-week highs. Factors driving the rise in SK Group stock prices include shareholder return expectations from the corporate value-up program and growth in the artificial intelligence (AI) semiconductor market.

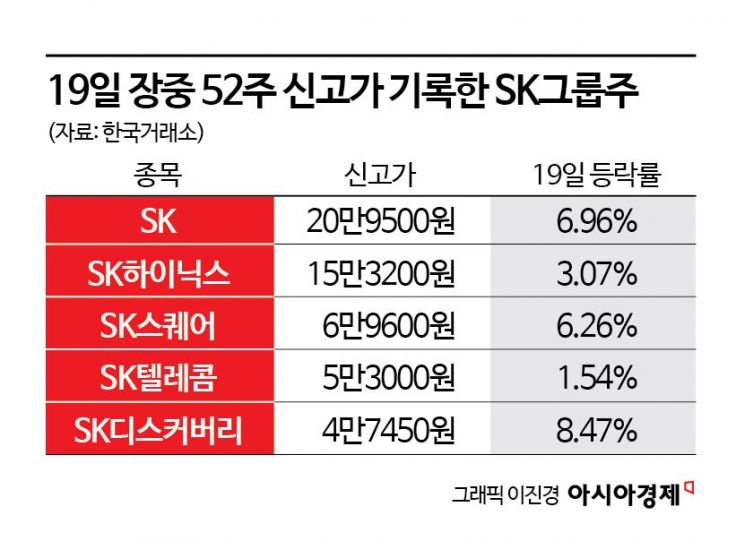

According to the Korea Exchange on the 20th, SK Hynix surged to an intraday high of 153,200 KRW, marking a 52-week high. SK Hynix has been continuously breaking its record highs recently, surpassing the 150,000 KRW level and reaching as high as the 153,000 KRW range.

SK Square also rose to an intraday high of 69,500 KRW, setting a new 52-week high, and SK Telecom climbed to 53,000 KRW, also hitting a new record high. In addition, SK and SK Discovery recorded new highs.

Due to the strong stock performance of SK Group shares, the SK Group Exchange-Traded Fund (ETF) is also on the rise. The KOSEF SK Group Representative Stock ETF, which invests in leading SK Group stocks, has increased by more than 13% over the past month.

Expectations for AI semiconductor growth driven by Nvidia are boosting SK Hynix’s stock price, and combined with shareholder return expectations from the corporate value-up program, this has led to a broad rise in SK Group stocks. Dongwon Kim, a researcher at KB Securities, said, "AI semiconductors will create new demand and become a mega trend. Over the next several years, AI semiconductor demand is expected to exceed supply, while AI semiconductor suppliers are extremely limited, which is expected to positively impact the earnings of Samsung Electronics and SK Hynix."

Ahead of the announcement of the corporate value-up program, SK Group’s proactive shareholder return policies are also cited as factors driving stock price increases. SK Innovation announced its first-ever large-scale treasury stock cancellation plan since its inception. On the 6th, SK Innovation disclosed that it resolved to cancel 4.92 million treasury shares, worth approximately 793.6 billion KRW. SK Telecom set its 2023 dividend per share at 3,540 KRW, a 6.6% increase from the previous year. SK Gas decided to raise its dividend per share last year by 1,500 KRW from 6,500 KRW to 8,000 KRW. SK decided on a year-end dividend of 3,500 KRW per share at its board meeting on the 7th. Including the interim dividend of 1,500 KRW per share paid in July last year, SK confirmed an annual dividend payment of 5,000 KRW per share. SK Networks also raised its regular dividend and decided to cancel 6.1% of its treasury shares to enhance shareholder value.

Ji-hwan Yang, a researcher at Daishin Securities, commented on SK, saying, "Considering that the major shareholder is sincere about ESG (environment, social, governance) and corporate social contribution, it is highly likely to comply with government policies. Although the treasury shares held are presumed to be for defending management rights, if the government introduces management rights defense systems such as the 'poison pill,' expectations for cancellation will spread."

Additional treasury stock cancellations are also expected from SK Square. Kwan-soon Choi, a researcher at SK Securities, explained, "SK Square plans to repurchase and cancel treasury shares worth 200 billion KRW by the end of March. If additional proceeds from the sale of SK Shieldus shares are received, there is a high possibility of further treasury stock repurchases and cancellations, highlighting the attractiveness of shareholder-friendly return policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)