Financial Services Commission Announces Improvement Measures for Treasury Stock System

No New Shares Allocation to Treasury Stock in Case of Demerger

Disclosure of Market Capitalization Information Excluding Treasury Stock

From now on, the 'treasury stock magic' will disappear when companies undergo a spin-off. Additionally, when a newly established company is re-listed after a spin-off, whether the rights and interests of general shareholders, such as gathering opinions from individual investors, are enhanced will also be examined as part of the review conditions. Information excluding treasury stock will also be provided when calculating market capitalization. However, the much-discussed 'mandatory treasury stock cancellation' was excluded.

On the 30th, the Financial Services Commission announced the 'Improvement Plan for Treasury Stock System of Listed Companies,' which includes prohibiting the allocation of new shares to treasury stock (treasury stock magic) during spin-offs of listed companies.

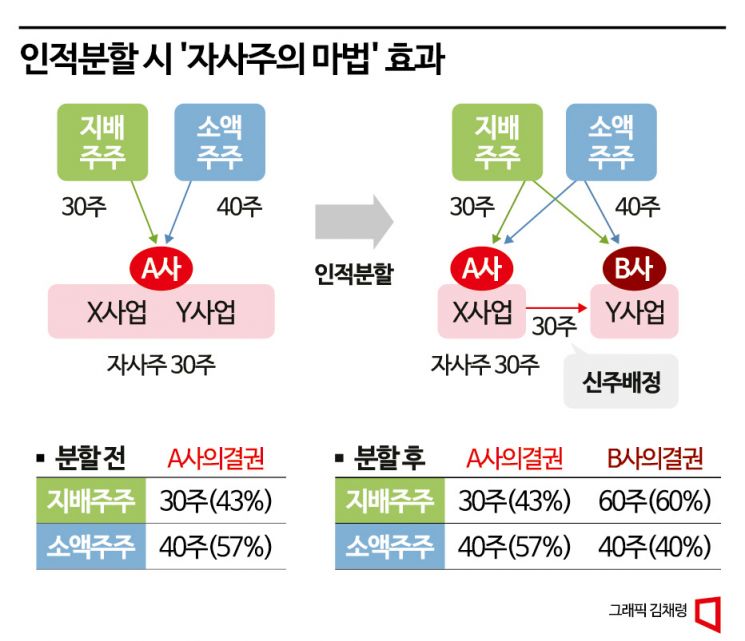

According to the improvement plan, the 'treasury stock magic' will be banned. Treasury stock magic refers to the revival of voting rights of treasury stock during a spin-off. Treasury stock originally has no voting rights. However, when new shares of the newly established company are allocated during a spin-off, voting rights arise. Since laws and precedents regarding spin-offs are unclear, new share allocations to treasury stock have been made.

As a result, major shareholders have used this as a means to expand control by transitioning to a holding company structure. If the treasury stock ownership ratio is high, the shareholder can increase the shareholding ratio of both the existing and newly established companies during the spin-off process without contributing funds. On the other hand, minority shareholders' share value is relatively diluted.

According to the Korea Capital Market Institute, an analysis of 144 spin-offs of listed companies from 2000 to 2021 found that treasury stock magic was mainly used in the process of converting to holding companies, combined with contributions in kind and paid-in capital increases.

The Financial Services Commission explained the purpose of the system improvement, stating, "There have been criticisms that treasury stock has been used to increase major shareholders' control rather than enhancing shareholder value. Also, there have been arguments that treating spin-offs differently from other shareholder rights is inconsistent with international standards."

However, treasury stock cancellation was excluded from the improvement plan. Kim So-young, Vice Chairman of the Financial Services Commission, said, "Protecting individual investors is important, but considering corporate activities such as fundraising and defense of management rights, sudden changes seem to be a burden on the market."

Also, when a newly established company pursues re-listing after a spin-off, whether 'investor opinion gathering' is conducted will be reviewed during the listing examination. This means considering the rights and interests of general shareholders.

Disclosure will also be strengthened throughout the entire process from acquisition to disposal of treasury stock. If a listed company holds treasury stock exceeding 10% of issued shares, it must compulsorily disclose the reasons for holding treasury stock, as well as plans for additional purchases or disposals. It is expected that market monitoring and checks will function regarding arbitrary disposal of treasury stock.

When calculating market capitalization, information excluding treasury stock will also be shared. Currently, treasury stock is included in market capitalization calculations. There have been concerns that market capitalization may be overestimated when the treasury stock holding ratio is high.

Finally, regulations will be strengthened when acquiring treasury stock through trusts, just as with direct acquisitions. If the amount spent on acquiring treasury stock is less than the initially disclosed purchase amount, a statement of reasons must be submitted. New trust contracts are restricted from being concluded within one month after the planned treasury stock purchase period ends.

The Financial Services Commission stated, "To promptly implement the improvement plan for the treasury stock system of listed companies, we plan to revise the Enforcement Decree of the Capital Market Act within the first half of the year," and added, "We will continue to strive to resolve undervaluation factors of our companies and capital markets (Korea Discount) and enhance investor rights and interests."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)