Attracting Investors by Promising 'Allocation of Volume to Institutional Accounts'

The Financial Supervisory Service (FSS) recently warned that financial investment scams inducing the installation of fake stock trading applications (apps) through social networking services (SNS) are on the rise, urging investors to exercise caution.

On the 28th, the FSS issued a consumer alert with a caution level regarding 'financial investment scams inducing the installation of fake stock trading apps.'

Fake Stock Trading App Installation Induced Financial Investment Scam Method

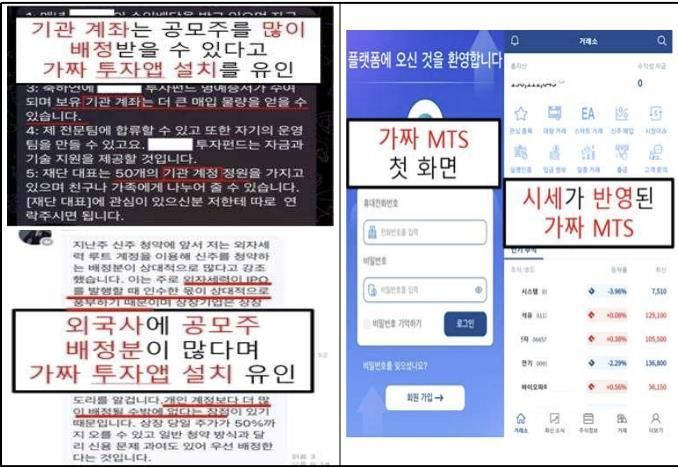

Fake Stock Trading App Installation Induced Financial Investment Scam Method [Image Source: Provided by Financial Supervisory Service, Yonhap News]

These scams typically begin by luring investors with advertisements impersonating celebrities or other famous figures, offering free financial management books. Subsequently, investors are invited to group chat rooms where scammers impersonate financial company employees or professors, providing financial management lectures, stock market updates, and stock recommendations to build trust. They then induce investors to install fake stock trading apps by falsely claiming that using institutional accounts allows for large allocations of shares during public offering subscriptions and the ability to purchase at low prices.

The scammers even employ accomplices to deceive investors and show fake successful investment cases to encourage participation in public offering subscriptions. They manipulate the fake stock trading app screens to display large quantities allocated relative to the margin and then demand additional deposits from investors. If investors request withdrawals, the scammers demand further payments under the pretexts of fees, taxes, or deposits, or threaten them by impersonating prosecutors or financial authorities, claiming that fines have been imposed.

The FSS noted that if investors request refunds or refuse to make additional deposits, the scammers close their SNS accounts or chat rooms and disappear, thereby embezzling the investment funds, and strongly urged consumers to be especially cautious.

The FSS emphasized, "Damages from transactions with non-regulated operators are not subject to dispute resolution by the FSS, making it difficult to recover losses. Regulated financial companies do not induce the installation of private stock trading apps through group chat rooms, so be careful not to be deceived by illegal operators impersonating financial companies." They added, "To prevent damages caused by illegal stock trading apps, rapid site blocking is crucial. If you find suspicious stock trading app posts or suspect illegal operators, immediately stop transactions and report to the FSS."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.