Temu, Number One in New App Downloads for 5 Consecutive Months

AliExpress Also Ranks High

Domestic E-commerce Industry Struggles to Devise Countermeasures

Chinese e-commerce companies, known as 'C-commerce', such as AliExpress (Ali) and TEMU, are rapidly increasing their number of new users in South Korea. As these C-commerce companies launch an all-out offensive in the domestic market, native e-commerce companies are also taking measures to respond.

According to the marketing cloud operated by IGAWorks on the 15th, TEMU, a C-commerce company providing direct purchase (direct import) services from China, recorded approximately 2.22 million new app downloads last month. This is the highest number of new downloads among major domestic shopping apps during the same period. During this time, AliExpress also recorded about 600,000 new downloads, ranking third in terms of volume.

TEMU has recorded the highest number of monthly new installations among domestic shopping apps for five consecutive months since September last year. A high number of new installations indicates an increase in the number of newly acquired customers. During this period, AliExpress has also maintained a top position, ranking second or third in new installations.

The continuous increase in new installations is also noteworthy. TEMU, which ranked fourth with about 420,000 new installations in August last year, rose to first place for the first time in September with approximately 1.29 million new downloads. Since then, new installations have increased to about 1.56 million (November), 2.08 million (December), and approximately 2.22 million last month.

AliExpress also consistently ranked among the top after achieving first place with 720,000 new installations in August last year. Having entered the domestic market earlier than TEMU, AliExpress has shown growth by recording between 600,000 and 900,000 new installations each month.

Chinese direct purchase apps are conducting large-scale marketing campaigns to target the Korean market. For example, TEMU offers points that can be used like cash within the app whenever a user invites a new customer who then successfully registers. Because of this, users are accumulating points through mutual recommendations called ‘TEMU Matchju (mutual recommendation)’ by recommending each other to join TEMU.

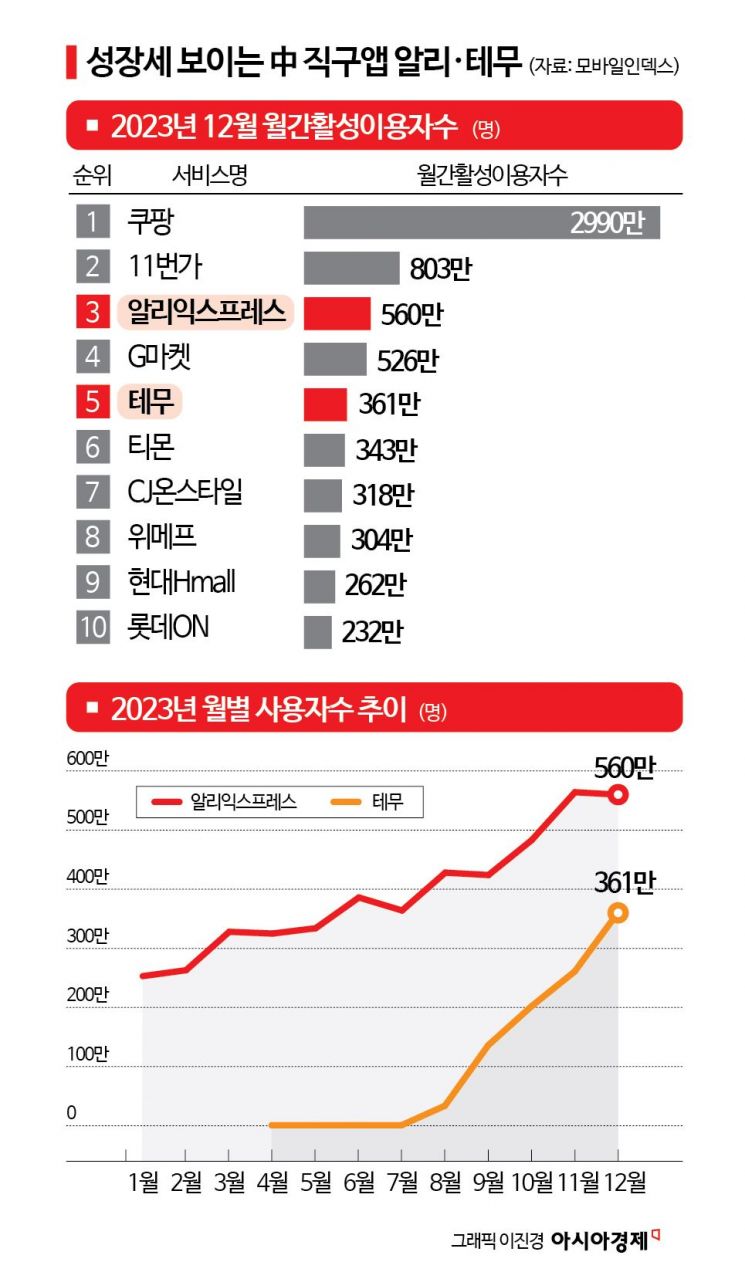

A significant portion of users newly acquired by C-commerce apps appear to remain as customers. The monthly active users (MAU) of C-commerce apps are rapidly increasing. TEMU's MAU last month was approximately 4.59 million, which is about 30% higher than the previous month. Compared to the MAU of about 340,000 in August last year, this represents an increase of about 13.6 times. AliExpress also recorded an MAU of 5.6 million as of December last year.

As these C-commerce companies rapidly encroach on the domestic market, the user growth of native e-commerce companies is slowing down. As of last month, new app installations for domestic distribution companies such as Danggeun (about 630,000), Coupang (about 490,000), and GS Retail (Our Neighborhood GS, about 340,000) were only about one-fourth of TEMU's approximately 2.22 million new installations.

C-commerce is targeting domestic consumers by leveraging strong price competitiveness. They sell mid- to low-priced items such as daily necessities, clothing, and accessories for under 10,000 KRW including shipping fees, and some products can be purchased for just over 1,000 KRW including shipping. This is much cheaper than buying the same products from native shopping malls.

Because of this, the government and domestic e-commerce companies have started to prepare countermeasures. The Ministry of Trade, Industry and Energy held a meeting yesterday afternoon at the Korea Chamber of Commerce and Industry in Jung-gu, Seoul, chaired by the Director of the Mid-sized Enterprise Policy Division, to assess the impact of overseas platform operators entering the domestic online distribution industry. Representatives from online distribution companies such as Coupang, Gmarket, 11st, SSG.com, and Naver attended the meeting. It was reported that attendees shared the perception that the rapid growth of C-commerce platforms threatens the survival of domestic small businesses and manufacturers.

In particular, the position of purchasing agents who buy goods through Chinese wholesale sites and resell them in the Korean market has become difficult, and there are voices claiming that domestic sellers are being unfairly disadvantaged. When domestic sellers purchase products from China and sell them, various tariffs, value-added taxes, and KC certification acquisition costs apply, but Chinese platforms are free from such regulations. Professor Jeong Yeon-seung of Dankook University's Department of Business Administration stated in the meeting's presentation, "We need to support the quality control capabilities of domestic small and medium manufacturers to increase domestic consumers' preferences," and added, "Legal grounds should be established to prevent consumer damages experienced on overseas platforms or to handle such damages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)