Average Household Cash Ratio 15.5%

Half of Japan's 34.5%

Limitations on Funds Flowing into Stock Market

Export-Oriented Industrial Structure Also Disadvantageous

High Export Share to China

As the Financial Services Commission's 'Corporate Value-Up Program' set to be announced at the end of this month draws market attention, there are claims that its stock market stimulation effect may not be as significant as in Japan. This is because the domestic household structure has a low cash ratio, and export-oriented stocks heavily dependent on China are leading the KOSPI.

On the 6th, experts in the financial investment industry pointed to △household asset structure and △export-centered domestic industrial structure as reasons why the Corporate Value-Up Program may struggle to achieve the same policy effects as Japan.

The 'Corporate Value-Up Program' is a policy designed to encourage listed companies to voluntarily make efforts to enhance shareholder value. The program is expected to include recommendations for companies to announce corporate value improvement plans and the introduction of exchange-traded funds (ETFs) composed of companies excelling in corporate value improvement.

This program benchmarks the stock market stimulus measures announced by the Japanese government last year (in January, March, and October). Companies with a price-to-book ratio (PBR) below 1 are required to present improvement plans, mainly focusing on corporate governance reforms. Furthermore, a list of companies that have actually improved their corporate value will be disclosed. As a result of Japan's specific pressure on listed companies to enhance corporate value, the Japanese stock market recovered to its highest level in 33 years and 10 months.

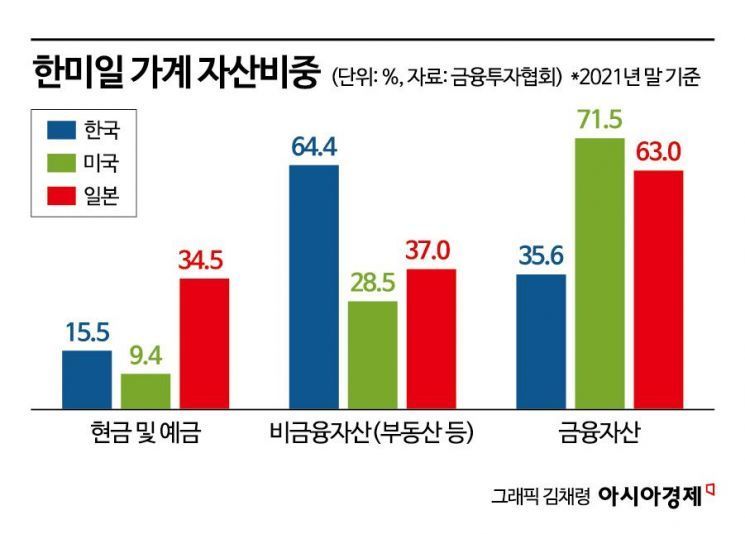

There is some skepticism in the market about the stock market stimulation effect of the Corporate Value-Up Program. This is because the proportion of cash in Korean households is relatively low.

According to KB Securities, as of 2021, the cash and deposit ratio in Korean household assets was 15.5%, about half that of Japan's 34.5%. On the other hand, the proportion of non-financial assets such as real estate was 64.4% in Korea, nearly twice that of Japan's 37.0%.

Hainhwan KB Securities researcher analyzed, "The significant difference in the proportion of the most liquid funds means there is a big difference in the capacity to inject funds into the stock market," adding, "Given the household asset composition, it is questionable whether the stock market stimulation effect can be expected to be as strong as in Japan."

Secondly, the export-heavy industrial structure is considered unfavorable for sustainable shareholder value enhancement. Since dividend expansion is possible based on stable cash flow or net cash of companies, domestic companies have less capacity for shareholder returns compared to Japan.

Yoonjung Kim, a researcher at Ebest Investment & Securities, diagnosed, "Due to the characteristics of the domestic industrial structure with a high proportion of manufacturing and exports, it is greatly affected by business conditions," adding, "Because earnings stability is low, even if dividends are expanded by policy, there is uncertainty about their sustainability."

Furthermore, the significant influence of international political and economic variables cannot be ignored. The strength of the Japanese stock market was influenced not only by the stimulus measures but also by its linkage to the Nasdaq. In contrast, the KOSPI shows a trend similar to the average of the Nasdaq and the Hong Kong Hang Seng Index. This is because Korea's export structure has a large dependence on China.

There are also voices warning of the possibility of a decline in the profit consensus for domestic companies in 2024. According to January trade data, the export growth rate increased by 18% compared to the previous year but decreased compared to December of last year. Imports increased compared to December, significantly shrinking the trade balance. Researcher Kim advised, "Since trade indicators are closely related to domestic corporate performance, market responses should consider the possibility of adjustments in future earnings forecasts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)