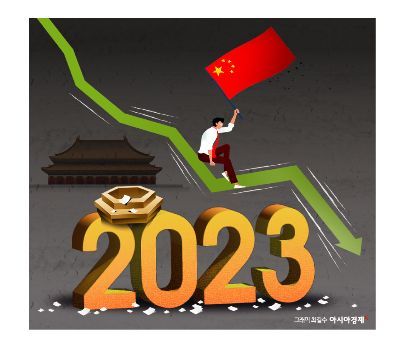

China's Economic Slowdown Attributed to US-China Conflict

Foreign capital has flowed out of the Chinese stock market for six consecutive months until last month. The cause is attributed to the prolonged economic slowdown in China and the escalation of conflicts between the U.S. and China, which have extended from trade and technology to the investment sector.

Bloomberg reported on the 1st that foreign capital net outflow through the Shenzhen-Hong Kong Stock Connect and Shanghai-Hong Kong Stock Connect amounted to 14.5 billion yuan (approximately 2.6893 trillion KRW) last month.

Although this is an improvement compared to the approximately 100 billion yuan net outflow of foreign capital in August last year, the outflow has continued for six consecutive months. Over the past six months, foreigners have sold Chinese stocks worth 201 billion yuan (approximately 37.2794 trillion KRW).

The capital flight is analyzed to have occurred due to the combination of rising tensions between the U.S. and China, the absence of economic stimulus measures in China, and the slowdown in the real estate market. In addition, so-called 'Snowball' derivative products have been pointed out as a problem; these products can cause investors not only to lose interest but also face principal loss if the Chinese stock index enters the knock-in (loss occurrence) zone.

In fact, the CSI 300 Index, composed of the top 300 stocks by market capitalization on the Shanghai and Shenzhen stock exchanges, is at its lowest level in five years. Last month, the CSI 300 Index fell by 6.29%, while the Shanghai Composite Index and Shenzhen Component Index dropped by 6.27% and 15.94%, respectively.

On the first trading day of this month, the Chinese mainland stock market was also weak. The Shanghai Composite Index and Shenzhen Component Index closed down 0.64% and 0.46%, respectively, compared to the previous session, while the CSI 300 Index was flat (+0.07%).

On the same day, Li Xianzhong, Director of the Treasury Department of the Chinese Ministry of Finance, expressed his commitment to economic stimulus at a press conference regarding the national bond issuance plan, stating that "support will be provided to ensure the necessary spending intensity." Following the release of the Caixin Purchasing Managers' Index (PMI), the market briefly turned upward but declined again in the afternoon.

Meanwhile, amid the sluggish performance of Chinese stocks and real estate prices, domestic Chinese investors were found to have flocked to gold, considered a 'safe asset,' last year.

Major foreign media also reported that the World Gold Council (WGC) announced in its gold demand trends report that China's gold investment and jewelry demand stood out globally last year.

China's investment gold demand, including gold bars and coins, increased by 28% to 280 tons last year, while gold demand for jewelry rose by 10% to 630 tons.

Gold prices soared last year, reaching record highs, and it is analyzed that demand from central banks worldwide, along with Chinese demand, influenced the price increase. Analysts at Swiss investment bank UBS pointed out that China's demand has been underestimated in analyses of factors driving gold price increases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)