High Investment in Corporate and Capital Bonds During ELS Management

Concerns Over Deteriorating Funding Environment as Demand Base for Asset-Backed Bonds Shrinks

"Significant Reduction in Asset-Backed Bond Proportion Compared to the Past," Counterargument Also Raised

As commercial banks show signs of halting sales of equity-linked securities (ELS), concerns are emerging that the demand base for credit specialized finance company bonds (CSFC bonds) issued by card companies and capital firms may weaken. Since securities firms invest a significant portion of the funds raised through ELS issuance into CSFC bonds, a contraction in the ELS market could lead to a corresponding decrease in demand for CSFC bonds. However, some counterarguments suggest that the negative impact on CSFC bond supply and demand may not be significant, indicating an anticipated debate.

Gilsungju, Chairman of the Hong Kong ELS Victims' Association, is speaking at a press conference for victims of the Hong Kong index-based ELS damage incident held at the National Assembly Communication Office on the 30th. Photo by Hyunmin Kim kimhyun81@

Gilsungju, Chairman of the Hong Kong ELS Victims' Association, is speaking at a press conference for victims of the Hong Kong index-based ELS damage incident held at the National Assembly Communication Office on the 30th. Photo by Hyunmin Kim kimhyun81@

If the 93 Trillion Won ELS Market Shrinks, CSFC Bond Demand Base Will Contract

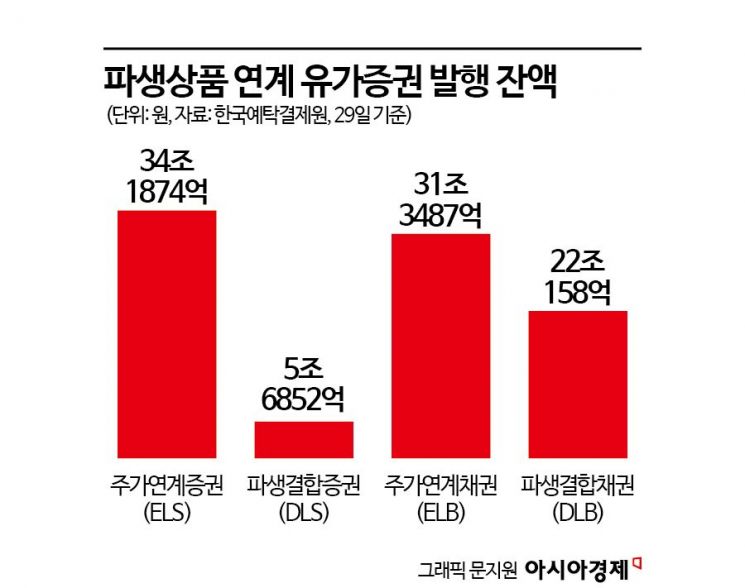

According to the Korea Securities Depository on the 31st, as of the 29th, the outstanding issuance amount of domestic derivative-linked securities (including ELS, ELB, DLS, and DLB) stands at 93.2371 trillion won. ELS accounts for the largest portion at 34.1874 trillion won, followed by ELB (equity-linked bonds) at 31.3487 trillion won, DLB (derivative-linked bonds) at 22.0158 trillion won, and DLS (derivative-linked securities) at 5.6852 trillion won.

These products are all classified as similar because they are operated through derivatives and their yields are determined by the price movements of underlying assets. ELB and DLB guarantee principal as long as the issuing securities firm does not default, whereas ELS and DLS offer higher expected returns but do not guarantee principal. The outstanding issuance amount of ELS and DLS, which carry the risk of principal loss, is approximately 40 trillion won.

Securities firms operate the funds raised through ELS issuance by investing in bonds, stocks (indices, individual stocks), and options. This fund management to hedge the ELS issuance position is called 'hedge operation.' For principal-guaranteed products, the bond investment ratio is high, while for non-principal-guaranteed products, the bond ratio is relatively lower. A securities firm ELS hedge operation manager stated, "For principal-guaranteed products, over 90% of funds are invested in bonds, and for non-principal-guaranteed products, it varies by company but typically 50-70% of funds are invested in bonds."

According to industry sources, among the bonds invested in for ELS hedge operations, CSFC bonds have the highest proportion. This is because CSFC bonds offer higher interest rates compared to other government or bank bonds and yield better returns than corporate bonds of the same rating. A bond market official said, "AA- rated CSFC bonds have interest rates 10-20 basis points (1bp=0.01%) higher than corporate bonds of the same rating," adding, "Securities firm hedge operation managers include many CSFC bonds in their hedge books to increase operational yields."

The large issuance volume and good liquidity are also reasons why ELS accounts invest heavily in CSFC bonds. An industry insider commented, "The outstanding issuance amount of CSFC bonds is steadily maintained at 70 to 80 trillion won, with a large volume circulating in the market, allowing liquidation at fair prices," and added, "These bonds have many advantages for managing large funds while enhancing yields."

Therefore, if banks stop selling ELS, there is concern that the demand base for CSFC bonds worth trillions of won could disappear. A securities firm CSFC bond issuance manager predicted, "If banks halt ELS sales, the volume of ELS issuance will inevitably shrink significantly," and "As the demand base for CSFC bonds decreases, it is highly likely to have a negative impact on the market."

CSFC Bond Proportion in ELS Operations Has Significantly Decreased... Counterargument: "Negative Impact Will Not Be Significant"

There are also counterarguments. Since the proportion of CSFC bonds included in ELS has significantly decreased compared to the past, even if the ELS market contracts, it is analyzed that there will be no major negative impact on CSFC bond supply and demand.

Kim Eun-gi, a researcher at Samsung Securities, recalled, "In the past, 20-30% of hedge operation assets in ELS, amounting to 20-30 trillion won, were invested in CSFC bonds, so ELS had a very large impact on CSFC bond supply and demand." However, he added, "Financial authorities have gradually lowered the maximum inclusion ratio of CSFC bonds in ELS operation books to 12%, significantly reducing the proportion of CSFC bonds in ELS operation books."

He forecasted, "According to recent surveys, the actual investment scale of CSFC bonds in securities firms' ELS operation books is around 6-7 trillion won, which is below the maximum limit," and "Considering that the total CSFC bond market size exceeds 80 trillion won, the contraction of the ELS market will not have a significant negative impact on CSFC bond supply and demand."

An IB industry official expressed concern, saying, "Due to recent project financing (PF) defaults, the issuance environment for CSFC bonds is not favorable," and added, "Even a reduction of 1-2 trillion won in CSFC bond demand could adversely affect the funding of credit specialized finance companies." The official advised, "Considering the overall market structure, flexible responses such as maintaining sales of principal-guaranteed products even if banks stop selling ELS are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.