Long Adjustment Leads to Historic Low

Expectations for February Stimulus Effect Maximize

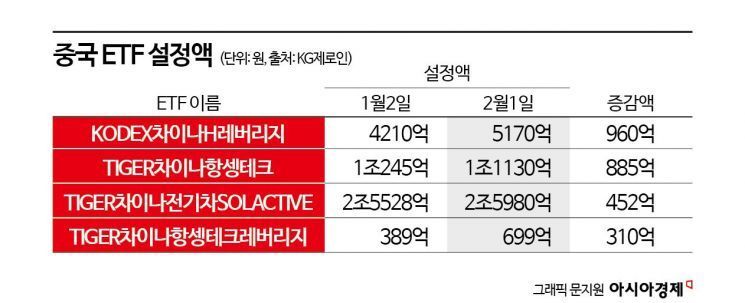

Samsung KODEX... 96 Billion KRW Increase

Funds are pouring into Chinese exchange-traded funds (ETFs). This is interpreted as investors taking advantage of the historically low levels of the Chinese stock market to buy at a bargain price.

According to fund rating company KG Zeroin on the 5th, the net asset value of Samsung KODEX China H Leverage ETF was 517 billion KRW as of the 1st of this month. This is an increase of 96 billion KRW from 421 billion KRW on the 2nd of last month. During the same period, Mirae Asset TIGER China Hang Seng Tech ETF also rose by 88.5 billion KRW from 1.0245 trillion KRW to 1.113 trillion KRW, and Mirae Asset TIGER China Electric Vehicle SOLACTIVE ETF increased by 45.2 billion KRW from 2.5528 trillion KRW to 2.598 trillion KRW.

The KODEX China H Leverage ETF tracks twice the daily return of the Hong Kong H Index (Hang Seng China Enterprises Index), which consists of 40 Chinese H-shares listed in Hong Kong. Meanwhile, the Mirae Asset TIGER China Hang Seng Tech ETF invests in Hang Seng Tech companies, representing innovative firms in China's new growth industries, and the TIGER China Electric Vehicle SOLACTIVE ETF mainly invests in Chinese electric vehicle and battery companies.

The reason these ETFs are attracting funds is attributed to expectations of a rebound in the Chinese stock market. The Shanghai Composite Index (SSEC) fell from 3291.04 in August last year to around the 2700 level recently. During the same period, the Hong Kong H Index also dropped from 6899.31 to around 5200, reflecting the sluggish performance of the Chinese stock market. Factors such as the real estate downturn and weak domestic demand have had an impact.

As the economic slowdown continues, China has announced a series of stock market stimulus measures this month, including reports of the Securities Stabilization Fund injection by foreign media, adding market capitalization to the key performance indicators (KPIs) of state-owned enterprises, and a 50 basis point (1bp = 0.01 percentage point) cut in the reserve requirement ratio. Additional economic stimulus measures are also expected.

Shin Seung-woong, a researcher at Shinhan Investment Corp., explained, "Unlike the widely accepted January effect in global stock markets, China has a distinct 'February effect.' This is because, ahead of the March Two Sessions (National People's Congress and Chinese People's Political Consultative Conference), local governments and ministries announce their targets, maximizing expectations for stimulus measures." He added, "With the prolonged adjustment, valuations have fallen to historically undervalued levels. It is reasonable to keep upside risks open rather than downside risks, as the market can react sensitively even to small positive news."

However, there is also analysis suggesting that if the Chinese real estate crisis expands, it will be difficult to expect a stock market rebound. Jeon Jong-gyu, a researcher at Samsung Securities, said, "If real estate debt risks expand, the mainland stock market and the Hong Kong stock market could face another wave of declines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)