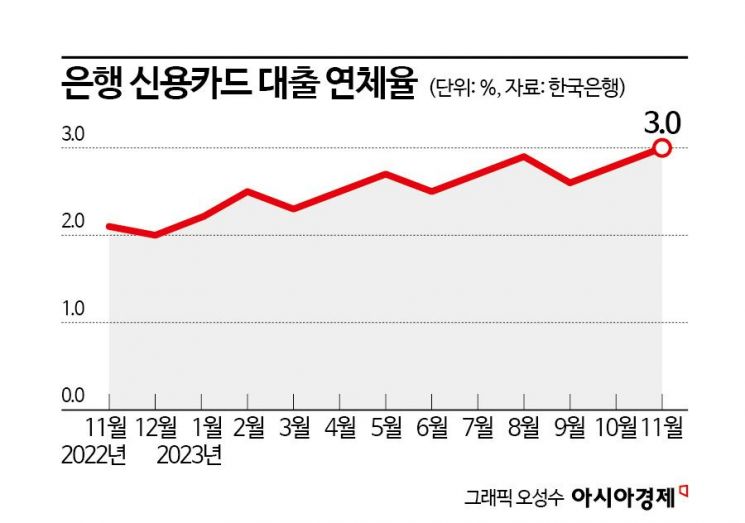

Delinquency Rate at 3.0%... Highest Since 2015

Youth and Low-Income Groups Mainly Unable to Repay Loans

Credit Card Delinquency Amount Also Significantly Increased

The delinquency rate on bank credit card loans continues to rise. This is interpreted as an increasing number of people, especially among the younger generation and low-income groups, failing to repay their credit card loans on time due to worsening economic conditions and sustained high interest rates.

According to the Bank of Korea's Economic Statistics System on the 31st, the delinquency rate on credit card loans at general banks exceeded 3.0% as of November last year. This figure, based on principal overdue by more than one day, surpassed 3% for the first time in 8 years and 3 months since it recorded 3.1% in August 2015. Compared to 2.1% recorded in November 2022, a year earlier, it rose by 0.9 percentage points.

Bank credit card loans refer to small, high-interest loans such as cash advances or card loans. Since credit card loans can be borrowed in relatively small amounts, they are mainly used by the younger generation or vulnerable borrowers (people who are multiple debtors and have low income or low credit).

Not only the delinquency rate on bank credit card loans but also the delinquent amounts on credit cards by card companies are significantly increasing. As of the end of the third quarter last year, the total delinquent amount on credit cards (based on over one month overdue) of the eight major domestic card companies was 2.0516 trillion won, a sharp increase of 53.1% compared to the same period the previous year.

The surge in credit card loan delinquency rates and delinquent amounts is due to more people failing to repay their debts on time amid sustained high interest rates. To curb soaring inflation, the Bank of Korea raised the base interest rate, pushing credit card loan interest rates to currently exceed 15%.

Credit card loan delinquencies are estimated to mainly occur among the younger generation and low-income groups. According to an analysis by Sujin Lee, Senior Research Fellow at the Korea Institute of Finance, of credit card usage data for about 1.07 million individual borrowers from Korea Credit Bureau (KCB) and Korea Credit Information Services last year, 22.1% of borrowers under 30 had experienced credit card delinquencies. This is significantly higher than the approximately 13% recorded for those aged 30 and above.

Additionally, during the same period, the proportion of card delinquency experience among borrowers in the lowest income quintile was 18.0%, which is three times higher than the 6.1% in the highest income quintile. By occupation, self-employed individuals had a delinquency experience rate of 12.4%, relatively higher than the 10.2% of salaried workers. Lee emphasized the need for management focused on these groups, stating, "Credit card delinquency problems mainly occurred among the younger generation and low-income groups."

The delinquency rate on household loans is also rising, centered on vulnerable borrowers with poor financial conditions, raising concerns about undermining the financial stability system. According to the Bank of Korea's Financial Stability Report, the delinquency rate on household loans for vulnerable borrowers was 8.9% at the end of the third quarter last year, a significant increase from 6.41% in the same period the previous year. The proportion of vulnerable borrowers among all borrowers also increased to 6.5% as of the third quarter last year, up from 6.3% in the first quarter.

A Bank of Korea official explained, "The increased risk of default among vulnerable borrowers appears to be due to their high debt repayment burden relative to income, compounded by recent loan interest rate hikes and income constraints." The official added, "The household loan delinquency rate is expected to continue rising for the time being, centered on vulnerable borrowers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)