Winia and 4 Other Restructured Companies as M&A Assets

Record High of 65 Restructured Company Deals Last Year

Diversification and Large-Scale Deals Expected This Year

Last year, corporate bankruptcy and rehabilitation filings reached an all-time high, and mergers and acquisitions (M&A) of rehabilitated companies have also surged. Already this year, five rehabilitated companies have been put up for sale. Established companies with long histories or well-known mid-sized firms are also appearing on the market. Experts predict that not only the increase in the number of available companies but also the diversification of industries and the growth in scale could present new investment opportunities.

According to the courts and the investment banking (IB) industry on the 1st, five rehabilitated companies?CCL International, Neon Photonics, Winia, Hans Intech, and Hans Chemical?announced M&A proceedings last month. In the same period last year, only two companies had announced M&A procedures to the court. Expanding the scope to December 2023, the number of rehabilitated companies entering the M&A market reached 11 over two months.

Struggling 'Distressed Companies' Collapse and Appear on the Market One After Another

Winia is a well-known mid-sized company familiar for its kimchi refrigerators and air conditioners. Hans Intech and Hans Chemical are core affiliates of the 'Hans Group,' which grew mainly in the Gyeongbuk region. Neon Photonics was once invested in by a major venture capital (VC), and CCL International was known for having a solid distribution network in China. However, all of these companies have now fallen into the position of seeking 'new owners.'

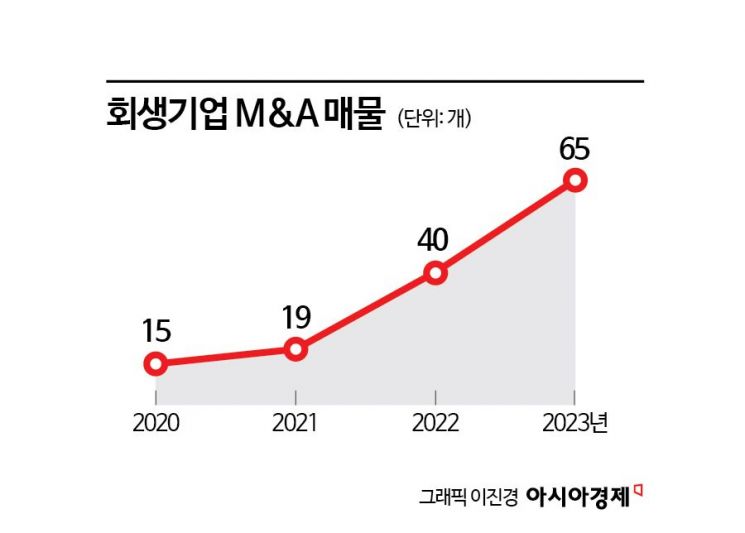

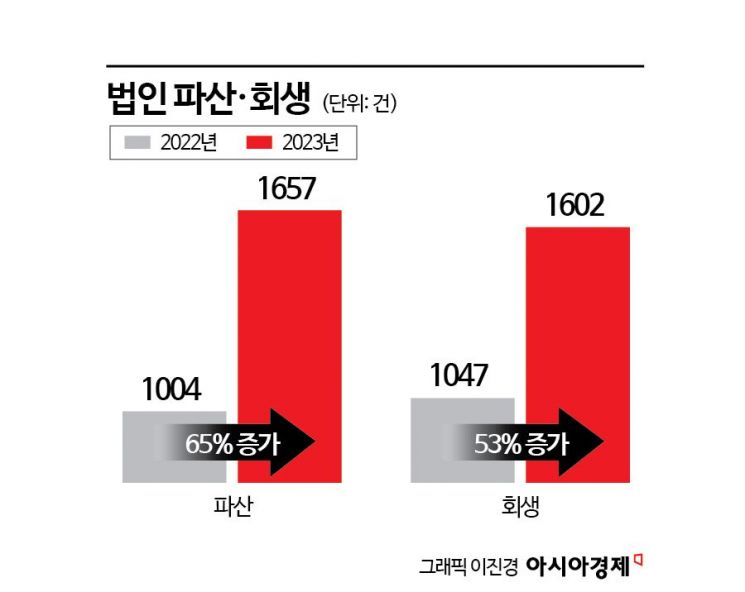

The number of rehabilitated companies looking for new owners has been steadily increasing in recent years. The number of M&A listings for rehabilitated companies rose from 15 cases in 2020 to 19 in 2021, 40 in 2022, and a record high of 65 last year. This is because many companies collapsed under domestic and international environmental changes such as the 'three highs' (high inflation, high interest rates, and high exchange rates). According to the 'Court Statistics Monthly Report,' the number of corporate bankruptcy filings in 2023 reached 1,657, the highest since the court began compiling statistics in 2013. During the same period, corporate rehabilitation filings also reached 1,602. Compared to 2022, bankruptcies increased by 65%, and rehabilitations by 53%.

Market Expected to Expand with Industry Diversification and Larger Scale

Corporate rehabilitation is commonly referred to as 'court receivership.' M&A of companies under court receivership has distinct advantages and disadvantages compared to regular transactions. Kim Sang-man, a partner and M&A expert at the law firm Hwawoo, said, "Once a company's rehabilitation plan is approved, repayment obligations apply only to the reported creditors, so there is no risk of contingent liabilities," adding, "On the other hand, because the company is under court supervision, the procedures to go through are cumbersome and numerous." He also noted, "Since the company's value has significantly declined, the price can be attractive. However, the company is often so damaged that it is difficult to achieve short-term results, so a long-term perspective is necessary."

Experts expect the upward trend in M&A of rehabilitated companies to continue this year. Jung Kyung-soo, head of the M&A Center at Samil PwC, said, "Deals involving companies that have reached their limits will become more active starting this year," and added, "By industry, the construction sector, which is particularly exposed to real estate project financing (PF) risks, will be especially active." There is also an expectation that the types of companies on the market will diversify beyond the small and medium-sized enterprises focused on traditional 'smokestack industries,' and that the scale of deals will grow larger. Kim said, "Currently, most companies are small to medium-sized, but it is highly likely that larger companies will knock on the court's door in the future, and some well-known companies may also come onto the market. Buyers should comprehensively evaluate various aspects such as future potential and turn these into good investment opportunities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)