Operating Profit Down 49%, Sales Down 11% Last Year

Due to Weak China Market and Reduced Duty-Free Sales

Double-Digit Growth in North America, Europe, and Japan Markets

Amorepacific experienced a significant decline in performance last year as it faced negative growth in both domestic and international markets. Although a rapid recovery in performance is unlikely due to continued sluggishness in the duty-free channel and the Chinese market, steady efforts to penetrate the North American, European, and Middle Eastern markets resulted in double-digit sales growth this year.

According to Amorepacific on the 30th, operating profit last year was 108.2 billion KRW, down 49% from the previous year. Sales amounted to 3.674 trillion KRW, a decrease of 11%. Both domestic and overseas sales declined, leading to a sharp drop in overall performance.

Domestic market sales were 2.2108 trillion KRW, down 14% from 2.5813 trillion KRW the previous year. This was mainly due to a double-digit decline in sales from the duty-free channel, which accounts for 20% of domestic sales. The reduction in sales to daigou (personal shoppers) at duty-free stores and fewer Chinese and foreign tourists shopping at duty-free stores were the primary reasons. Additionally, e-commerce sales decreased as consumer sentiment weakened amid the economic downturn. Operating profit fell by more than 34% during the same period. Costs increased due to product renewals and intensified marketing efforts. By product category, luxury brands (Sulwhasoo, Hera, Primera, etc.), premium brands (Laneige, Estra, IOPE, etc.), and daily beauty brands (Ryo, Mise-en-sc?ne, Longtake) showed declines of approximately 16%, 18%, and 9%, respectively.

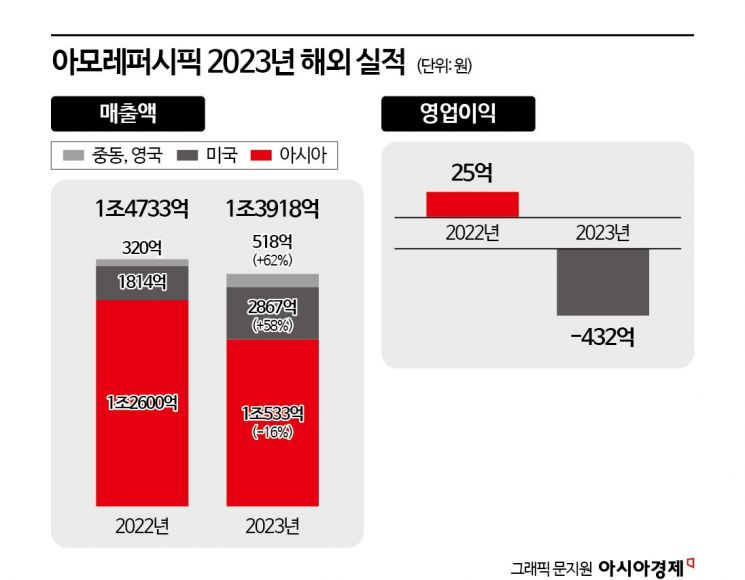

Overseas sales amounted to 1.3918 trillion KRW, down about 6% from the previous year. A more than 20% drop in sales in the Chinese market pulled down overall overseas sales. Efforts to reduce inventory within the Chinese channel and optimize offline stores had an impact.

In contrast, the Japanese, North American, and European markets showed remarkable growth. The Japanese market saw a 30% increase in sales based on localization standards. Strengthened collaboration with key channels for Laneige and Innisfree in Japan contributed to solid sales growth, and the entry of new brands such as Hera and Estra was positive. The Americas region recorded explosive growth with a 58% increase in sales compared to the previous year. Strengthening the product portfolio and expanding experiential content in offline markets were effective. The Laneige lipstick portfolio was expanded, and Innisfree and Sulwhasoo increased their presence in multi-brand shop (MBS) channels. In the UK and Middle East (EMEA) markets, total sales increased by 62%. Among the brands, Laneige stood out, entering the luxury beauty multi-shop ‘SPACE NK’ in the UK and launching in the Sephora channel in the Middle East.

An Amorepacific Group official stated, "We are focusing on enhancing core brand values and developing customer engagement content," adding, "We plan to secure global growth momentum by establishing distribution partnerships centered on global growth regions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)