Export Recovery, General Election Benefits

Raw Material Price Increase as a Variable

Last year, the domestic paper industry, which saw a sharp decline in performance across the board, aims for a rebound this year. Although last year was challenging due to rising manufacturing costs caused by economic recession, high interest rates, and increases in oil and electricity costs, the industry expects this year to be different. Exports have been recovering since the end of last year, and favorable factors such as the April general election are awaiting the paper industry.

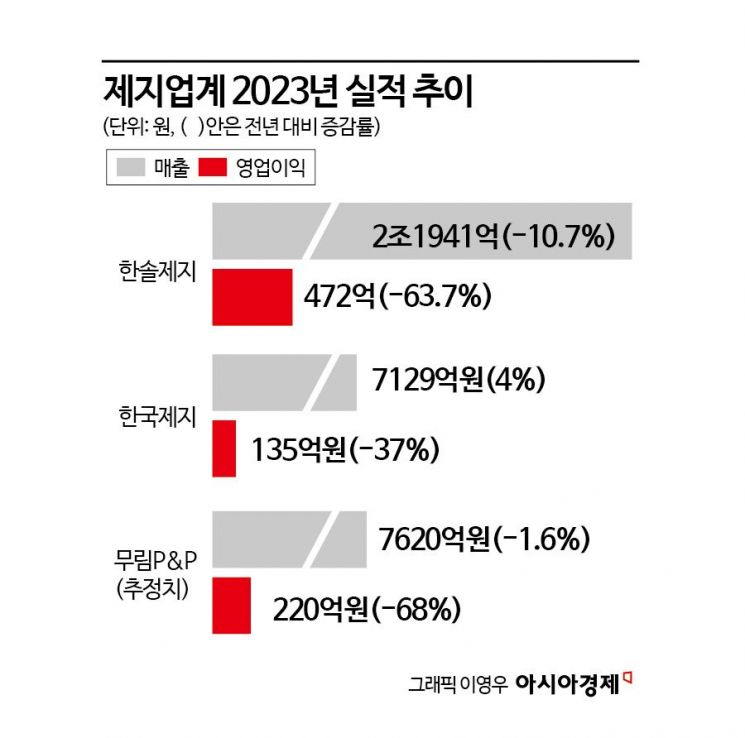

On the 7th, Hansol Paper announced that its operating profit last year was 47.2 billion KRW, down 63.7% compared to the same period the previous year. During the same period, sales amounted to 2.1941 trillion KRW, a 10.7% decrease from the previous year. Korea Paper also posted poor results last year with sales of 712.9 billion KRW and operating profit of 13.5 billion KRW. Sales increased by 4% compared to the previous year, but operating profit fell by 37%.

The securities industry estimates that Murim P&P, which is about to announce its performance, had sales of 762 billion KRW and operating profit of 22 billion KRW last year. Sales slightly decreased, but the decline in operating profit was significant, down 68% compared to the previous year. While the domestic market conditions are deteriorating due to digital transformation, rising prices have increased manufacturing costs, causing a sharp drop in operating profit margin. In other words, last year was a year of “wailing” for the paper industry.

However, this year is expected to recover from last year’s slump. The industry anticipates overall sales to rise due to the effect of paper price increases at the end of last year and increased paper demand for candidate promotional materials due to the general election.

Hansol Paper raised sales prices by reducing discounts on industrial and printing paper by 8% each in December last year. Also, from January 1 this year, the price of transfer paper, a type of specialty paper, was increased by about 10%. Transfer paper is a special paper used to print designs such as logos on clothing or products. Murim P&P also raised printing paper prices by 7% around the same time.

Paper is produced using pulp, the main raw material, at a paper mill. (Photo by Korea Paper Association)

Paper is produced using pulp, the main raw material, at a paper mill. (Photo by Korea Paper Association)

The election is welcome news for the paper industry. A general election is scheduled in Korea this April. The election paper to be used this year is expected to be around 10,000 tons. The industry estimates sales of approximately 15 billion KRW. This year, political calculations have become more complex, with news of satellite party formations from various parties, and there are forecasts that the ballot paper length could reach a record 48 cm. The longer the ballot paper and the more candidates there are, the better it is for the paper industry. In years when nationwide elections were held, the paper industry’s sales were higher than usual. Compared to presidential elections, elections with more constituencies and candidates, such as parliamentary and local government elections, are more beneficial to the paper industry.

Export prospects are also positive this year. Hansol Paper and Murim P&P have export ratios reaching half of their sales. The strong dollar trend is also expected to act as a favorable factor. The won-dollar exchange rate fell to the 1,200 KRW range at the end of last year but started rising again, reaching 1,327 KRW as of the 6th.

However, rising pulp prices are a concern. The price of mixed hardwood pulp from the southern United States has been increasing every month since June last year. As of last month, the price per ton was 785 dollars, up nearly 40% in half a year. If pulp prices continue to rise this year, the effect of last year’s product price increases will inevitably be offset.

A paper industry official explained, "Performance is rebounding due to increased exports in the first quarter, and with various domestic and international events scheduled, performance improvement is expected. We are monitoring the price fluctuation trends of international pulp prices, and the industry plans to respond to the market through product diversification."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)